Why we added UNH UnitedHealth Group

Equity Spotlight

Why did we add UNH a couple of weeks ago?

Safe to say it was nothing at all to do with fundamentals, inside knowledge or some deep understanding of the company or its sector.

This is some of the metrics that I measure for everything I track.

Top green circle teeny tiny number in the top right…

For the backtest window UNH spends 69% of its time trading above zero on those wiggly lines at the bottom.

Simply when it trends it trends higher.

Bottom green circle when my measure of signal strength is very low across all timeframes we have trigger_9b which is a short hand way to say some numbers got to some combination of values which in the past have been important.

What’s different about UNH is because the first number is so high 69% it means this trigger_9b very rarely occurs. It almost never gets to this level of selling pressure.

This means the forward returns are really quite skewed to only one timeframe.

UNH after this trigger has an 85% to be higher over the next 20 days but only a 35% chance of being higher over the next 60 days.

Looking at the white lines when it is down it can be down a lot!

Perhaps this is a new paradigm for UNH where that top trending number 69% will start to fall over time?

Who knows…

This was an example of a bottom trigger what I deem as a max selling pressure.

Now over the last week we have had the first of what could be many continuation triggers.

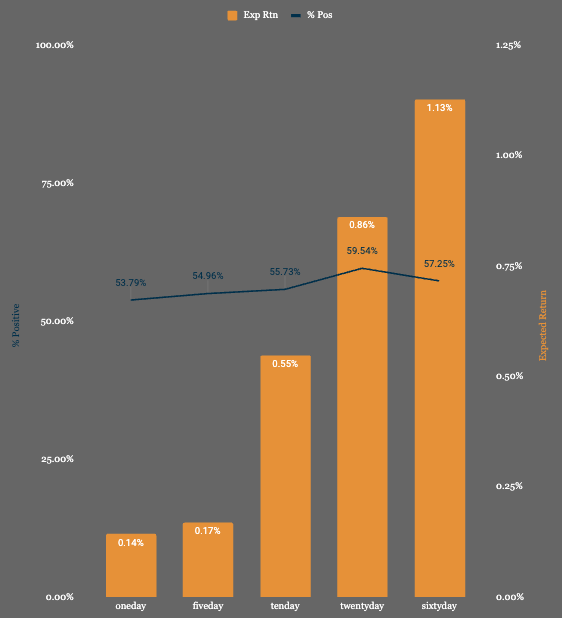

These are not as dramatic between 50-60% likelihood of a positive return.

Again we have this sharp cliff. When it doesn’t works it really doesn’t work!

What about this paradigm shift?

Well the last time this trigger occurred was in late March this year where it went on to have a minus ~40% drawdown.

What are you trying to say Chris?

Everything is in a constant state of flux.

Do we use the entirety of the ~9 years of data and say UNH is a very high trending equity or do we weight the last 90 days of data that says everything could be changing?

Who knows?

All I know is this is why I take many small bets.

UNH could be up 12% after hours because of some fundamental shift or new product or blah blah but that is not at all my wheel house.

Just as likely is it is up because it met some metrics that meant it was incredibly cheap to buy upside convexity in the options space.

New user guide - Paid Portfolio Posts

Latest portfolio Update

Hot Takes with Hank

Think pieces!