Macro Tuesday - Oil. The commodity only a mother could love...

Macro Update - Tuesday 10th June

TL;DR

💵 FX : Mexican Peso worked a treat.

📈 Equities : Broad strength is giving way.

🏗️ Metals : Underweight gold overweight everything else.

Lots of images so please view in browser as many email clients truncate the newsletter and their is juicy stuff at the end…

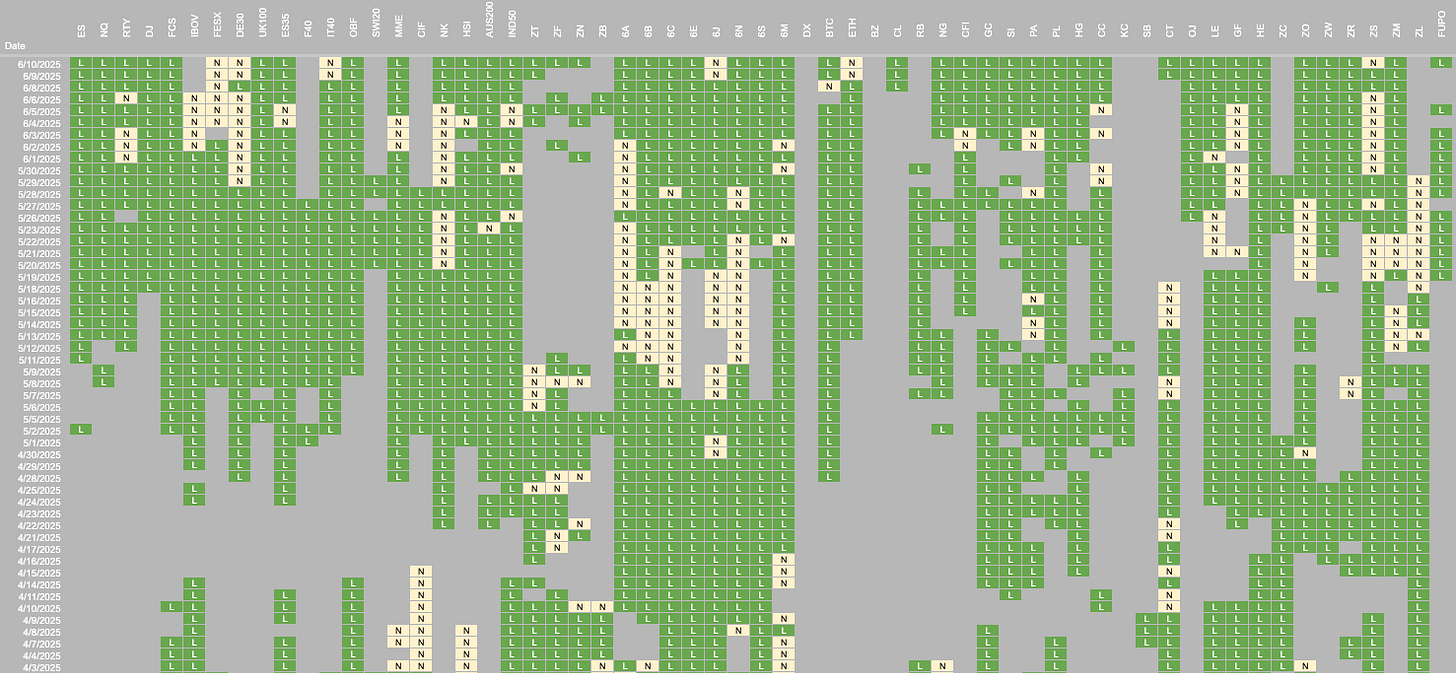

The longs have picked back up. Open profits = larger margin which is good until it isn’t. For now 🟢 green lights.

This chart can also be helpful for equity investors. It can give you signs to sectors maybe picking up strength.

The theme of this post is energy and if you are looking at US equities alone it is not a clear picture. Here you can see OBF futures contract is linked to the Norwegian index which of course is linked to oil. I don’t have the Krone shown here but pull up a chart of NOKUSD. Finally you see at least the first tick long in the US oil contract CL but not yet in BZ Brent.

Recent Equity Portfolio Update

Latest Hot Takes with Hank Episode

This is the last macro update I made a comment at the end about oil and those first signs might be turning into something more promising.

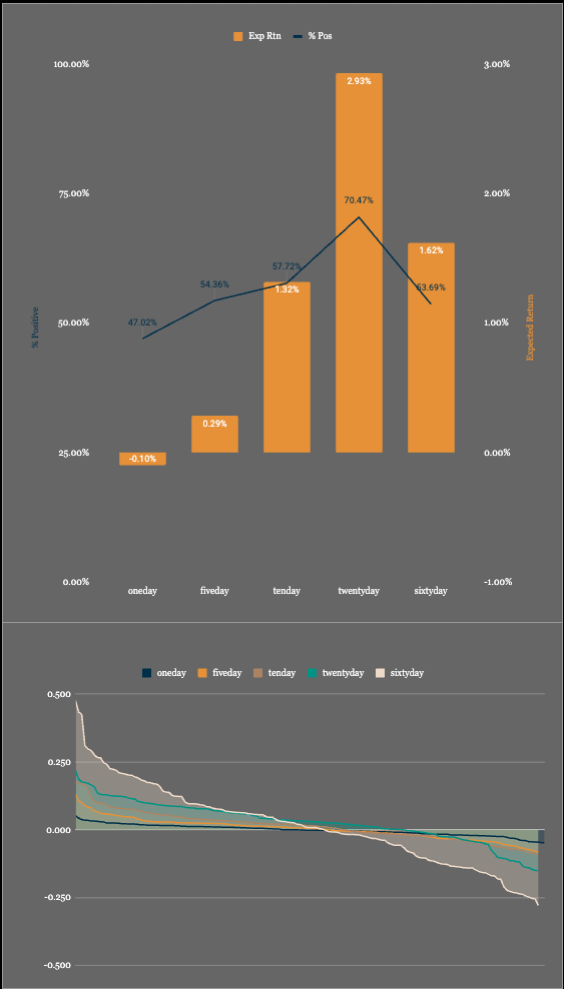

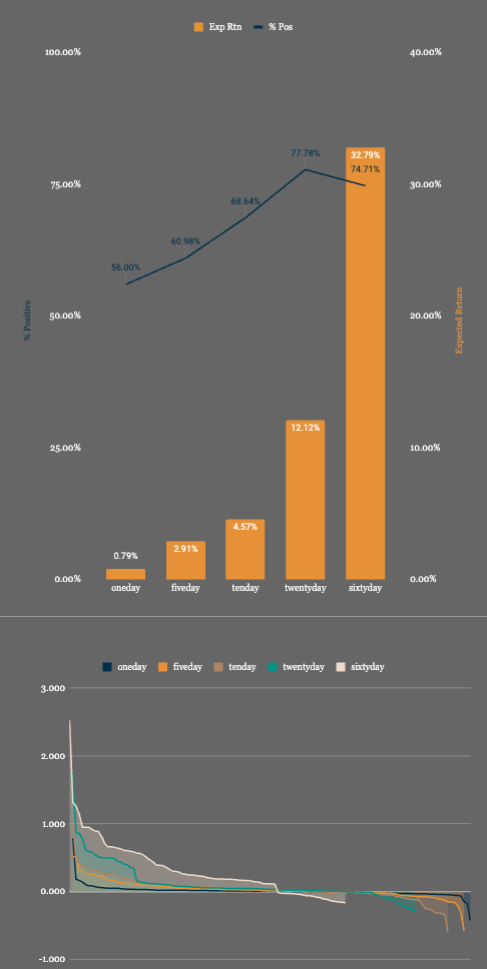

Strength of Signal measures have reached an interesting point, based on the lower segment of this chart.

Circled shows that returns are often front loaded in a move, but…

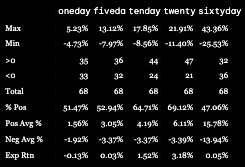

Expected Return calculations are not great. As the data points increase shown at the top the “averages” become somewhat meaningless. How I have discussed this in the past is when the distribution of outcomes are wide for me options become a better way to express a trade. If it is a negative outcome we know how much we can lose, if positive we can get convex returns.

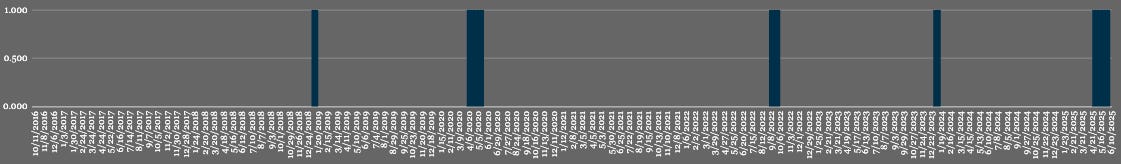

Trigger_1 : SoS 21 <0, SoS 21 uptrend =1, SoS 63 Uptrend =1

aka fast uptrend reversal

Trigger_2 :SoS 21 <0, SoS 21 uptrend =1, SoS 128 Uptrend =1

aka slow uptrend reversal

Less occurrences less clear cut but it could be important where it is happening. If you look at the first CL chart and the pink straight line SoS_128 hasn’t weakened below here since 2017. That doesn’t mean it can’t weaken from here!

Both Trigger_1 and trigger_2 have hit within the last 3-4 days.

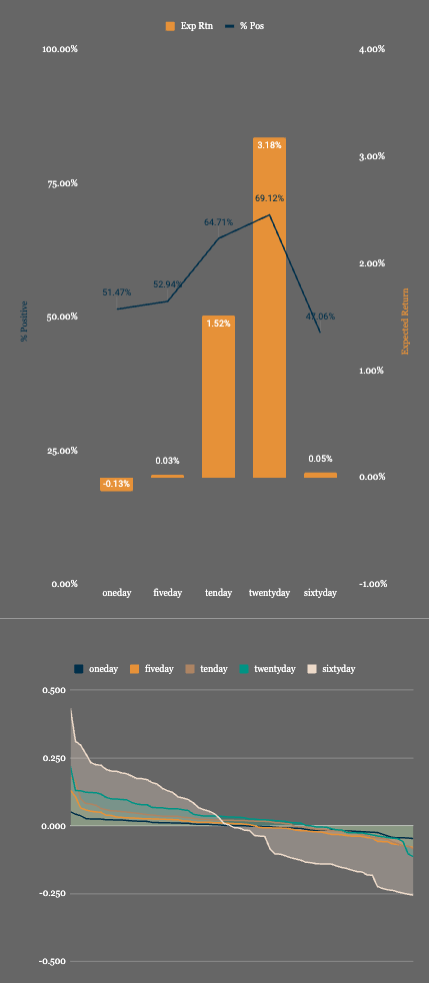

Trigger_4 : Mtum_21 <0, Mtum_63 <0

aka did momentum stall across timeframes.

The last trigger was May 5th

Remember 2020 return will skew the results, but unlike what economists like to think 2020 really existed it wasn’t a dream. Shit happened that created crazy numbers.

Trigger_9 : SoS_21 =-1, SoS_63 =< -0.9, SoS_128 = <0

aka Cramer says Oil is going to $45

Finishing with a little bit of macro nonsense, but only one sentence. The last time Oil triggered this much was 2020.

Have a lovely day everyone.