$FANG FANGtastic Opportunity in Oil

Equity Spotlight

…reading myself trying to make a clickbait title is cringe.

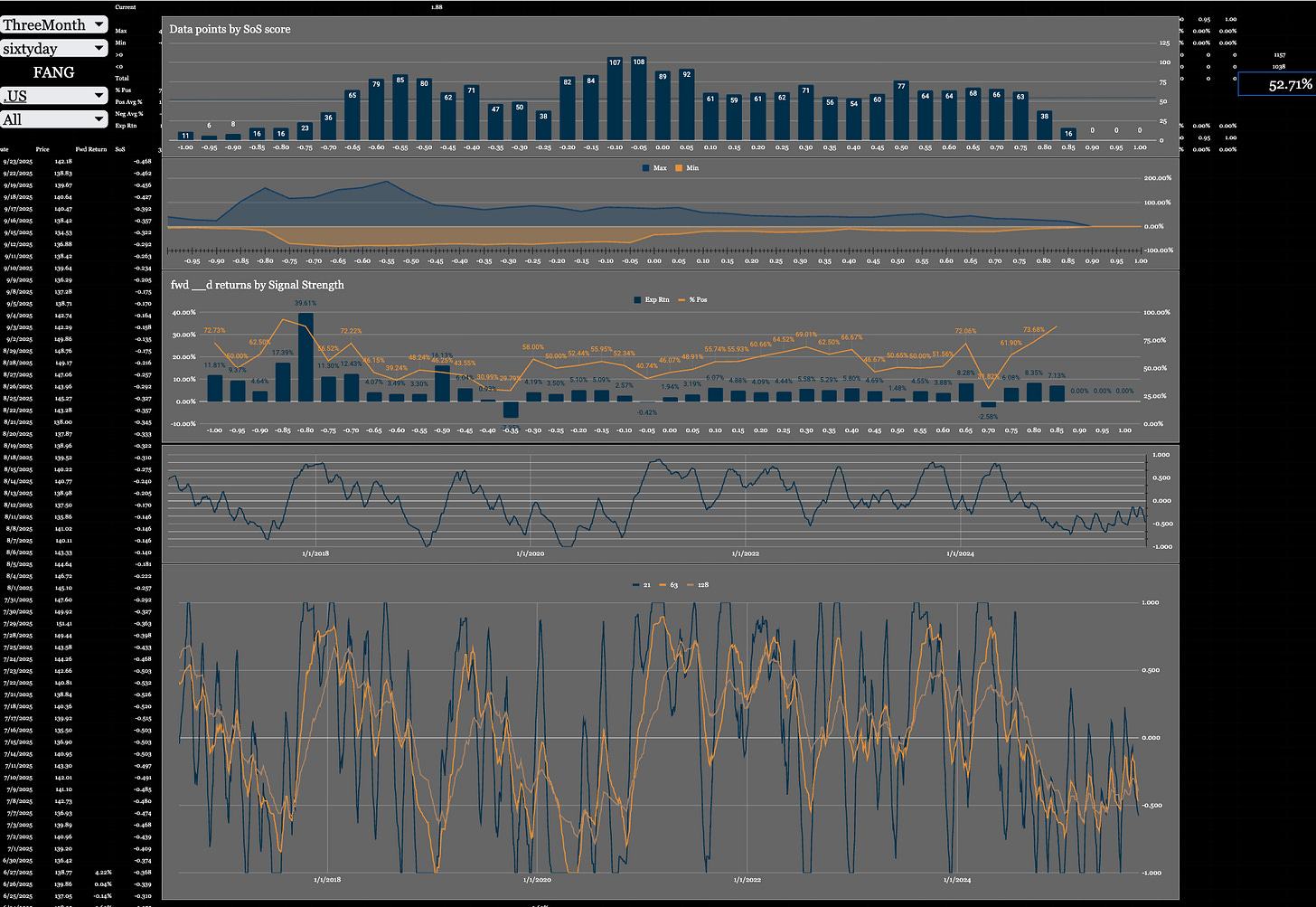

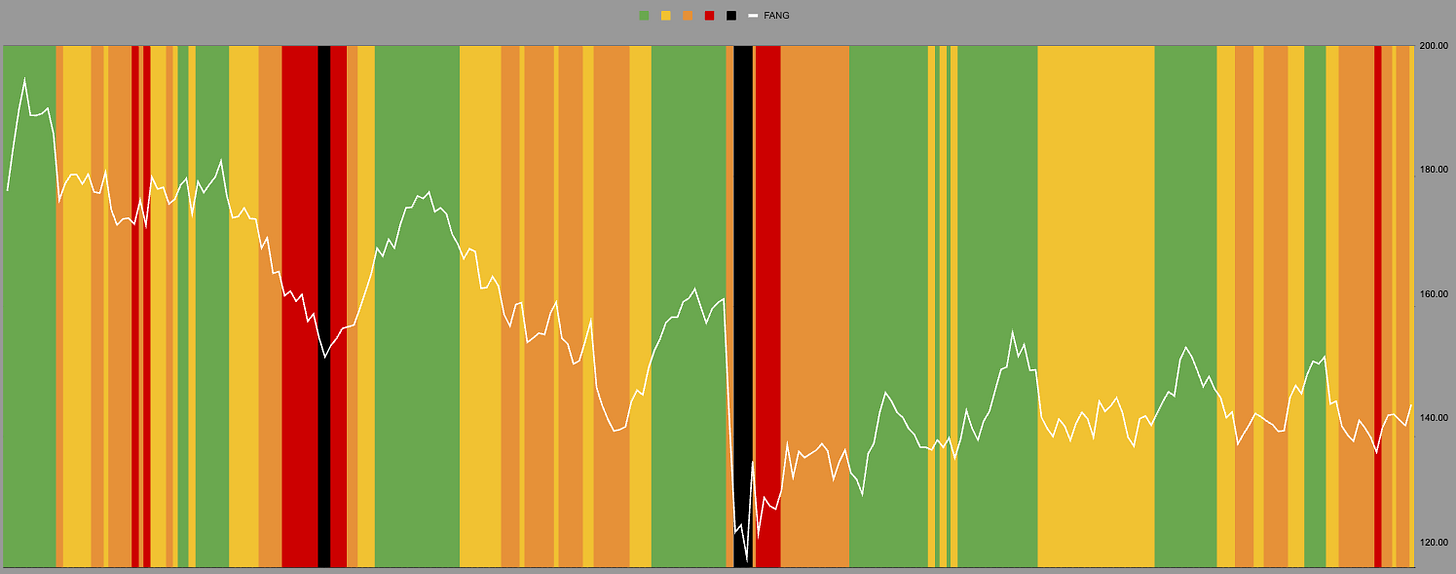

A whole lot of nothingness really over the last few months.

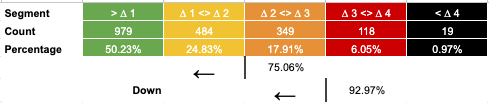

We had a Trigger_4 which is a negative momentum measure.

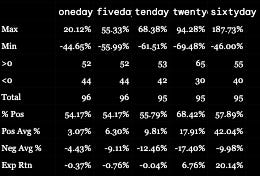

You can see from the results of an expected return calculation that they can be OK over long periods but it is 50/50.

Add that to the fact that FANG only trends 52% of the time putting it well and truly in the IWMy camp.

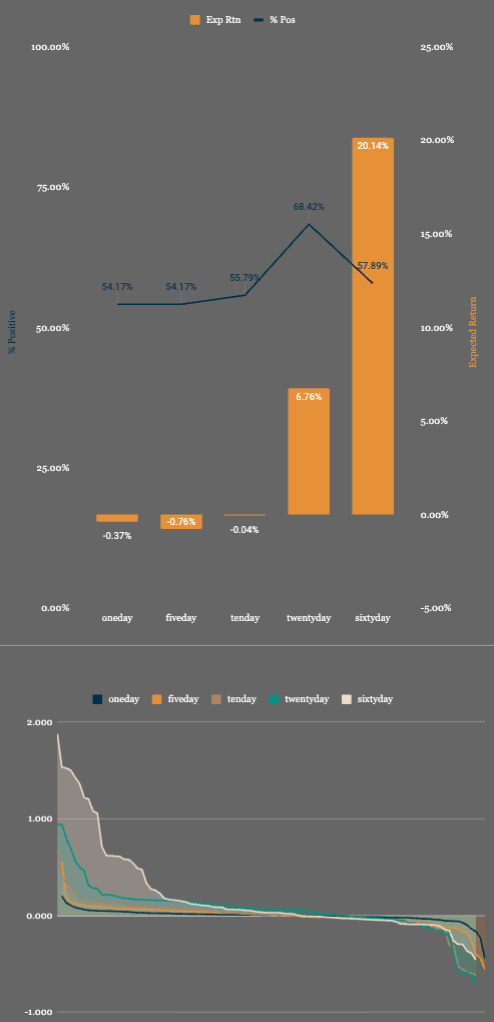

What if we change the calculation?

If we use options we can define our max lose, by sizing the position so as not to cause great harm if it is wrong.

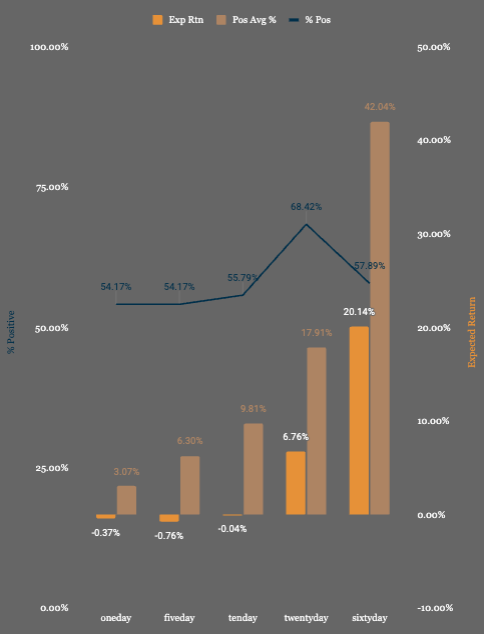

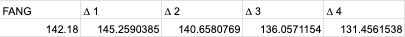

Let’s say we risk 0.5% of our capital. Well now we no longer need the negative part of the calculation into expected value. Let’s just use the positive return averages. That looks more fun.

So where can it go?

What strikes?

What duration?

There are other services for that I am not an option guy, I like futures. I just know that even though its not a big part of my personal space options are a big part of everything market wide so I make sure my work flow captures it in some way.

If you have a useful service that you take this data and then go and structure a trade please share so we can all learn together.

Currently to get back into the green where it spends 50% of its time it needs to break 145 is that interesting? Meh.

Perhaps the main takeaway from this post is that energy overall and here is FANG which is in SPY QQQ and the largest factor ETF baskets is signalling a transition.

Just like 3 months ago who would have thought Health Care would be the top performing sector and we were buying UNH in the portfolio?

Here are some people that at least look like they know what they are talking about!

Hmm the fact that “some” means one person directly speaking to FANG might be another signal itself.

Who knows?

New user guide - Paid Portfolio Posts

Latest portfolio Update

Hot Takes with Hank

Think pieces!