12 Years of Practice for 5 Seconds of Glory.

Wednesday 6th November - Daily Update

Looking at the futures, it’s safe to say this will open in the green. 😉

Those who have been following along since summer will know that I’ve been discussing this outcome for a long time. Volatility, it appears, moves in two-year cycles, though what drives it is anyone’s guess. It could be large allocators, election midpoints, or structured product dates—who knows?

The 2022 equity drawdown now seems like just a blip, SVB is long forgotten, Halloween 2023 turned into a treat for dip-buyers, and here we are. The last obstacle was this major political turning point.

I’m not a political person, and it’s not my place to comment on another country’s election. But I will say that enough people felt it was significant, and they took action to hedge or protect themselves.

Imagine if, during a penalty shootout, a little man ran onto the field before each kick to tell the kicker and goalkeeper the market odds of scoring or saving. Would it impact the outcome? In markets, that’s exactly what happens. The VIX, or volatility complex, is no longer just a score of the game—it’s a player on the field.

With all markets rising, a 5% hedge that might have cost $10 million ten years ago now costs $100 million. The measuring stick has become a player. The tail wags the dog.

Here’s a post where I discussed this (skip to 8m15s in the video).

The point is, we’re now seeing the craziness play out. Money will be reallocated, cash will be put to work, and hedges will be taken down.

The U.S. may have the same President as in 2016, but it might not lead to a 2017-style market outcome.

As always, this is not a prediction. I will simply follow what the market is doing. It’s essential to think through these scenarios.

I fought hundreds of fires on a submarine: torpedo fuel leaks, hydraulic bursts that ignited, galley fires—you name it, we practiced it over and over again. Preparation was key.

In all those years, I only used a fire extinguisher once. During a maintenance period, someone left cardboard too close to an area that had been welded an hour earlier. Five seconds of CO2, and it was out.

Now, the finance industry, which always tells us “past performance is not a predictor of future performance,” would take my single experience and package an ETF that bets on five-second CO2 extinguishers, rather than focusing on the years of practice.

The benefit of systematically doing what the market is doing is that it gives us the space and time to think through scenarios we hope never to face. I’d rather have the basics of a plan for the worst-case scenario than be unprepared for something unexpected.

Can President Trump lead us to market glory? Maybe.

Perhaps we need another 2018 or 2020 to clear the brush first.

It’s not here yet and might never be, but knowing it’s possible means we won’t be caught off guard if it does happen.

After all the nonsense, the little chart is back to green…

You can see more in this week’s weekend rundown and portfolio update.

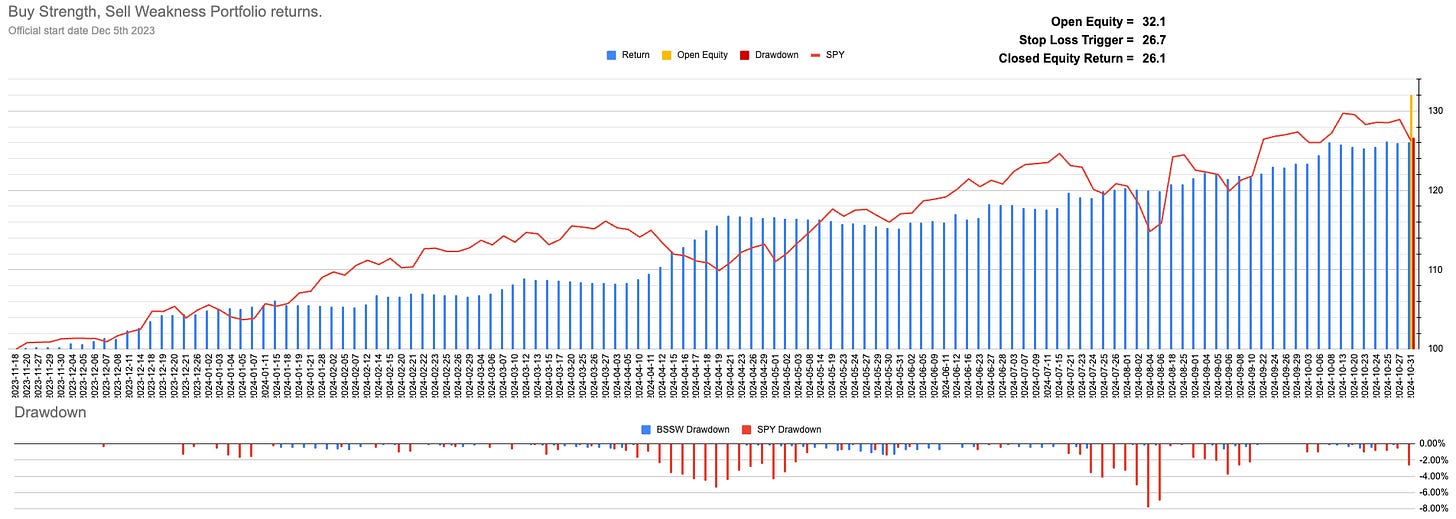

Current Open Equity = 32.1%

Stop Loss Trigger = 26.7%

Current Closed Equity Return = 26.1%

I use the knowledge above to build a portfolio of the best-performing stocks within the SP500.

Subscribe to see the portfolio. You can do it for free using the 7-day trial if you want.

https://discord.gg/5q6Xcf4V ← New subscribers make sure to join Discord using this link. If you are a new paid subscriber send me a DM to gain access to the subscriber section.