Riding Out the Pullback: Cash on Hand, Strategic Patience, and the Myth of the ‘Trump Trade’

Week 45 - Equity Portfolio Update

A lot is going on this week, so with respect to paying subscribers, what I might normally share in front of the paywall will all be behind it.

All I will say is that we were well-positioned for this pullback, with a large cash position to ride it out.

Now we have to execute on when and where to allocate it.

There is a thrill in allocating early and getting large moves. You know what’s better?

Waiting and allocating to confirmed trends that you can ride for months, not days.

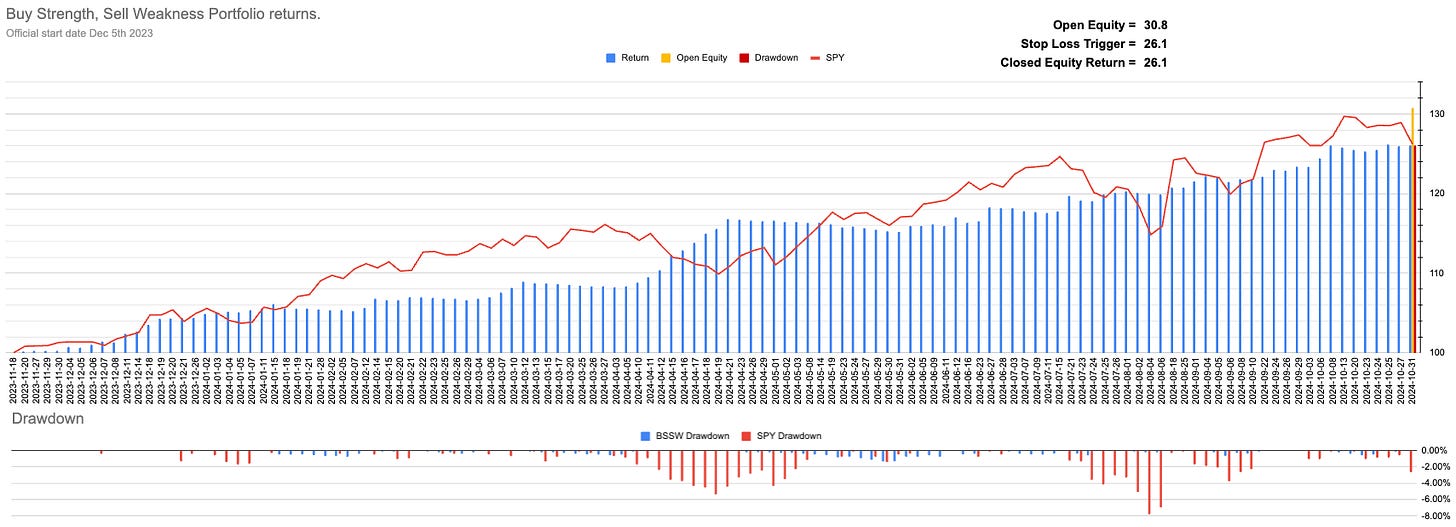

Current Open Equity = 30.8%

Stop Loss Trigger = 26.1%

Current Closed Equity Return = 26.1%

Here is an example of the positions that we have closed this week:

It hurts but I would rather close small losses than large ones.

And our current open positions:

The system is currently building up a cash position. Lets see how that works out…

Please subscribe if you want to see more of the portfolio we are constructing.

New user guide - Paid Portfolio Posts

New user guide - Free Index Overview

Subscriber Discord