The Safety Trade is Over?

My Grammar Is Terrible. Is That a Statement or a Question?

You can feel the market vibrating.

It's like you have a jar of bees, and it’s being shaken up. Thirty seconds ago, you could see the person rattling the jar, but now the jar is perfectly still, while the bees are going crazy inside.

The index is the jar.

The bees are the stocks.

Sometimes the jar is shaking; sometimes, it's not.

Sometimes the bees are crazy; sometimes, they are not.

In between those times, you still have to collect the honey.

All the time, you have to try not to get stung.

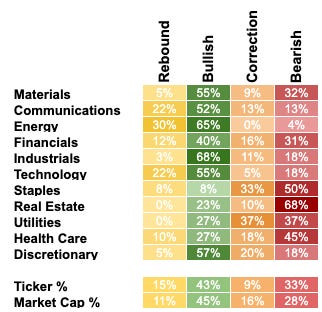

Subscribers can use the weekend links to access updated dashboards, but you can see from this chart how much is moving internally.

The safety trade is no more?

Liz Ann Sonders - Hedgeye Investing Summit

In this interview, Liz Ann Sonders highlighted the same point. As always, these things need to confirm.

In the portfolio, our allocation to staples, utilities, and REITs has dropped significantly. We picked up on discretionary a little earlier than materials, and energy looks to be next. Luckily, through all of this, we held onto financials and some industrials, and they performed well.

Realised volatility continues to fall.

Are people holding hedges now because they wished they had hedges a month ago?

Is that pushing up implied volatility while realised falls?

Humans never chase what they wish they owned. Ever.

Portfolio Rerank

New user guide

Current Closed Equity Return = 26%

Current Open Equity = 30.6%

Stop Loss Trigger = 26.2%