SPX Decision Point or Reset Point?

Week 26 - Equity Portfolio Update

I highly recommend using the link to view these posts in a desktop browser. Substack limits the size of emails, and since I use a lot of images, some readers have been missing important data by only viewing the truncated email.

We cannot un-see the two red bars.

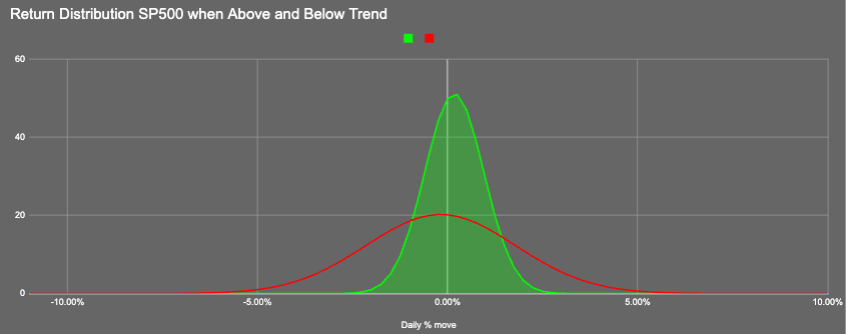

We are below momentum.

We are above trend meaning we are still within this tight green distribution curve.

Did the VIX trend turn negative yes but for the moment the large driver was the old vix data leaving. This is a prime example of why I don’t short anymore.

It free’s me up to make this decision, remember outside of the portfolio I trade futures on the index.

Have new buy signals on the short-term measures appeared?

No.

OK. Go have fun and reload the data tomorrow.

Mr Croissant would say we have weakness into month end.

We have a week of Twittering about “JPM Hedge blah blah 5900 blah”

If the market is pinned into that level to the end of month it could make everything within the index push and pull in weird and wonderful ways.

Current Open Equity = 26.2%

Stop Loss Trigger = 22%

Current Closed Equity Return = 24.1%

Our open equity outstanding is ~26% since we started in Dec ‘23. We have been able to capture ~24% returns in closed trades, meaning ~2% open equity still belongs to Mr Market. Until we close the trade it doesn’t yet belong to us!

Subscribe to see the portfolio. You can do it for free using the 7-day trial if you want.

New user guide - Paid Portfolio Posts

Hot Takes with Hank

Think pieces!