Speed Wobble, or just another Wiggle?

Week 43 - Equity Portfolio Update

I highly recommend using the link to view these posts in a desktop browser. Substack limits the size of emails, and since I use a lot of images, some readers have been missing important data by only viewing the truncated email.

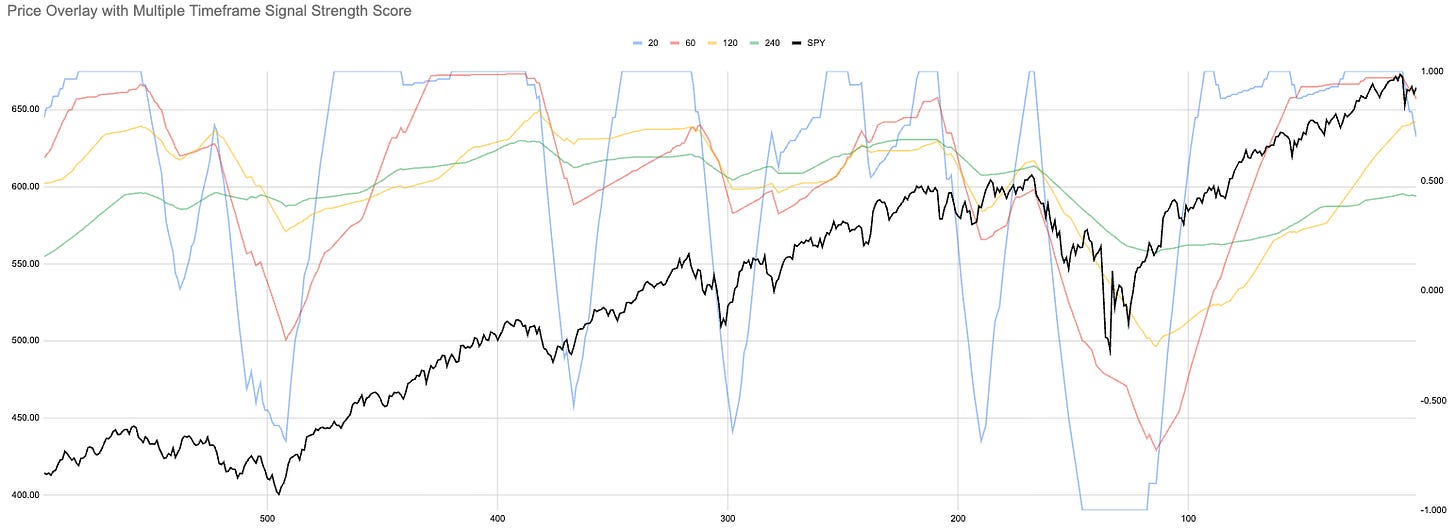

As prices rise and old wiggles and wobbles disappear from the lookback our levels rise with them.

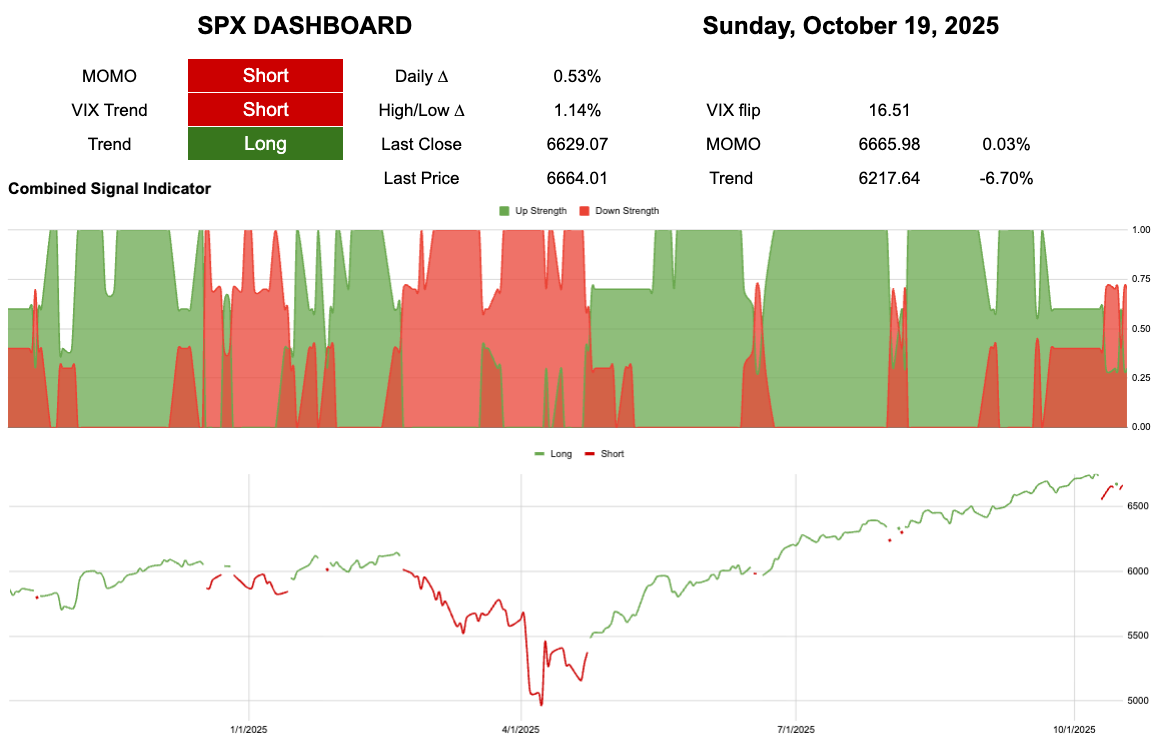

6665 to break momentum

6217 to break trend

As discussed over the last few months rising prices are great, but then you have to comp against them…

Momentum is now 6665 which means with the weakness we now have a “stretch goal” to get the index back above momo.

If you have hedges keep them on.

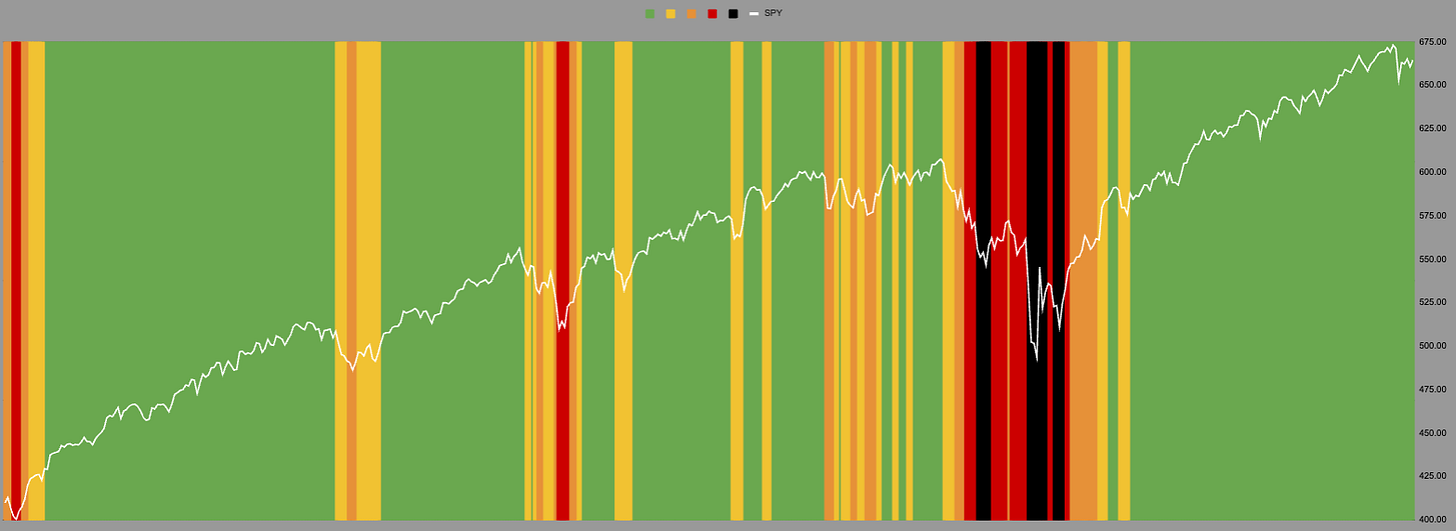

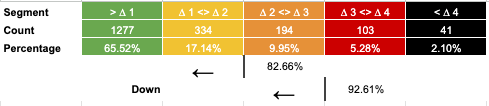

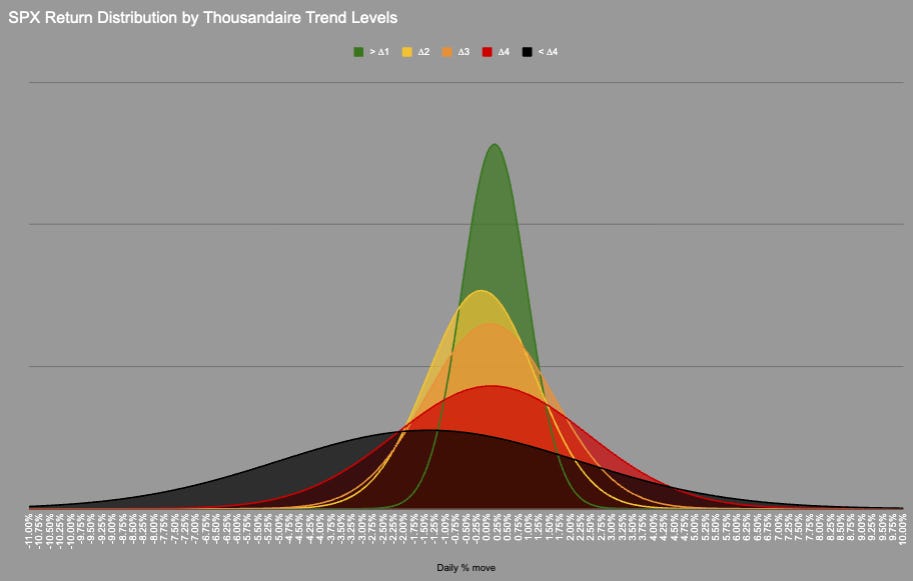

We remain in the green zone where SPX spends 65% of its trading time. This zone has a narrow but positively skewed distribution.

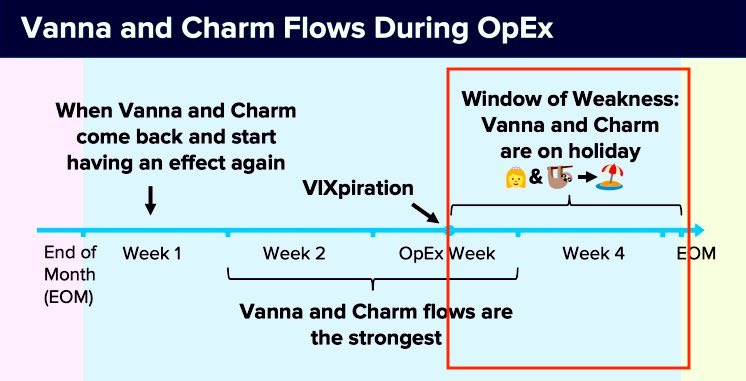

We are in a funny week where VIXperation comes after the Equity OpEx does that mean the weakness of the all powerful red square is delayed? Do we have a double dip?

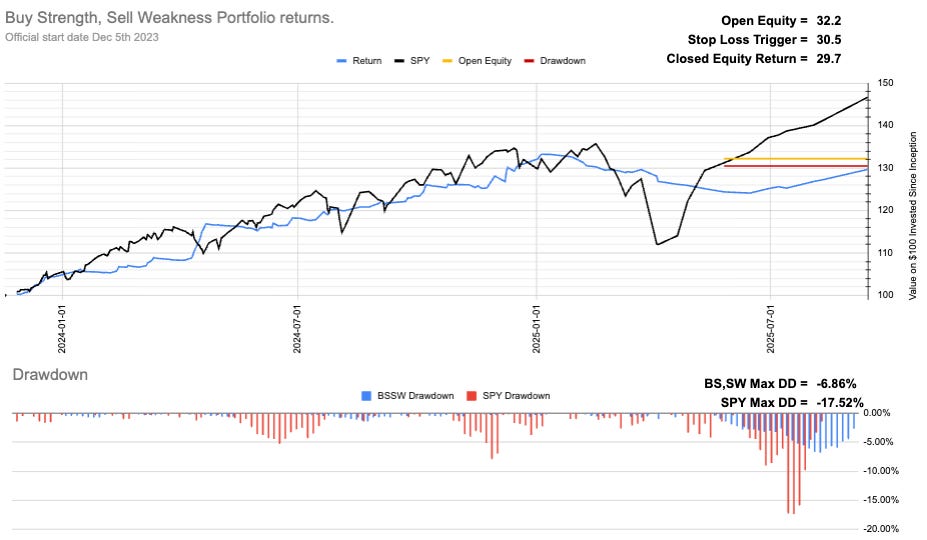

Current Open Equity = 32.2%

Stop Loss Trigger = 30.5%

Current Closed Equity Return = 29.7%

Our open equity outstanding is ~32% since we started in Dec ‘23. We have been able to capture ~30% returns in closed trades, meaning ~2% open equity still belongs to Mr Market. Until we close the trade it doesn’t yet belong to us!

Do I wish it was higher? Of course I do! Equities have had a crazy year in 2025 and I wish I had captured more of it.

I am also super proud that the system in the panic of April allowed us to keep our head and not make any stupid forced mistakes.

Everyday is a school day.

Subscribe to see the portfolio. You can do it for free using the 7-day trial if you want.

New user guide - Paid Portfolio Posts

Hot Takes with Hank

Think pieces!