Portfolio with Christmas Sprinkles

Week 51 - Equity Portfolio Update

Short and sweet this weekend, lots going on outside of finance as we move into Christmas.

Lets try and keep everything in perspective at this time of year.

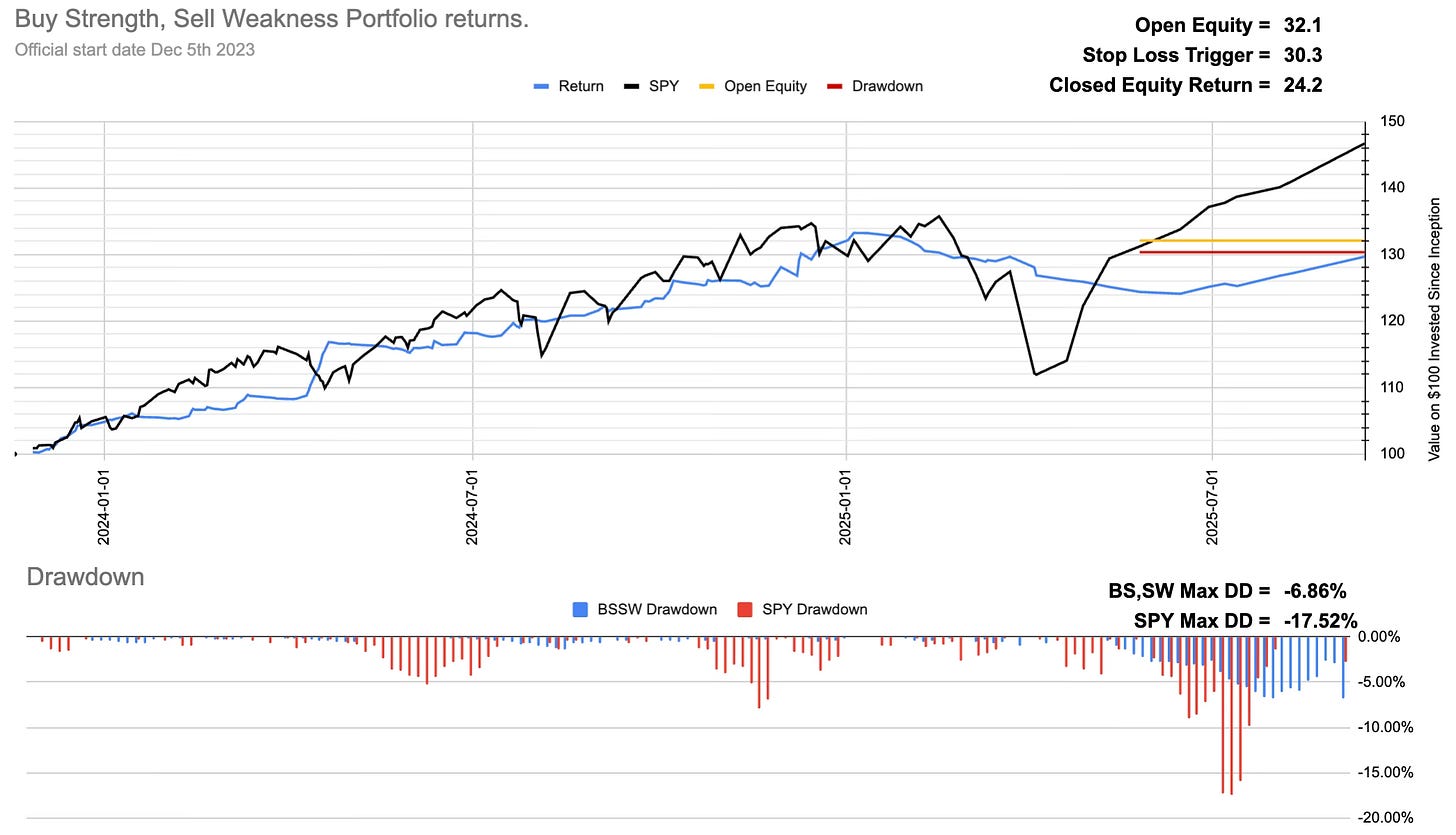

Current Open Equity = 32.1%

Stop Loss Trigger = 30.3%

Current Closed Equity Return = 24.2%

Our open equity outstanding is ~32% since we started in Dec ‘23. We have been able to capture ~24% returns in closed trades, meaning ~8% open equity still belongs to Mr Market. Until we close the trade it doesn’t yet belong to us!

Do I wish it was higher? Of course I do! Equities have had a crazy year in 2025 and I wish I had captured more of it.

I am also super proud that the system in the panic of April allowed us to keep our head and not make any stupid forced mistakes.

Everyday is a school day.

Subscribe to see the portfolio. You can do it for free using the 7-day trial if you want.

New user guide - Paid Portfolio Posts

Hot Takes with Hank

Think pieces!