Portfolio Breakdown heading into Week 02 of 2026

Week 02 - Equity Portfolio Update

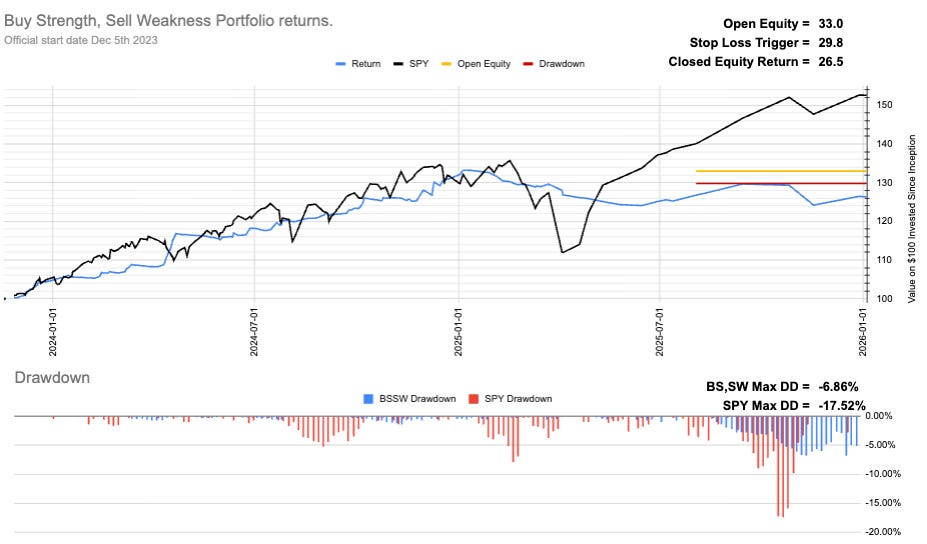

Portfolio is up 1.37% vs our SPY benchmark up 1.10%

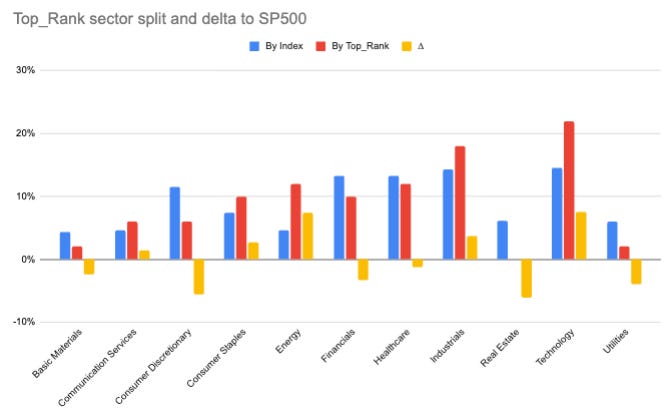

So this is how the portfolio lines up against the SP500.

Real Estate still with no position, will that come to hurt or help us?

Big overweights in Energy and Technology. Tech is the continued darling but if Venezuela nonsense turns out to be actual nonsense will energy again be a thorn in our side?

Current Open Equity = 33%

Stop Loss Trigger = 29.8%

Current Closed Equity Return = 26.5%

Our open equity outstanding is ~33% since we started in Dec ‘23. We have been able to capture ~27% returns in closed trades, meaning ~6% open equity still belongs to Mr Market. Until we close the trade it doesn’t yet belong to us!

Subscribe to see the portfolio. You can do it for free using the 7-day trial if you want.

New user guide - Paid Portfolio Posts

Hot Takes with Hank

Think pieces!