Just Keep Swimming ver397

"let’s not overcomplicate it"

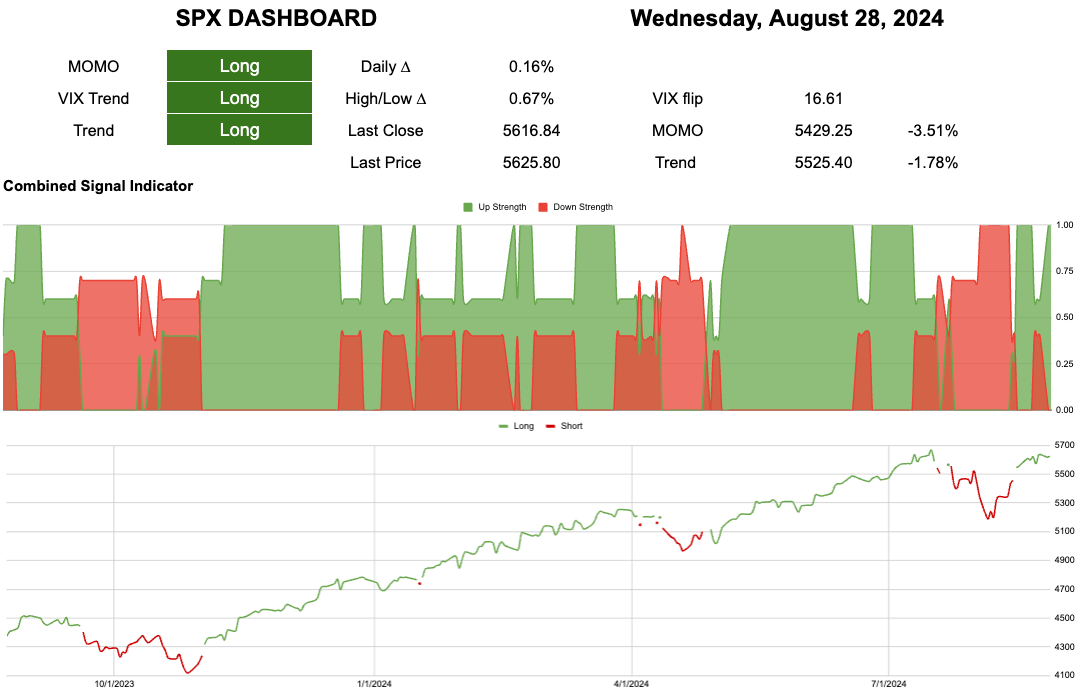

Back to all green on the board.

The VIX echo has now rolled out.

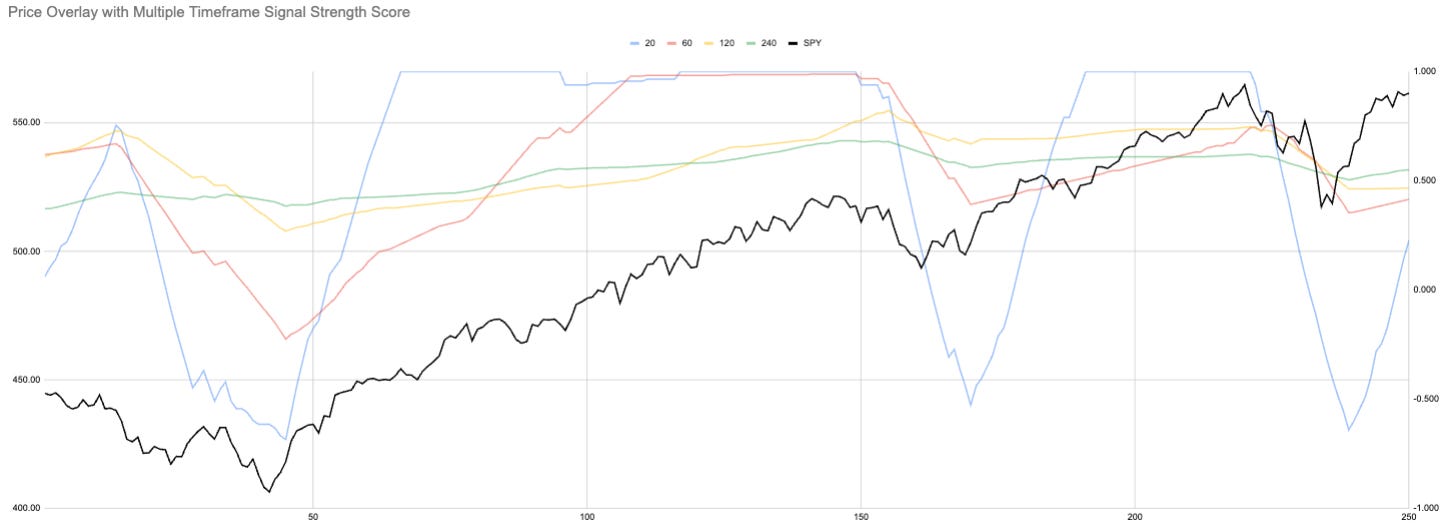

Plus the options-driven metrics discussed by Cem Karsan et al.

If we add one of my own.

If we look at the summer quarters as divided by monthly and quarterly OpEx we see these gamma bumps into quarter end.

Hourly

If only someone highlighted the chance of sideways index price action??

I would pay for that kind of insight. Wouldn’t you?

Daily

559 was an important level over the last couple of days. It did break lower yesterday at the open.

Let’s see where we end up. 551 could be a gift on any NVDA nonsense.

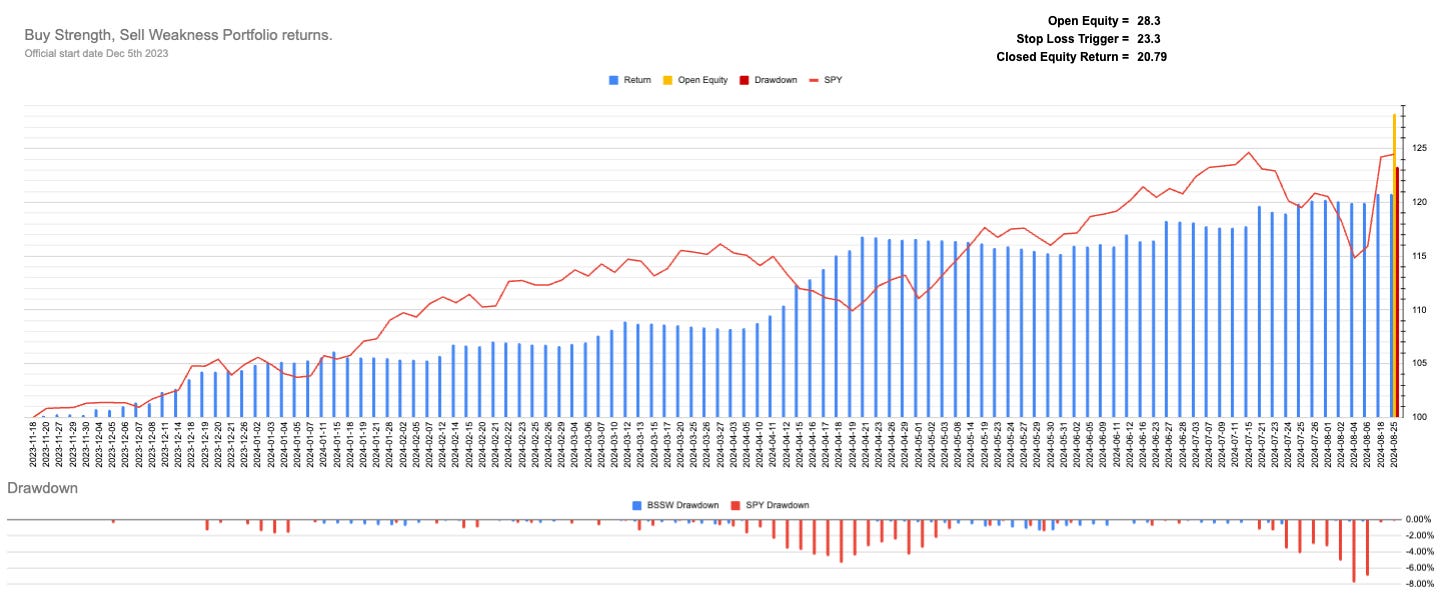

This fast move has brought not only positive performance but it has lifted our stops. This can be viewed in two ways. One it raises the risk of us flip-flopping positions. We have a fix for this but ultimately let’s not overcomplicate it we win some we lose some. The big positive is that if all our stop losses were hit today we would close out with +23.3% return. As I always highlight gap risk is a major risk just as it is for everybody.

I am a random dude on the internet none of this is trading advice this is me sharing my portfolio and trying to share how I think about things. Do your own research and where possible share it with the group.

“Every day is a school day.”