I Hadn't Realised what You Were Implying...

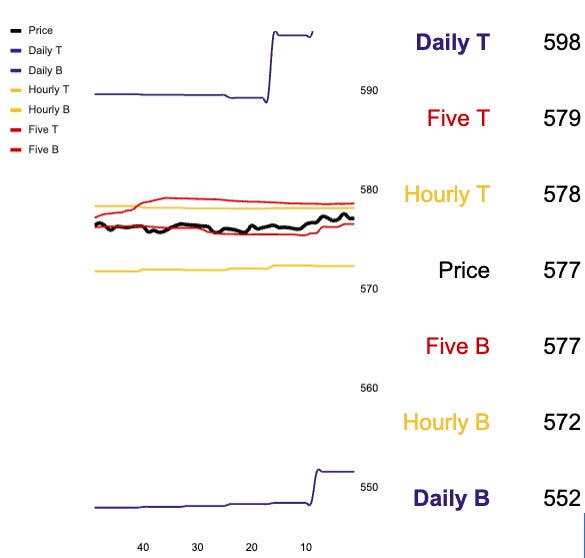

5649 - 5658 is the line in the sand for the index.

Momentum and trend are both long. The VIX signal is still processing the elevated volatility from the last few weeks.

The realised volatility continues to fall while the implied forward volatility being priced into the market remains “high”.

Did everyone get scared into puts that they wish they had in August and September?

Daily

This is supported by daily levels.

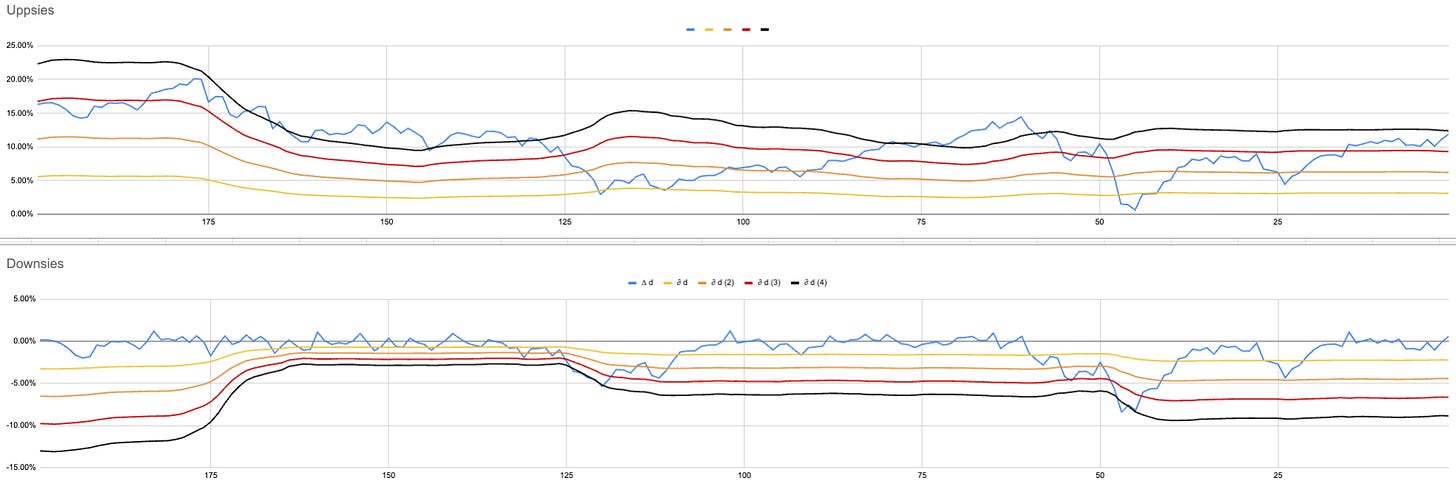

As I have highlighted, the accuracy of the upside calculations tends to be lower than that of the downside.

I strongly believe this is a combination of options and passive-driven dynamics. If all else remains equal, Vanguard and similar funds still need to buy at the end of each day.

Options, all else being equal, have a defined loss profile (premium) and an unlimited payoff profile. If your calls expire out of the money (OTM), you lose $1. If they expire in the money (ITM), you make $10. Leading up to expiry, the rising value of the option creates a pull, like a magnet, towards the strike prices.

I think this is why the upside is more often invalidated as a jump risk exists, and is rarely used as a sell signal.

On the other hand, with the downside, we know that certain strikes are used at 5% OTM or 10% as defined loss or pain levels for those who hedge.

Another important factor often missed is how prices leaving your lookback window impact your calculations just as much as today’s price movements.

This is why levels can shift even without significant price changes, and previously important “prices” can become irrelevant.

Portfolio Rerank

New user guide

Current Closed Equity Return = 26%

Current Open Equity = 31.6%

Stop Loss Trigger = 27.1%