Flows? Where we're going we don't need Flows..

Week 50 - Equity Portfolio Update

I highly recommend using the link to view these posts in a desktop browser. Substack limits the size of emails, and since I use a lot of images, some readers have been missing important data by only viewing the truncated email.

TL;DR

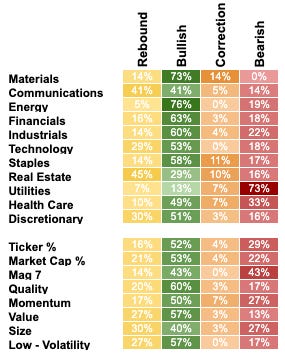

🛢️ Energy rotation continues in stocks while oil still hasn't got the memo..

🏗️ Materials have bullish numbers but not so much of the returns.

Ticker vs Market Cap is balanced with the Mag ⑦ lagging.

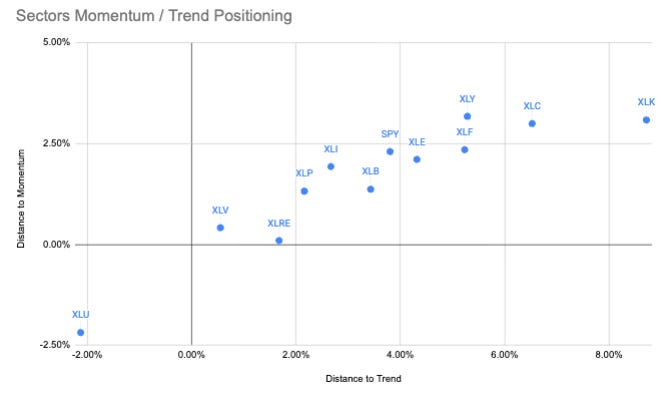

As I said in yesterdays index review all the underlying signs are good…

but…

It needs to translate into a new high else it will simply become the first bear market bounce.

The High betas have done their bouncey thing, will it be sustained?

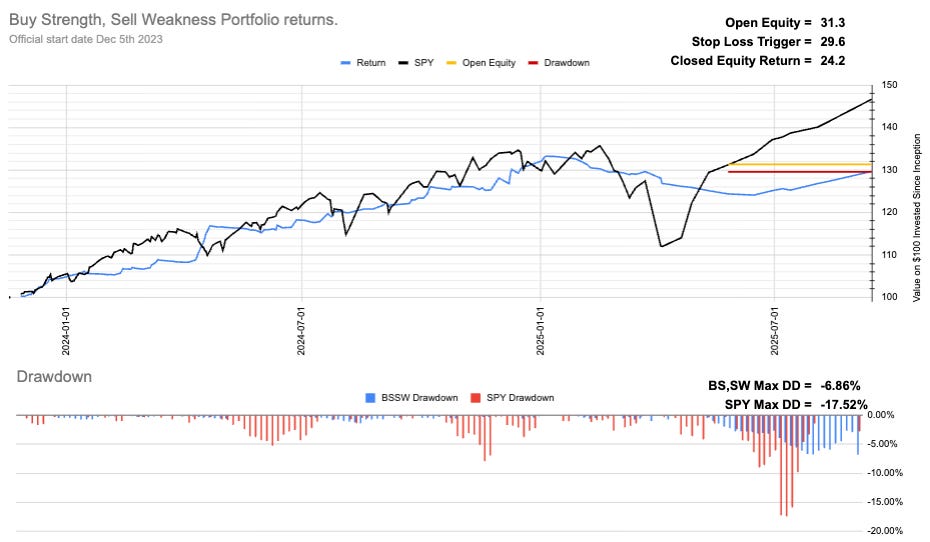

Current Open Equity = 31.3%

Stop Loss Trigger = 29.6%

Current Closed Equity Return = 24.2%

Our open equity outstanding is ~31% since we started in Dec ‘23. We have been able to capture ~24% returns in closed trades, meaning ~7% open equity still belongs to Mr Market. Until we close the trade it doesn’t yet belong to us!

Do I wish it was higher? Of course I do! Equities have had a crazy year in 2025 and I wish I had captured more of it.

I am also super proud that the system in the panic of April allowed us to keep our head and not make any stupid forced mistakes.

Everyday is a school day.

Subscribe to see the portfolio. You can do it for free using the 7-day trial if you want.

SP500 Index Update

New user guide - Paid Portfolio Posts

Hot Takes with Hank

Think pieces!