...But They Don't Know That We Know They Know.

Circles all the way down.

5584 - 5625

The VIX at 70 or 30, whichever it was, no longer exists.

Mr. Croissant, the window cleaner.

If we adjust the trading days in the options-adjusted SPX seasonality, will we still see October weakness?

It’s a game within a game.

Bears are “tactically” bullish. Bulls are cautious due to “seasonality.” I mentioned months ago that we were heading into crazy town.

Daily

Hourly

On balance, prices appear to be coiled up, just as we discussed over the last 5–10 days. The Middle East is doing what the Middle East typically does. The Fintwit army is forecasting doom and a $200 oil price.

…but what happens if things are only marginally not WW3?

Now, let’s flip this on its head.

What if those who rely solely on seasonality are correct?

What if the issues in the Middle East are being given more weight because they’re happening during a period of market weakness?

What if it wasn’t Israel/Iran but something like a boat stuck in the Suez? How do we know if it's truly “the news” that’s important, or simply that the news is happening during a period of market movement, thus making it seem more significant?

As always, I never want to downplay any particular plight or issue, nor do I wish to offend.

My goal is to put the news in context. I talk about markets, not politics because I can’t quantify political events. The only thing I can do is ensure my risk management process can navigate through them.

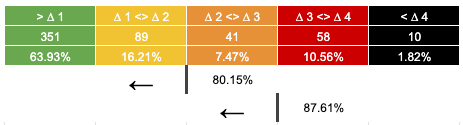

Current Closed Equity Return = 24.5%

Current Open Equity = 31.1%

Stop Loss Trigger = 25.5%

Some portfolio positions we closed this week have lifted our closed equity return to 24.5% since we started sharing this experiment via Substack last November.

I wish I had started earlier. Last Halloween, we had a positive Sept-Oct, which would make the above chart look so much better by comparison.

Unfortunately, it wasn’t public, so I won’t share it as it cannot be verified.

The updated discord link https://discord.gg/8eWHwVuZ is here.

If you are a new paid subscriber send me a DM with your substack email and I will add you to the paid section.