Back up to speed.

Week 30 - Weekly Equity Update

I made a more in-depth free index post here...

I had a question yesterday about going to cash.

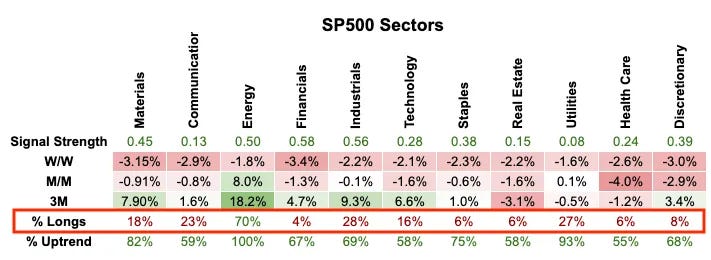

Here is the sector analysis from this week’s data update.

Here is the same analysis from my April 14th weekly post.

Notice anything different?

% Longs = percentage of names in the sector above momo/trend

% Uptrend = percentage of sector whose 63-day SoS is rising.

Should people consider moving to cash? It depends (duh).

Personally, no. I think we are heading into the crazy part of this move. I have talked about it many times, which will probably confuse the bulls and the bears.

If you have done well so far and want to sit out and miss the upside and downside stress, well I guess you have earned the right to do so.

Positions we closed this week and last.

These will be updated from tomorrow’s opening prices.

Current closed equity return = 19.3%

Current open equity = 23.6%

If all current positions close at stops our return = 19.1%

I am a random dude on the internet none of this is trading advice this is me sharing my portfolio and trying to share how I think about things. Do your own research and where possible share it with the group.

Every day is a school day.