Air test in progress...

Saturday 20th July - Daily Equity Update

These two posts stand up pretty well for the week we just had.

I listened to one of these podcasts this morning while walking Hank. Although it is not implicit or on the nose by podcast/YouTube thumbnail standards. I thought it was interesting that in 5 days we have gone from:

“Gung Ho Summer!”

To pricing, macro left tail risks.

At the index level, we have crossed momentum.

VIX trend has broken out.

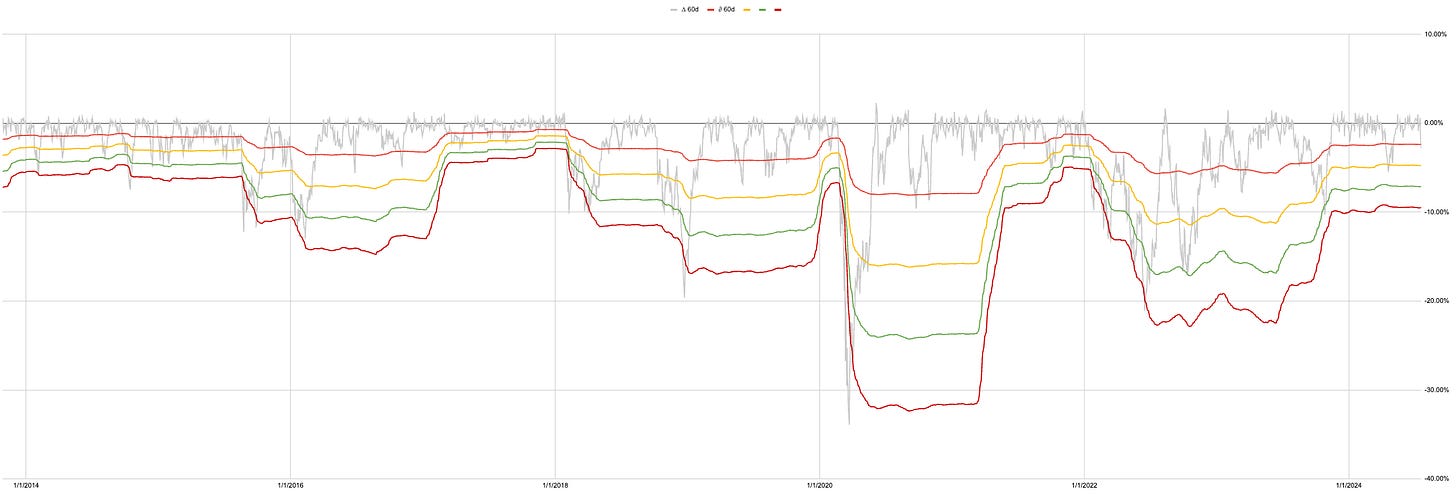

We are neutral on price trend as we fall between ∆1 and ∆2. In recent posts with the rainbow charts, you will remember SPX spends >70% of its time above ∆2.

Therefore by that measure alone, we are not short but when combined caution is needed.

“Thanks, Chris you are a couple of days late”

OK let’s look forward.

VIX is up in short order to where it tends not to spend much time.

Below is a terrible chart!

It is best viewed using a welder mask and on a desktop.

You cannot see it but there is a tiny yellow dot, which outside of 2020, Volmageddon or Q4 2018 tends to mean a top.

These things are never exact. They are not predictive but only measures to help us make decisions.

-4.76% would put us around 5398 is ∆2.

To the upside, hindsight is an amazing thing, that magic green line established in May was clearly strong with the force!!

What am I doing now?

I closed the final small part of my long futures position. Over the last 2-3 weeks I had mainly been using options to get exposure. I still have calls for next Friday but will need to roll those.

I don’t have puts I made zero trades last week. There is very little value in short-term puts left and I don’t think this will be a long-term pullback so as of today long-dated puts would be a poor trade for me!

“For me!”

If you are running other people’s money your decisions can and will be different.

The right choice for me is to catch up on work and wait for the right trade to come to me.

I am a random dude on the internet none of this is trading advice this is me sharing my portfolio and trying to share how I think about things. Do your own research and where possible share it with the group.

Every day is a school day.

Chris, one main reason I subscribe to this modeling is to make a bet that cash is a better place to be, less frequent but happens. Will you be posting an update before Monday’s open and what does a pullback look like (ie: <50 positions vs always 50 positions)? Sorry if the question is retarded. BN