5 Whole Percentage Points!! Get a Grip People!!

Week 48 - Equity Portfolio Update

I highly recommend using the link to view these posts in a desktop browser. Substack limits the size of emails, and since I use a lot of images, some readers have been missing important data by only viewing the truncated email.

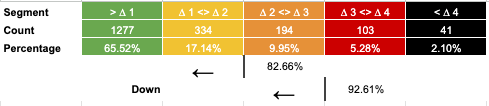

5 whole percentage points lower from an all time high after a 32% rise in the index!!

6723 to regain momentum +1.82%

6345 to break trend -3.90%

Looking at the skew what is more likely?

Of course this could be the end of everything as we know it! Just like:

Iran sending drone attacks against Saudi Arabias largest oil refinery.

Jerome Powell not cutting rates, because he is stupid.

Jerome Powell cutting rates because “he knows something is coming”.

North Korea Firing missiles over Japan.

Mr Trumps deal with China.

Mr Trumps Deal Failing with China.

Wuhan Whooping Cough.

Too much liquidity.

We stopped the economy so we can’t just keep going up.

Bubble.

Fed is raising rates.

Russia invading Ukraine.

The end of the bond market.

Inflayshun.

No one can trust America anymore not to steal their assets.

Tech crash.

Global banking crisis 2.0

Fed did too much when it was only 2 banks failing.

Aargh they blew another bubble.

The market went down just so we can make cool halloween puns.

Small caps going up for a change so this must be a bubble again.

Yay Trump is back.

Boo Trump is back.

Tariffs are good!

Boo tariffs are bad.

Hooray Bessent is going to do the stuff he said Janet shouldn’t have been doing.

Whatever the “reason” is for the current move? Maybe it’s just it’s going down for a bit because it went up a lot. Does it need to be anything more than that?

What did we gain from all those other stories above?

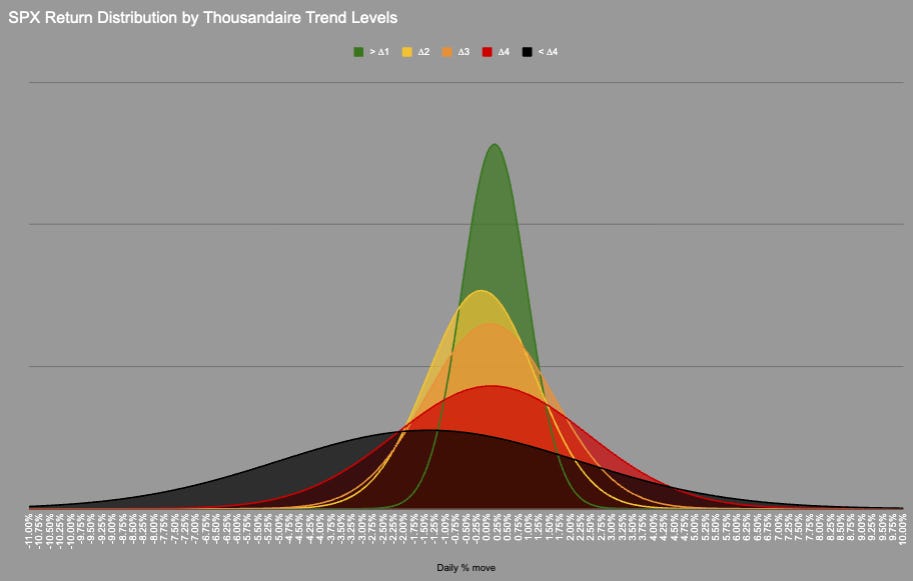

Those darn wiggles are wiggling!

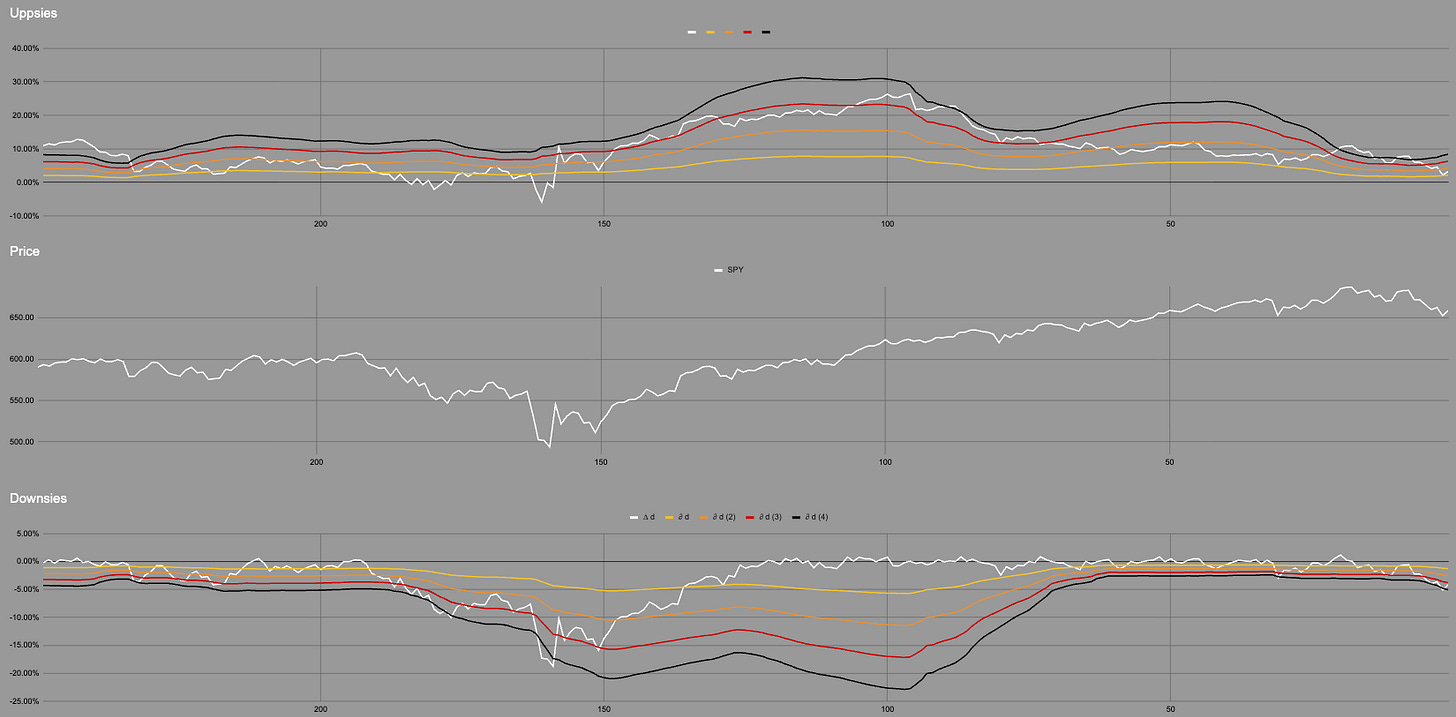

Bands are still super tight!

We had another brush with the “black line of doom”. Just like 41 other times in the last 1,962 days.

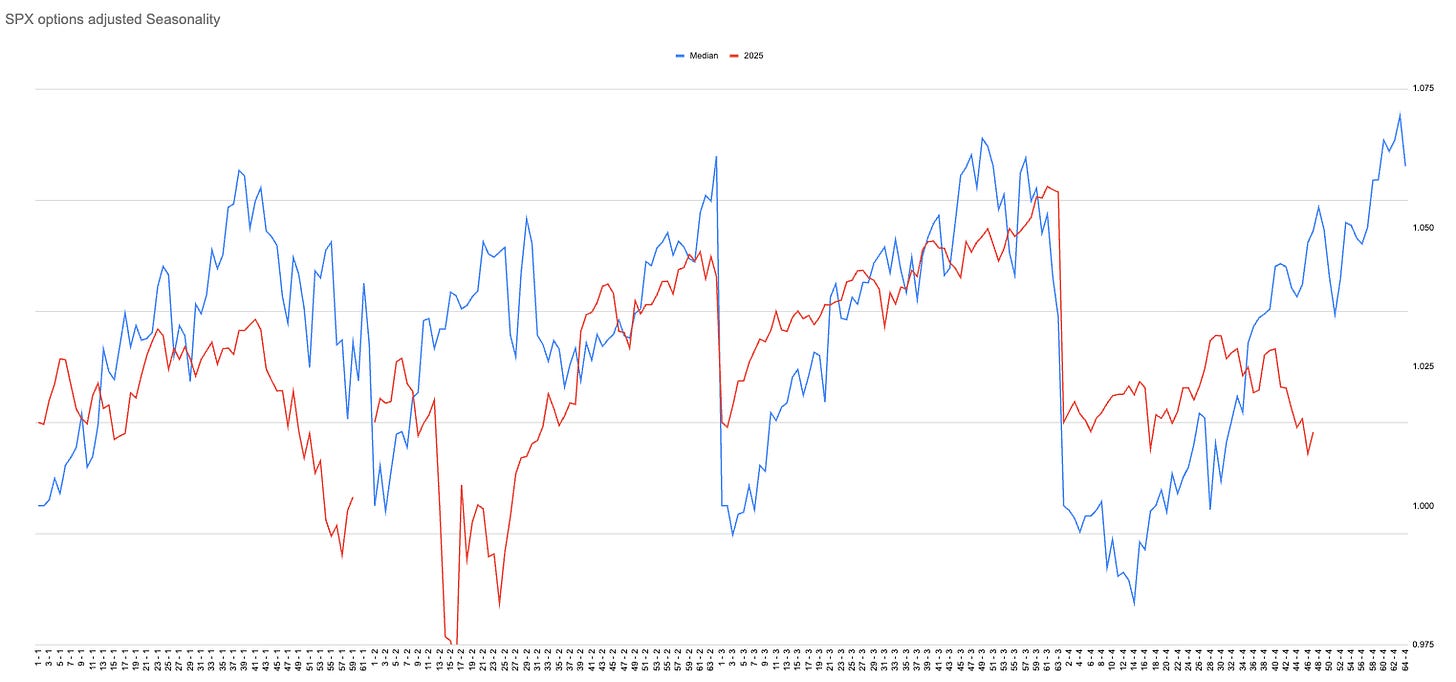

Options adjusted seasonality we have diverged much like April this year. Are we just seeing an echo? What happened when the divergence ended?

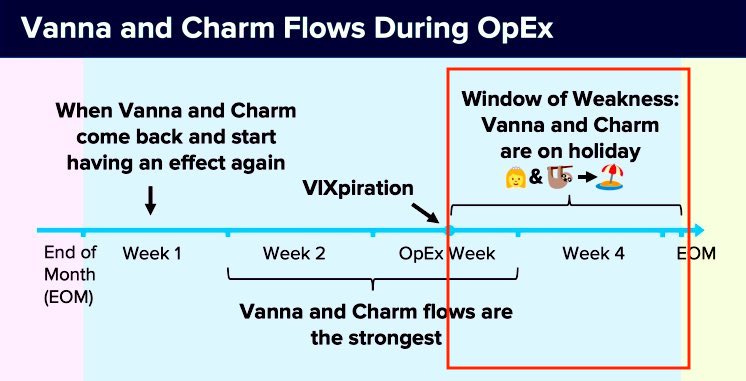

Mr Croissants flows are on their hollibobs.

Current Open Equity = 29.1%

Stop Loss Trigger = 27.3%

Current Closed Equity Return = 24.2%

Our open equity outstanding is ~29% since we started in Dec ‘23. We have been able to capture ~24% returns in closed trades, meaning ~5% open equity still belongs to Mr Market. Until we close the trade it doesn’t yet belong to us!

Do I wish it was higher? Of course I do! Equities have had a crazy year in 2025 and I wish I had captured more of it.

I am also super proud that the system in the panic of April allowed us to keep our head and not make any stupid forced mistakes.

Everyday is a school day.

Subscribe to see the portfolio. You can do it for free using the 7-day trial if you want.

New user guide - Paid Portfolio Posts

Hot Takes with Hank

Think pieces!