Windows in time.

Week 6 - Weekly equity Update

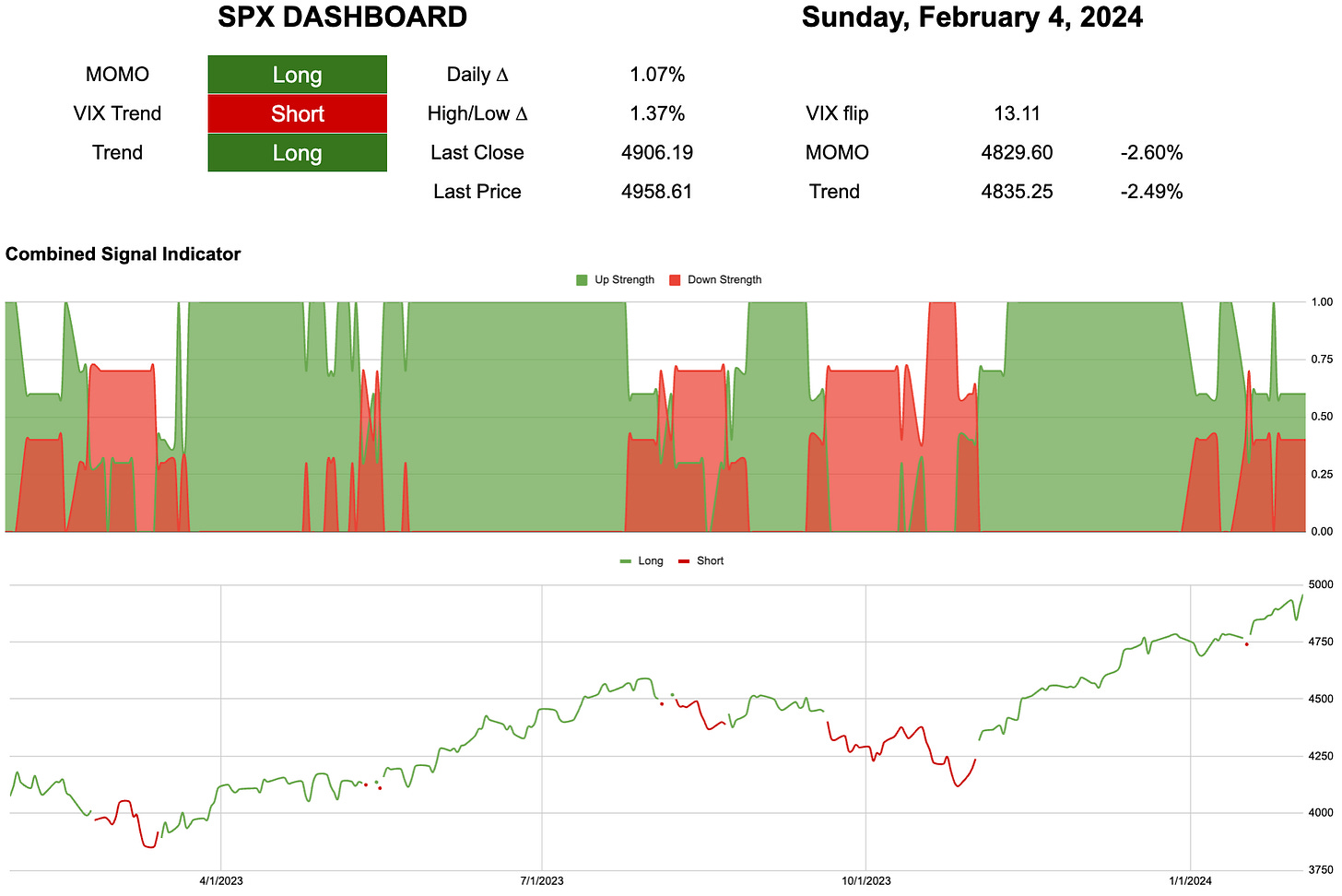

There might be a few more words in this week’s post. I spoke last week about windows of weakness discussed in great detail by Cem Karsan. He views the windows using decisions made at specific times not because some investment committee or spreadsheet decided to reduce exposure to Europe and reallocate that to EM. Structural decisions that must be made every quarter or month to protect or enhance an existing portfolio. There is a second layer to these decisions, where we are in terms of the level will affect the decision. If we come into these windows at all-time highs perhaps that skews the decision to protect. on the flip side if you came into all-time highs under exposed perhaps you are inclined to use convex instruments (options) to capture upside exposure with a known level of downside (premium).

Get to the point Chris!

People hedge the downside all the time everyone is worried about losing money from falling prices.

People rarely worry about crashing up. There has been the “cash on the sidelines” discussion for almost 2 years now. If you reduced equity exposure 2 years ago due to the recession risks rising would you dump all your cash back into the market at close to 5000 on the SP500?

Would you perhaps risk 3-5% to buy calls?

If you were left behind last year and look at January and already see SP500 up 4% what decision process might that force?

If these windows of weakness are specific points in time, what happens between them? Derivation of the so-called croissant crumbs points to a window that closed last week after opening post Jan Opex. The next doesn’t open until Valentine’s day, will price force decisions at just the wrong time and crash markets higher?

If we turn that around do bears just have to prevent succumbing to FOMO for just 2 more weeks?

Who knows?

I am just glad I have some numbers I know that I need to make decisions.

We are now ~2.5% from having to make decisions at the index level. VIX is still rising but not enough for us to reduce long positions.

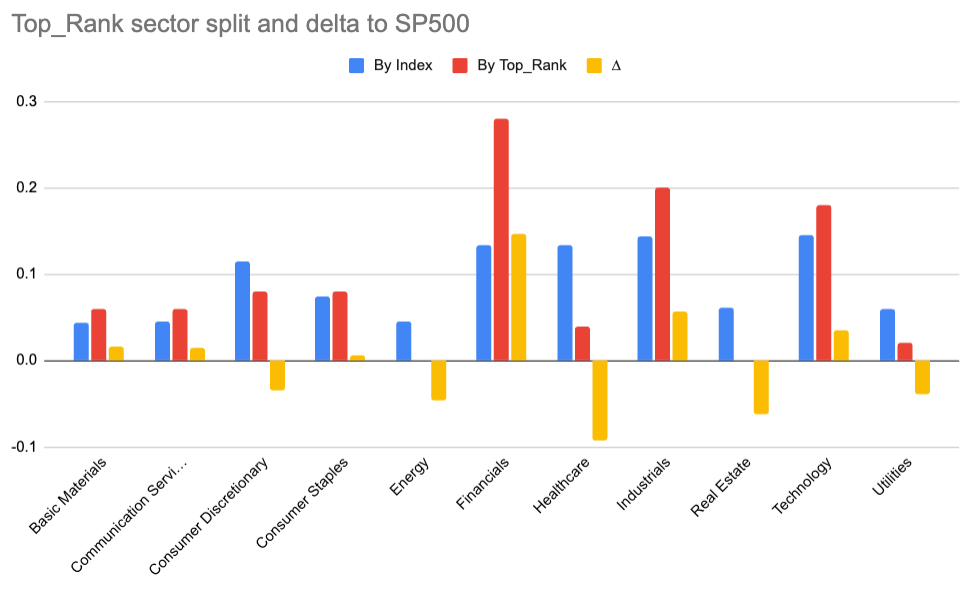

Still, no energy names in the portfolio. Last week that looked like a missed opportunity, but this week not so much. Funny how that works. Underweight Healthcare will that turn out to be a fumble? What about financials? Big overweight compared to the index. Let’s see.

Forgive me - I can't find a post about the new positions for 02/05 (tomorrow as of writing)? Love your work btw!