Who Matters? Exploring Market Divergence and the Fallacy of Macro Narratives

Subscribers behind the paywall or in Discord have seen me posting recently about “who.”

Does “who” matter?

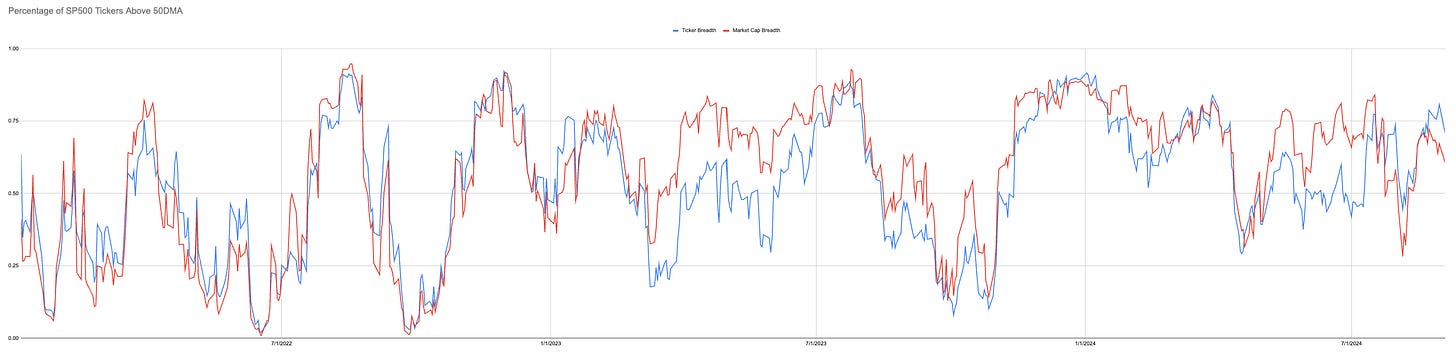

Here, I show the divergence between how we might calculate market breadth. I use a calculation for each ticker’s 50DMA (50-day moving average) and simply count how many are above it, represented by the blue line. Then, I apply the same calculation, but instead of assigning a simple 1 or 0 to each ticker, I weight it based on market cap.

You can see that these two measures often track closely, but the main divergence occurs when the simple count falls below the market-cap-weighted count.

This divergence typically coincides with the broader commentators saying, “the underlying market is telling a different story” or “it’s only the Mag 7 doing well.”

My point—and of course, this could be the end of it all—is: who saw the outperformance of the smaller stocks coming?

If so much time is spent when the “little guys” are supposedly telling us about impending pain, did those listening to that narrative manage to capture this outperformance?

I guess Mr Druckenmiller knew something. I wonder if he wished he bought XLU calls instead of IWM. Maybe not IWM had a big and fast move

Who knows?

This isn’t a tit-for-tat post.

I’m not here to say, “just follow price; it’s so easy.” But I am here to say that much of what is written or pontificated about is simply wrong.

It was wrong to attach small-cap underperformance to some kind of economic signal.

Just because I’m a person writing this and you’re a person reading doesn’t mean we should extrapolate that onto the market as a whole.

So many of the heuristics used today were authored during a time when human decisions and discretion ruled investing. Even though tweets and Substack articles are written by humans, I don’t see any target-date funds with Substack side gigs. That doesn’t mean human decisions lead the investment process.

Even the few truly discretionary funds will have either volatility targeting or risk control measures as an overlay. This means that while stock picks might be made by a person, if the VIX spikes to 30, the computer will be derisking.

I have no idea what’s causing it, but I can track it. I don’t always get it right, but to quote James Aitken: I will try “to be less wrong.”

If we replace the 50DMA measure with my own Strength of Signal metric and apply the same market cap adjustment, you’ll notice a shift to the right. There’s less in the rebound where the green shoots appear, and more already in the bullish zone, with some moving into correction.

“Who matters?”

The Mag 7 make up such a large portion of market cap that it may only take them recapturing momentum for this to all be a blip.

But on the flip side, where might the index be if there weren’t still 253 longs?

Like our macro friends, I feel like I’ve said everything and nothing. So, what’s the point?

My point is that simple heuristics only get you so far. They may sound interesting on podcasts or make for fancy charts that get lots of retweets, but it’s always the nuance that matters.

How often do we go back and check all the “facts” about prices that people spout day after day? Almost never!

We only remember the ones who were right, like the person who said, “Buy ScrinsonDoofer.com at $13” when it hits $33. We forget all the other noise and the wrong “picks.”

Yet for some reason, we keep listening.

Did I get to the point?

No. Oh well, just follow prices—it’s so much easier.