When one window closes before another opens.

Week 5 - Weekly equity Update

The first order of business is to thank everyone for their kind wishes and thoughts. Mrs Moir was great; we had an amazing surgeon and team looking after her. Now we have to get her back to fighting fitness!

That pesky Spot Up / Vol Up messes with my chi, man!

OK, two opposing thoughts time.

Shorter timeframe volatility is rising. How much emphasis do we put on VIX9D? Is it useful? Who knows but it is a data point.

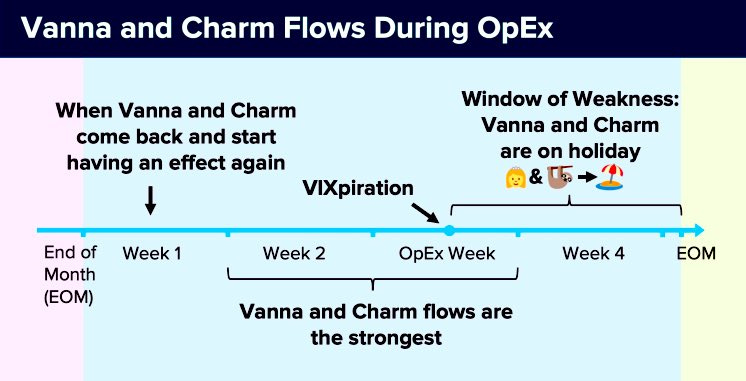

Mr Croissant aka Cem Karsan, has been talking about windows and sloths and Gary the gorilla and Vanna.

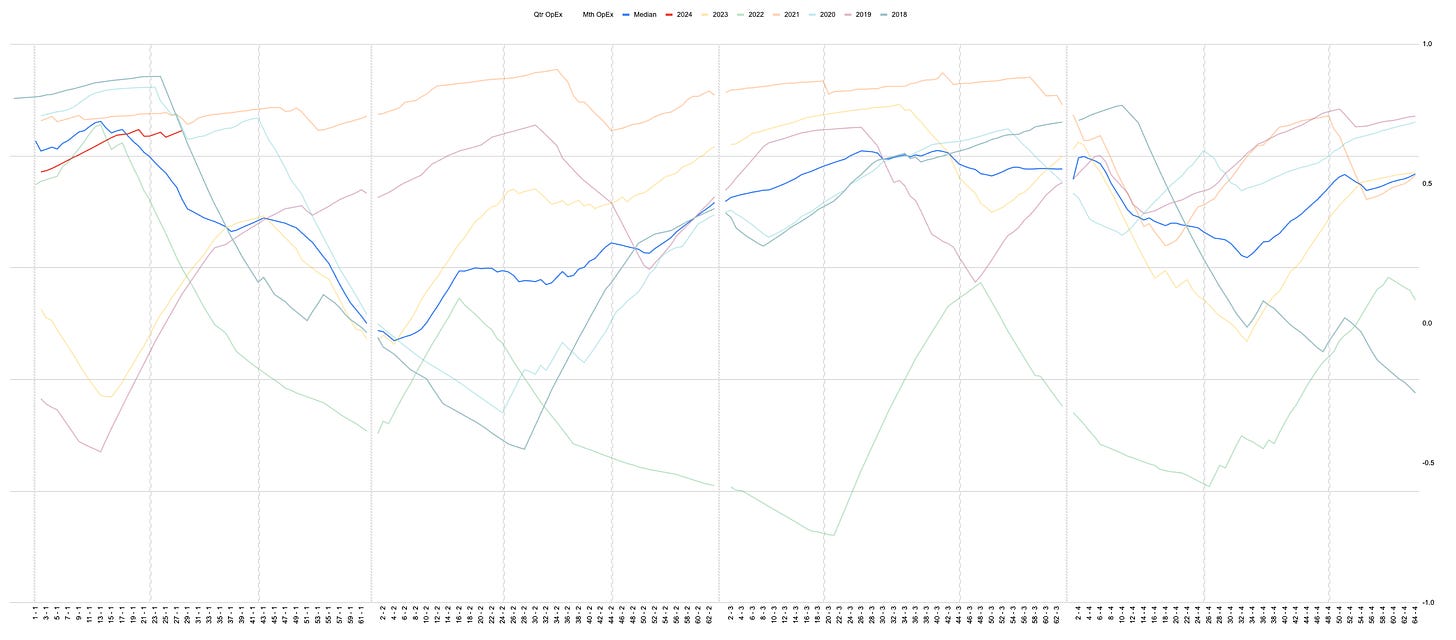

Right now we are the red line. The recent “window of weakness” he has spoken about is beginning to snap shut.

Vanna + Charm etc will ramp up from this week into next heading into OpEx.

If you look at the chart it eerily follows 2020 and the whole “why isn’t this market taking this seriously?”

Which could produce our two opposing views Spot Up / Vol Up?

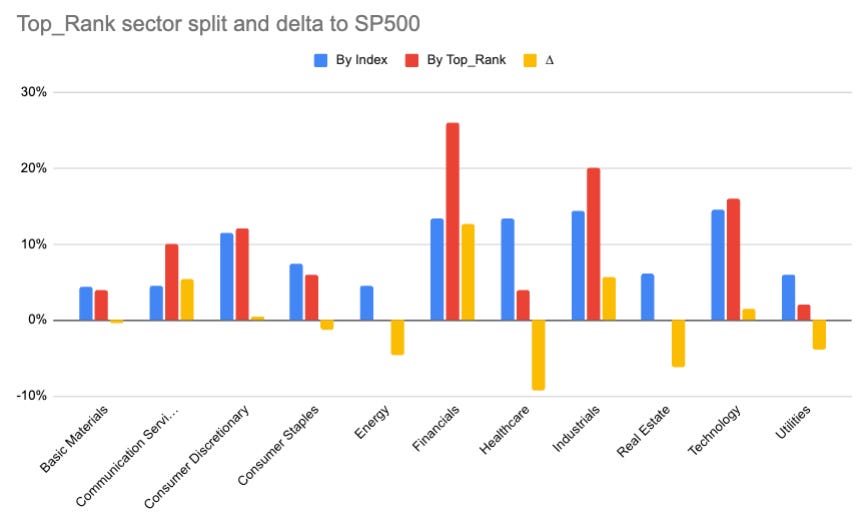

Let me throw a spanner in the works. I have related the last few weeks to a similar period last Apr/May where the index was pinned but the internals were being pushed around.

That also coincided with this period of “too many weakening indicators and recession risks for vol to fall from here”. I used VOLI here as I didn’t want to mess up my VIX chart. Could Vol crush again before Feb OpEx?

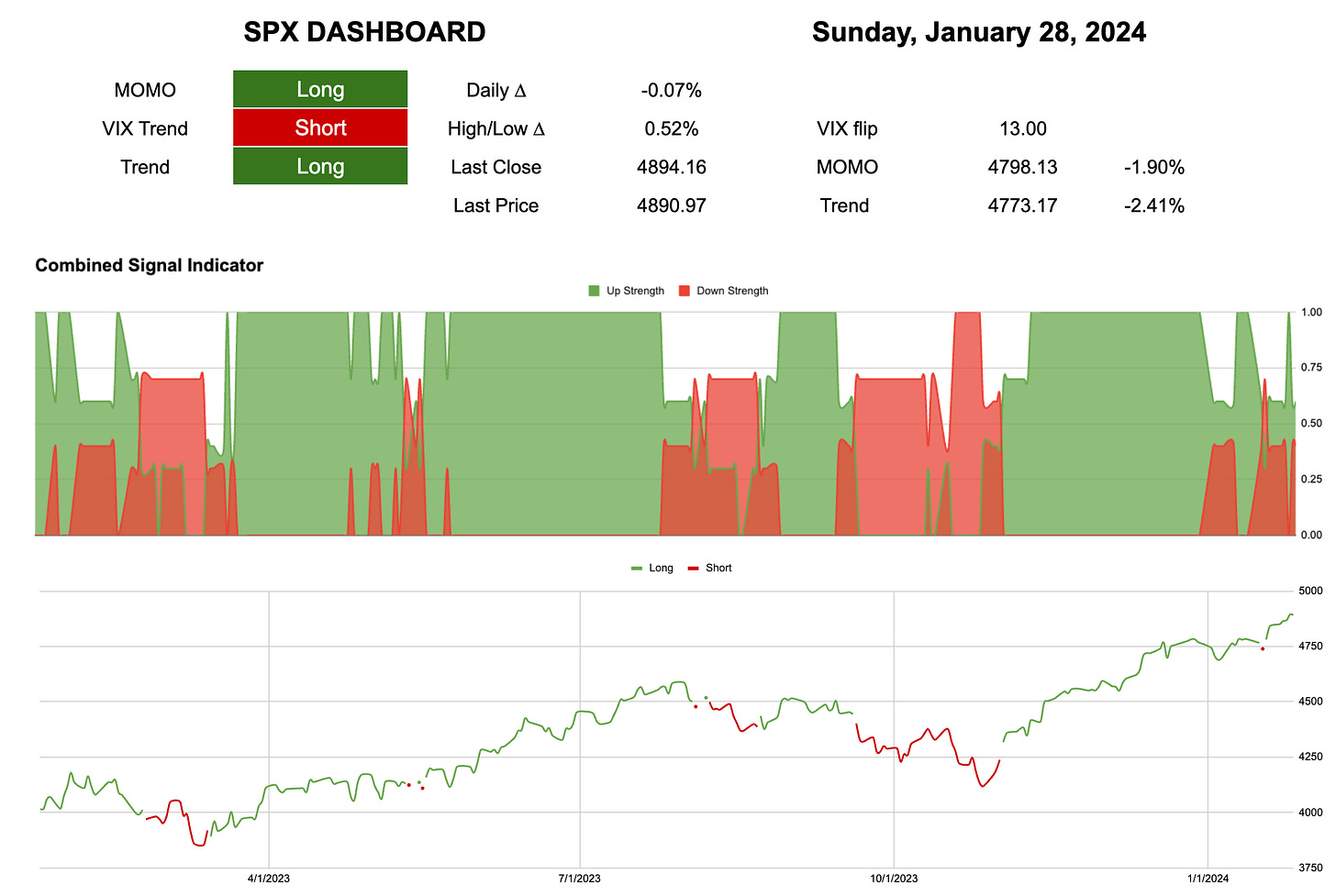

I remain long SP Futures Long VX calls.

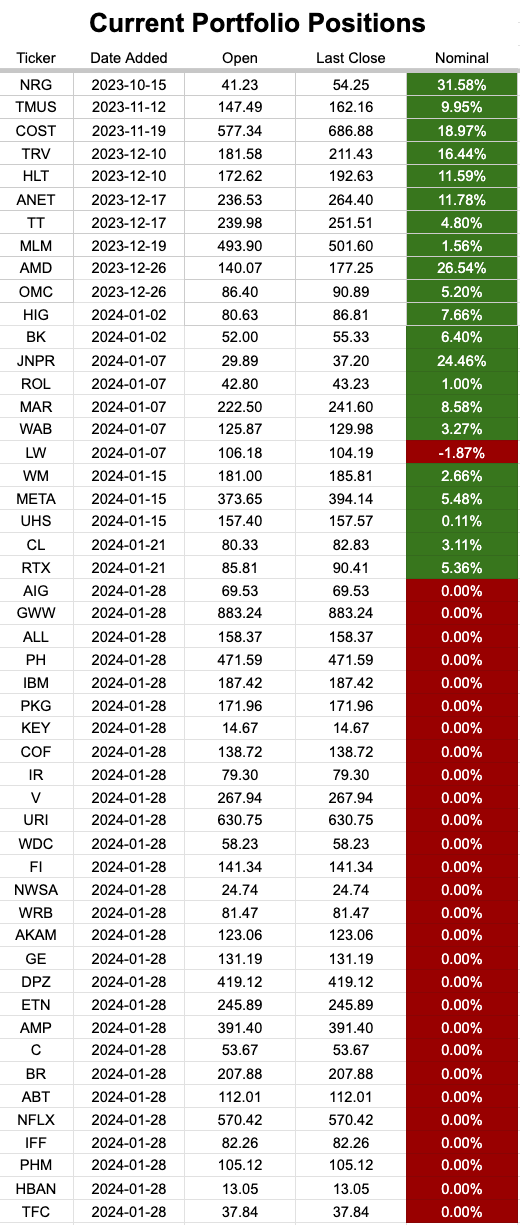

Yay, we have new positions!

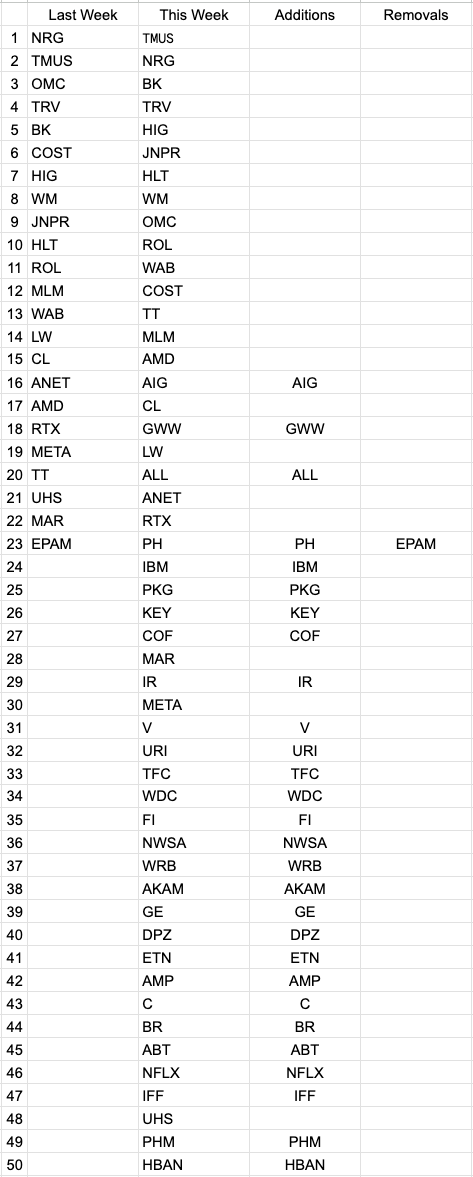

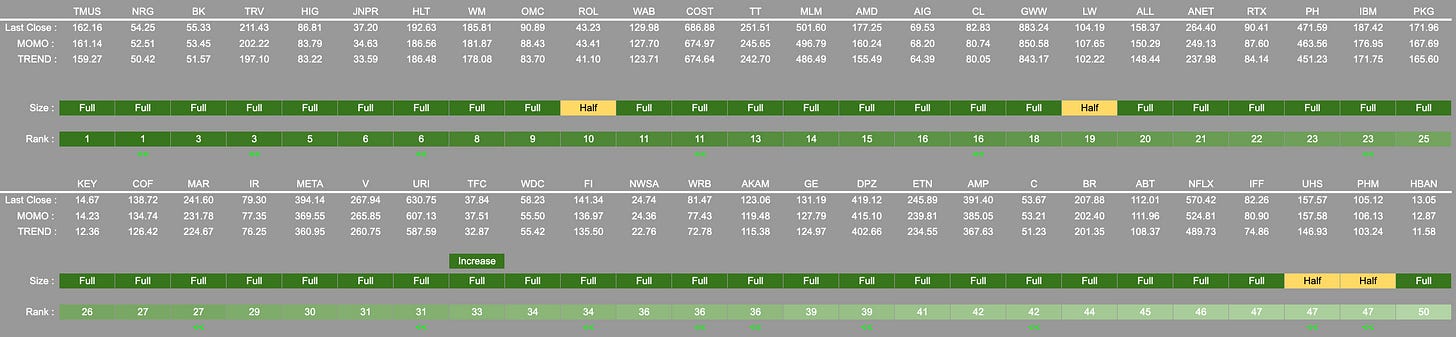

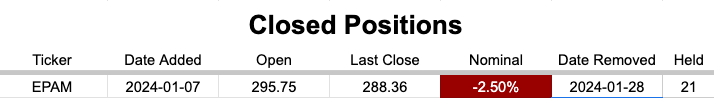

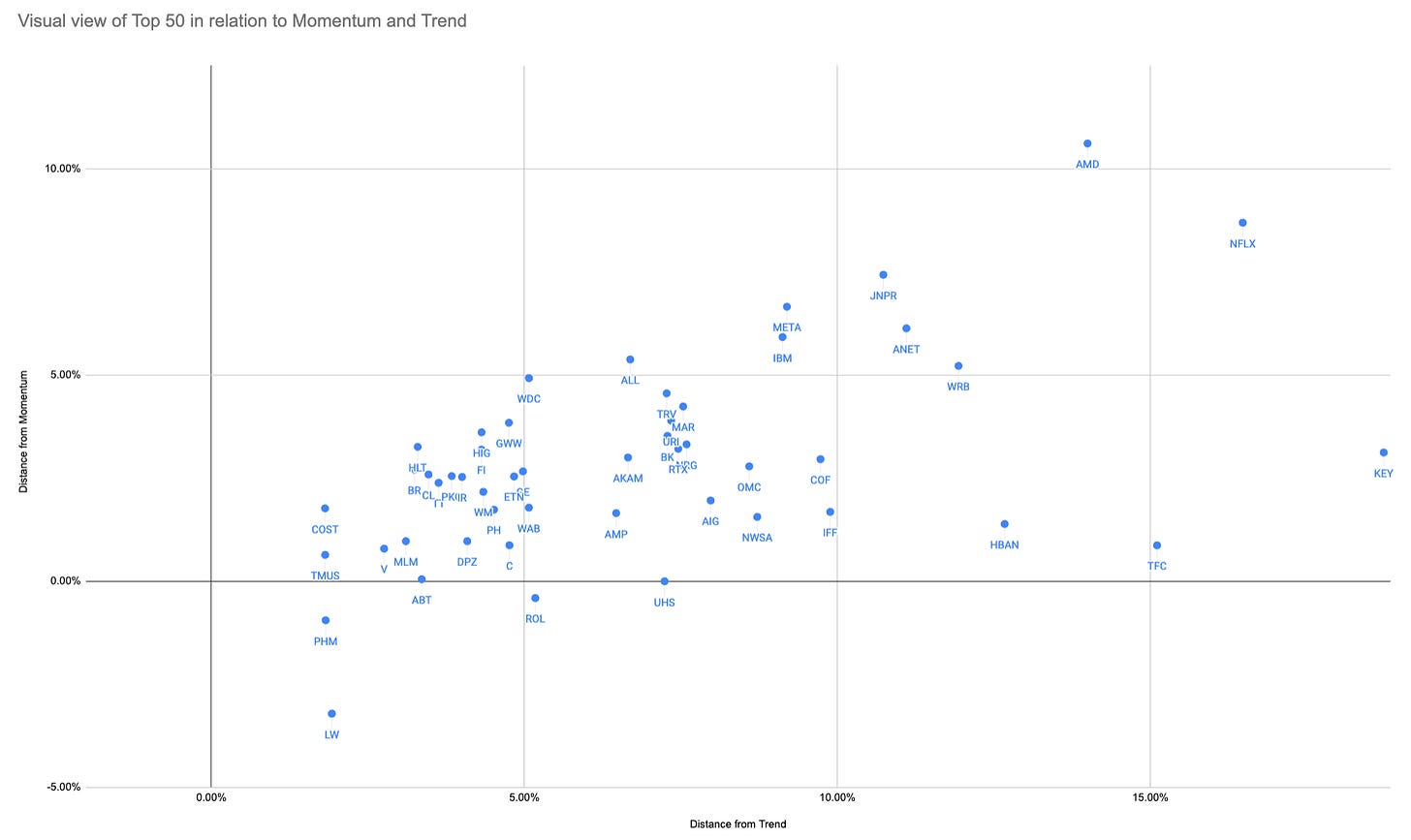

Removals : EPAM

Additions : AIG GWW ALL PH IBM PKG KEY COF IR V URI TFC WDC FI NWSA WRB

AKAM GE DPZ ETN AMP C BR ABT NFLX IFF PHM HBANI found this episode very interesting.

Someone reminded me last week about the perils of the American law system.

I am a random dude on the internet playing with Google Spreadsheets and posting about it. Trust but verify and do your own research.