What to do with the bounce?

Week 10 - Equity Portfolio Update

I highly recommend using the link to view these posts in a desktop browser. Substack limits the size of emails, and since I use a lot of images, some readers have been missing important data by only viewing the truncated email.

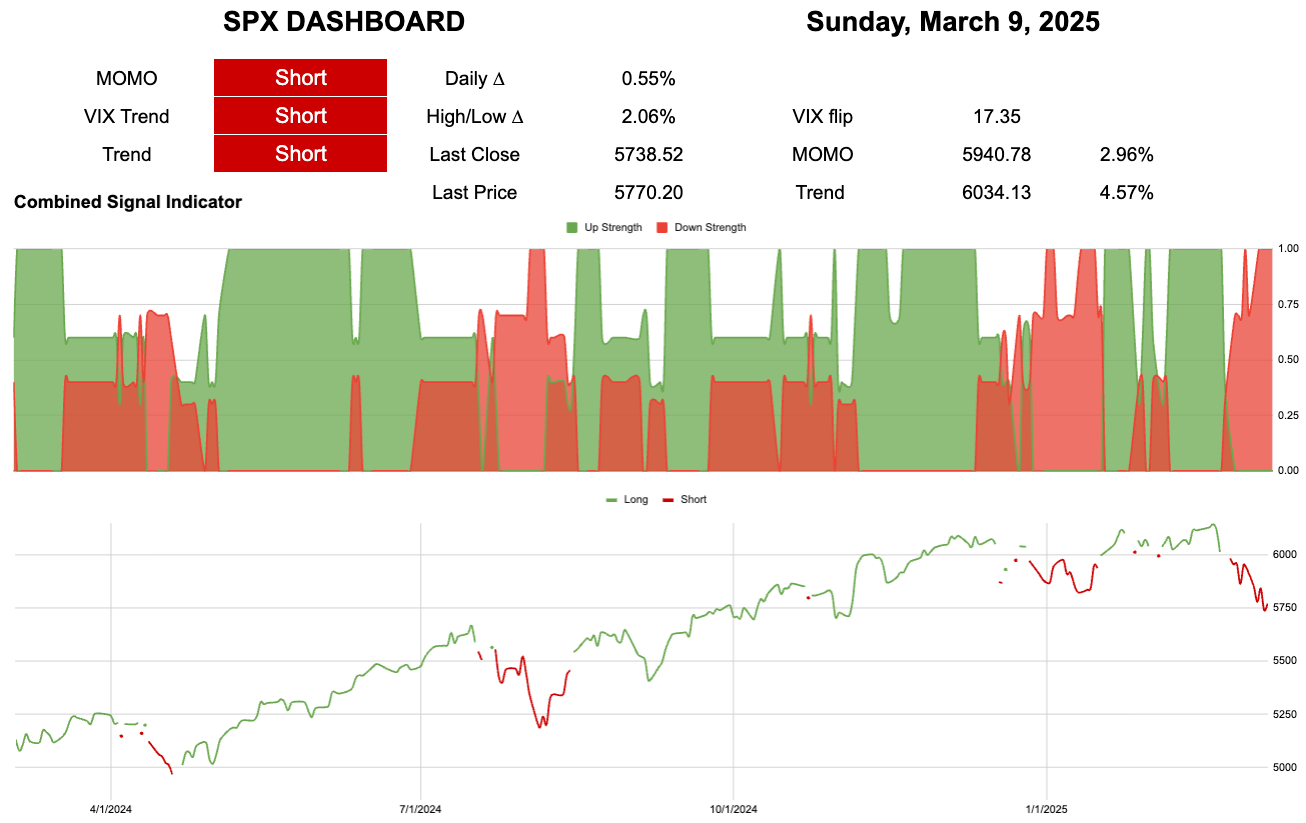

For new followers this dashboard is SPX centric. VIX trend short means the VIX trend is a negative to SPX.

We need ~3% to regain momentum (for now)… Remember as time passes so does old data. We could regain momentum as a function of time, making the hurdle rate easier. Corrections and rebounds occur in price and time.

Daily timeframe:

The longer timeframe strength of signal are deteriorating. Does that mean more weakness or looking forward the bottom can be made?

A bottom and the bottom are two different things.

This chart below shows how long we spend in each ∆ segment.

We haven’t closed in the black line of doom realm but we got there intra-day. I have highlighted some things further in the post for paid subscribers.

Being below trend puts us in this wide distribution. It is wide in both directions. Some of the largest rallies can come from oversold conditions in a falling market. That is a test for another day but soon. Is this a breakout to a new bull market or just a lower high in a bear market?

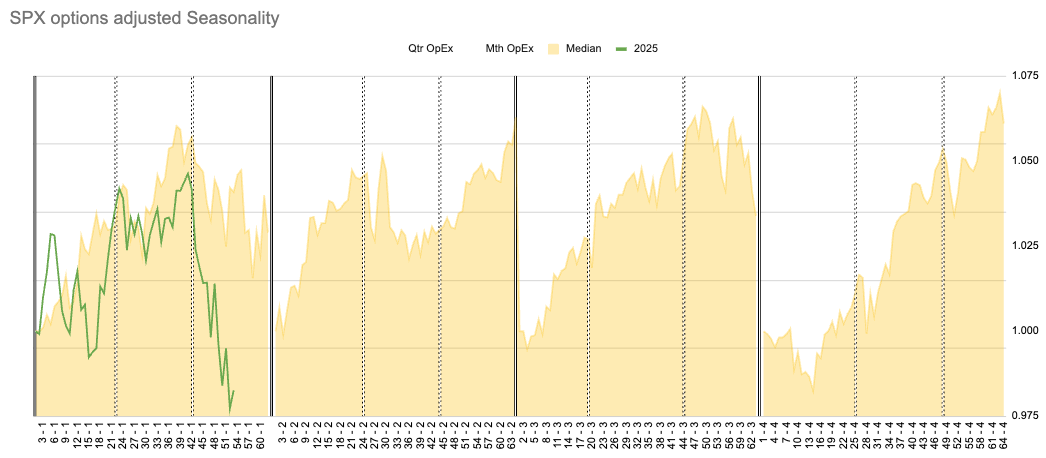

I wanted to share this chart of 2024 to highlight “seasonality” has its seasons. You can see in the Feb-Mar-Apr period seasonality was clearly sidestepped. Again in Sept-Oct-Nov.

If we change calendar dates Year to Date (YTD) Month to Date (MTD) or Quarter to Date (QTD) and use options expiry.

You can see this year we appear to be following a rhythm of the past.

What will really bake your noodle is did Trump tweet about tariffs because he knew about options derived seasonality. Or did the market do its thing anyway regardless of whatever was/did/has been said?

Current Open Equity = 33.1%

Stop Loss Trigger = 29.8%

Current Closed Equity Return = 29.4%

Our open equity outstanding is ~33% since we started in Dec ‘23. We have been able to capture ~29% returns in closed trades, meaning ~4% open equity still belongs to Mr Market. Until we close the trade it doesn’t yet belong to us!

If all our stop losses hit bar any gap risk we hope to close ~30%

It cannot always be rosy! There is no free lunch we have to risk losing to be in the game to win. We could have a +0.5% addition on closed equity.

Subscribe to see the portfolio. You can do it for free using the 7-day trial if you want.

And our current open positions:

Please subscribe to see more of the portfolio we are constructing.

New user guide - Paid Portfolio Posts

Hot Takes with Hank

Discord Channel - open channel available to all.