Weekly Equity Update - Week 10

Week 10 - Weekly Equity Update

Can you imagine last Halloween that we would be saying 5000 would be a downside trigger in our decision process?

Well, here we are ~5000 or 2.5% current price would be our decision point.

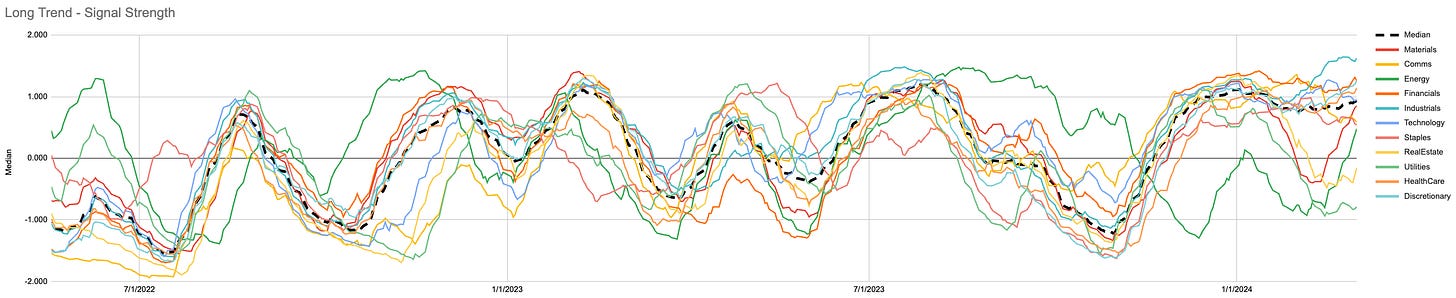

Momentum is now below trend. This is due to the lookback that the measures capture. One part of this is the volatile 2022 periods are now long gone only March 2023 remains. In a month that too will disappear. What that means is the trend levels will all compress. This potentially puts us closer to breaking those levels, but that doesn’t mean it will happen. 2017 is a perfect example of this where Volatility compressed and just kept going lower and lower.

Additions : TXN EMN DHI STZ WELL RVTY NOC INVH TER

Removals : FE UNH PPG XLB

Reduce : TRVBig rotation continues in cyclicals. We remain overweight the industrials sector. The FOMO is strong because we have zero energy exposure; the urge to tinker is strong but never ends well. Energy names will come into the portfolio and many will think “Why would I buy now?”. PWR was up 30% from the October low and 7% from Jan before it went up another 15%. META was up very similar numbers but additionally up 300% from November ‘22 before it went up another 30%.

Well, why don’t we buy them before those runs?

Because the expected return is skewed to the negative. Yes they have high positive expectations but they also have high negative expectations. Then once you factor in the likelihood of a positive outcome the R:R makes it a lower value trade. Yes we pick things up after an initial move but the R: R has skewed in our favour.

What are we fighting with cyclicals?

Well, the fact that they cycle.

These messy charts don’t look too different, do they?

Well, the timing looks kind of the same. Highs at the same time lows at the same time.

The value of the highs looks a little lower for IWM than SPY which is to be expected.

SPY spends 67% of days with a SoS higher than zero.

IWM only 52%.

That is the difference. How do we differentiate between a fakeout and a breakout?

Closed positions since the last weekly update.

Current portfolio positions and open equity.

Chris, you left us hanging! How can we tell the difference between a fakeout and a breakout?

I think it is what people refer to as “breadth” but not the bullshit, measures of it that they use.

Most people use moving averages x % of SPX is above the 200-day moving average. Great!

Did these people use the 200-day average to define them getting into or out of their trades? If not why are they using it as a definition now? Well mostly because it is a pretty chart to post on Twitter and get attention.

We know that individual companies are not created or treated as equal by the index so why would we use a measure that treats them as equal?

When we look at a combined SoS (both 1m and 3m) you can see we had a “dip” from the start of this year. Since then the laggards have now started a catch-up trade, save really Utilities.

It appears that the equity indexes can go up while AAPL is not if 398 individual tickers are in an uptrend.