Weekly Equity Update

Week 9 - Weekly Equity Update

In a month, we will wave goodbye to the last prices in the 3000s on this chart.

#goodtimes

Back again to the grind ~2.5% below current prices will be our decision point.

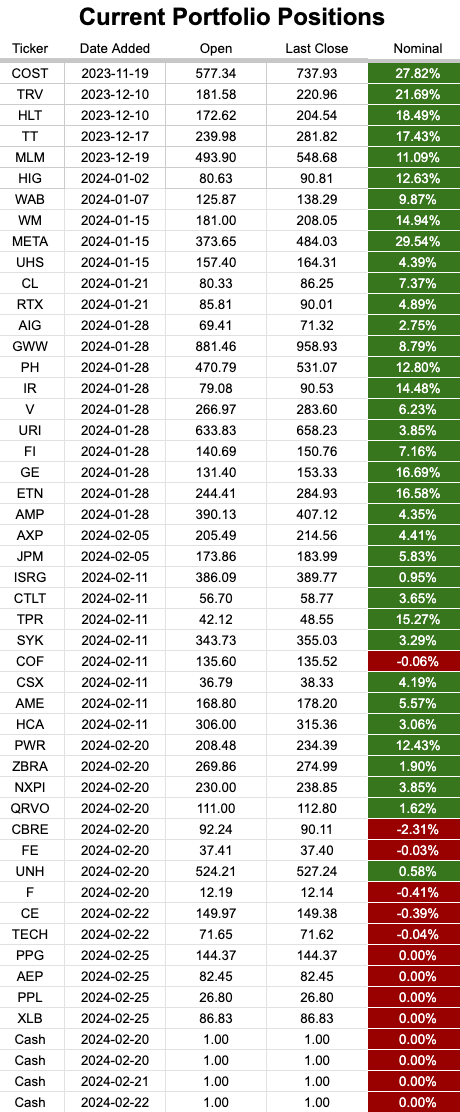

Additions : CE TECH PPG AEP PPL XLB

Removals : AMD ALL BKNG IBM FSLRWhat ho, an ETF in our midst?

XLB was included to highlight the materials breakout and it signaled independent of any single names in the new “timing” bucket.

Treat it as you see fit in terms of sizing. For the tracking of this portfolio, I am keeping it equal weight like all the rest of the single names.

This may be a little wonky with the cash positions but it highlights where the large delta is between our positioning and the Index.

Our closed positions last week. BKNG pricing will be updated as of today’s opening price.

There hasn’t been much chatter about windows since the “slam dunk” Feb OpEx will kill this market.

Ironically probably means it now becomes more valid ;)

Many people have highlighted the weakness that occurs in the Feb-Mar period. As you can see above the Feb OpEx is so often the catalyst but 2021 (light orange)bucked the trend. Showing the last 5 years it hug on until ~ 2nd March before a little pullback before continuing on doing 2021 type things.