Week 50 - Weekly Equity Update

Sunday 10th December

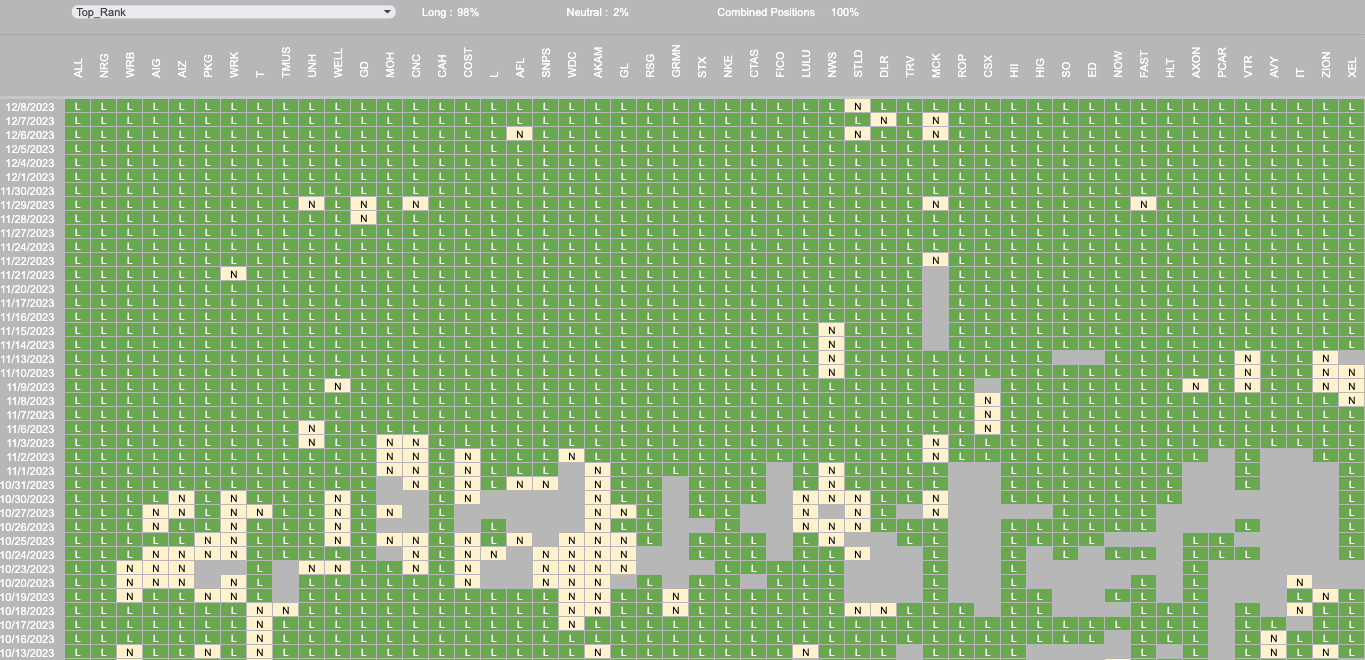

Directionally at the index level heading into next week, all indicators are long.

Momentum and Trend levels are ~2.5% below current prices.

VIX flip is up at 15.29. We have low 20s levels to chew through over the next 10 trading days before we are likely to see a significant drop in that number.

Industrials on deck!

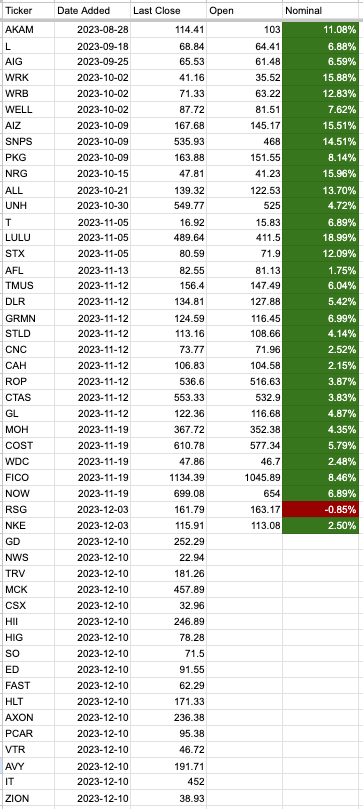

A big rotation this week. Overweight Industrials now mainly at the cost of Technology and Energy. The last energy position falls out of the portfolio.

Many exits came during the last trading week, but a few more fell on their sword based on the Friday close.

Only STLD would be held at half position. All other positions are max long.

A list of closed positions since we started documenting this portfolio.

Here I wanted to visualise where the current portfolio holdings are in relation to trigger levels. STLD highlighted above you can see closed below momentum.