Week 49 - Weekly Equity Update

Monday 4th December

I want to start today by showing everyone what a huge hypocrite I am.

Now that we have that out of the way let’s get down to it. Over the last few years, I have been working on a way to find the strength inside of the S&P500. We all know the Magnificent 7 or the outperformance of any given sector like Energy earlier this year.

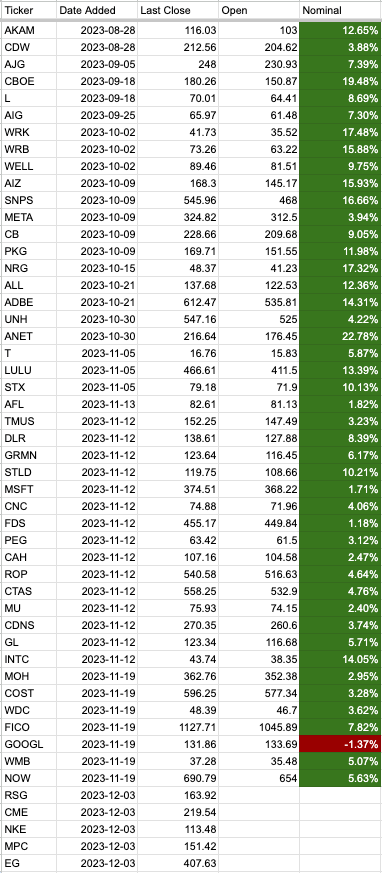

I look at all 500 individual stocks and using momentum, trend, volume and volatility I rank them all. From that, I built a portfolio of 50 equities. Below you can see the sector weightings and the divergence, if any, from the index. Over time of course this will shift.

Below we have the portfolio as we came into last week, and the changes to be made this week based on Friday’s close.

5 changes this week, 2 removals came mid-week after breaking momentum/trend AZO and ACGL. Taking small losses before they get too big.

Capturing 3 wins against them. These prices on CEG, GD and AXON are per Friday close and will be updated today.

The existing position’s performance since they were added to the portfolio.

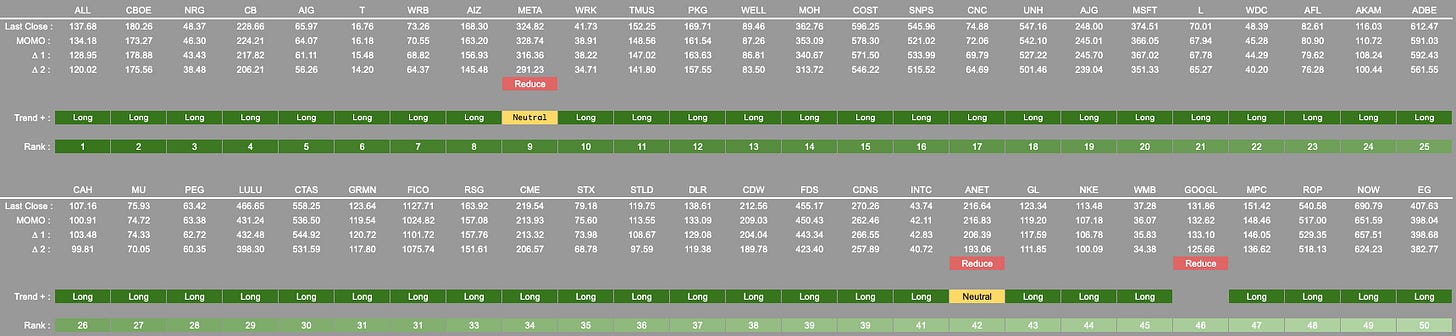

Of those positions, there are three to highlight. ANET, META have broken momentum and as of Friday, they are “neutral” meaning they should be cut to a half-position size. GOOGL has broken on multiple metrics and although it is still in the top rank is currently a zero position size.

From SPX/vol perspective, it is currently "as you were" but the Vix flip level has steadily fallen over the last couple of weeks. That in and of itself is nothing of note but moving forward that hurdle becomes smaller.