Walking the line...

Which line?

If only there was someone out there letting you know the technical reasons why volatility may breakout.

Then we could be better equipped and have planned ahead.

Daily

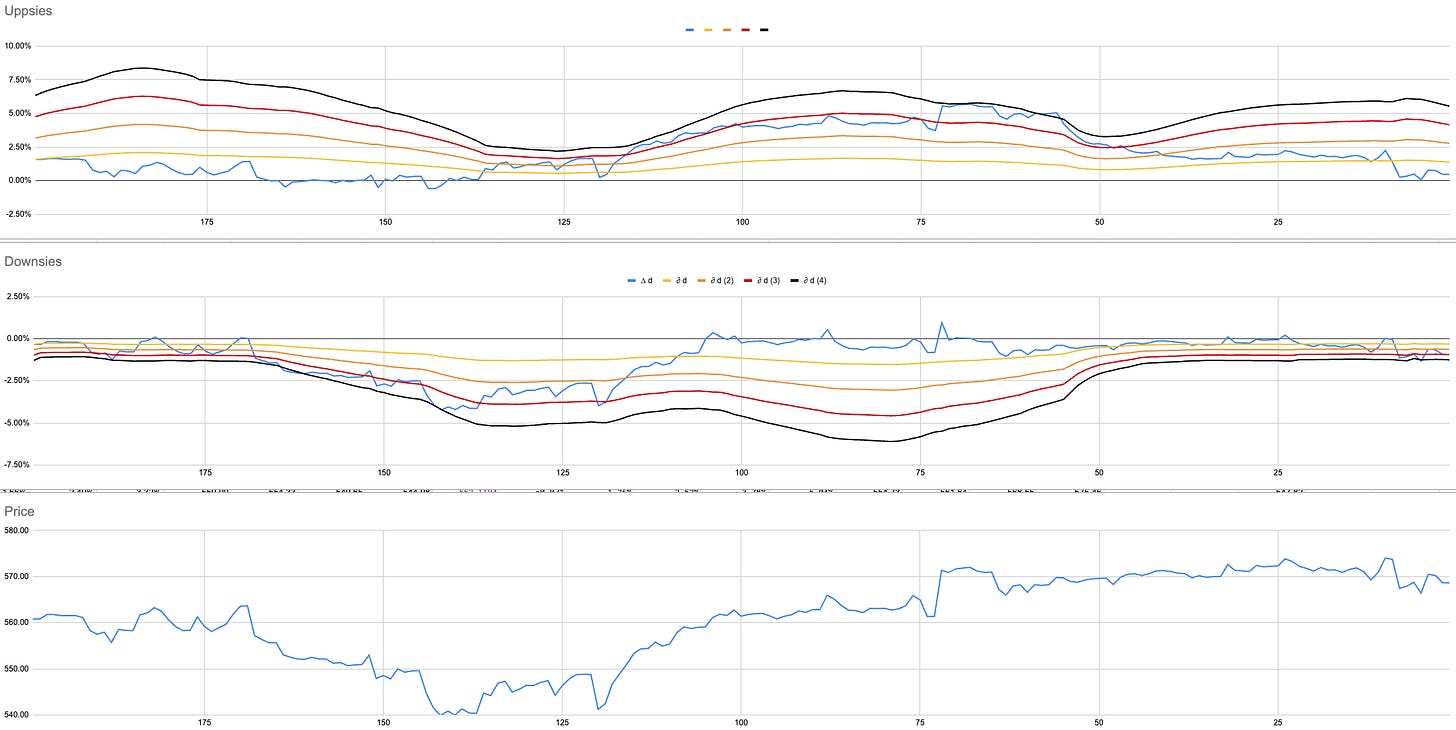

At the daily level we could we a volatility squeeze.

Hourly

At the hourly level we could see a volatility expansion.

Five minute

At the 5-minute level, we are in the middle of a volatility expansion.

We know where we are and we know how often we spend time in the respective levels.

The question is do we get to 548?

If we go all the way to the top of the page we spent long periods at the beginning of the year with at least one of our combined indicator measures being red.

That is where we can draw on our knowledge of the internals of the index.

There are still well over 300 tickers that are still long and in an uptrend.

Remember my goal here is to build a good portfolio. If my portfolio is not being affected by this current move then it means very little to me. The most important aspect as a long only portfolio is should volatility break out is to manage the stop loss on all my positions.

Cash will be my hedge.

Timing will be my edge.

There is a time to be long and a time not to be. I gave up trying to follow news and being clever about what I thought the market should be doing. Now I have a system to act only on what the market is actually doing.

There is a better way.

Current Closed Equity Return = 23.4%

Current Open Equity = 31.3%

Stop Loss Trigger = 26.1%