The wiggles are wiggling.

Wednesday 17th January - Daily Equity Update

VIXperation today so the previous contract stopped trading last night which mechanically means the spot price must time average to the next 2 contracts.

Does it count as a spike in Vol? We’ll see. Stay until the end where I do my best Jam Croissant impression.

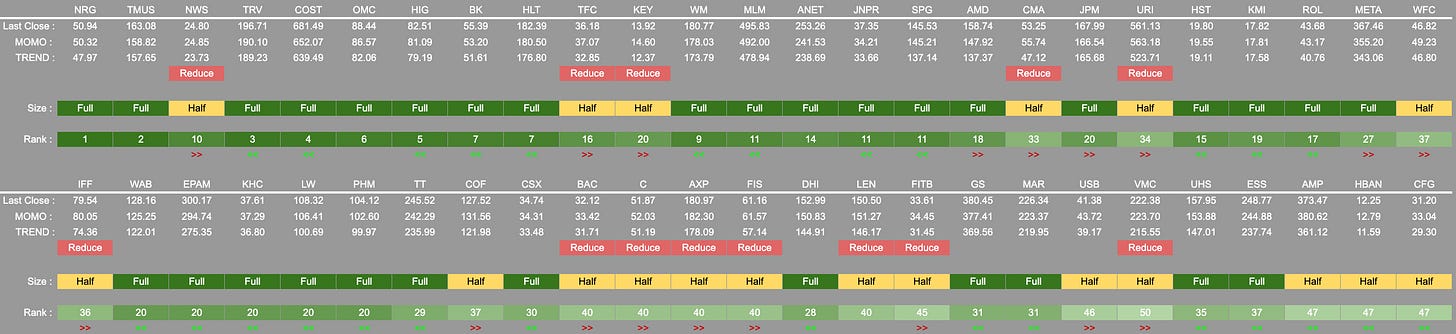

Reduce : Half position NWS TFC KEY CMA URI IFF BAC C AXP FIS LEN FITB

VMCThe high turnover of positions is itself an indicator.

Closed positions as they stand for January. There is not as much green as is to be expected from where we are in the mini-cycle. What is clear is you must take every shot! You cannot cherry-pick! We have no idea where the outlier will come from.

I do not have the emoji game of Cem Carson but I wanted to have a view on “seasonality”.

Through the lens of major options expiry dates (quarterly).

Instead of measuring gamma, vanna, nominal returns etc I wanted to use my Signal Strength measure.

So far I have only used 5 years of data and adjusted for the options cycle so 1 - ?? goes from Dec OPEX - Mar Expiry 2 - ?? March OPEX - June Expiry and so on.

What is very interesting is the huge dip where things like SVB came completely out of the blue. Or if we flip the narrative are these points in the cycle where an SVB is more likely to happen?

What about the September-October dip is that caused by LDI pension fund blow-ups or are these things at a higher risk of happening during these times?

Tin foil hat time.

If this is in some way indicative of our future path. Is the Fed getting ahead of this with dovish forward guidance, or is it the "air cover for potential future stimulus?

Who knows?