The Storm Flipped the Tea Cup!

Week 09 - Equity Portfolio Update

I highly recommend using the link to view these posts in a desktop browser. Substack limits the size of emails, and since I use a lot of images, some readers have been missing important data by only viewing the truncated email.

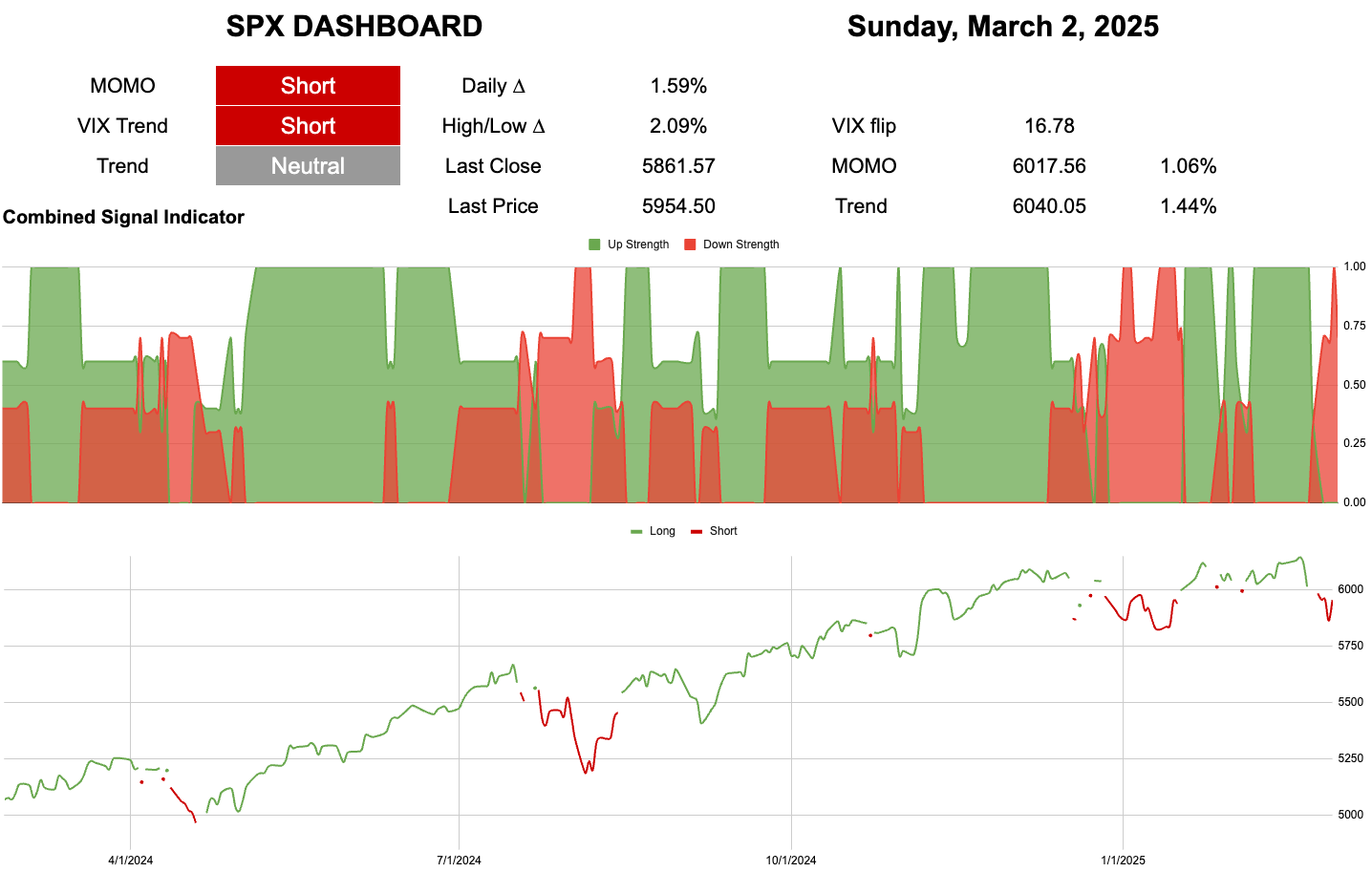

Are MOMO and Trend now resistance?

Who knows?

I never mean for these comments to be flippant. I use the SPX/SPY as my benchmark but my goal here is not to trade the SPX/SPY.

On Friday there was a note posted to the effect of:

“Four red days in a row, four days of Trump tweets”

I guess IWM must have known 62 trading days ago that Trump was going to send some tweets.

Daily timeframe:

When we look at the different timeframes for calculating signal strength, the short term (20) fell from a maximal value. As we move further out in time signal strength hasn’t quite reached the peaks we saw last year rising out of Halloween 2023.

We made a black line of doom intra-day but we had a sharp reaction from it in the afternoon on Friday.

We remain in the negative wide distribution. Remember this means large moves, it does not mean down moves. The biggest bounces come in these regimes due to the underlying market making dynamics.

I mentioned in this weeks Hot Takes with Hank (linked below) about viewing similar moves in different timeframes.

I will go through this in more detail for paid subscribers below.

Are we there yet?

Current Open Equity = 33.1%

Stop Loss Trigger = 29.8%

Current Closed Equity Return = 29.4%

Our open equity outstanding is ~33% since we started in Dec ‘23. We have been able to capture ~29% returns in closed trades, meaning ~4% open equity still belongs to Mr Market. Until we close the trade it doesn’t yet belong to us!

If all our stop losses hit bar any gap risk we hope to close ~30%

It cannot always be rosy! There is no free lunch we have to risk losing to be in the game to win. We could have a +0.5% addition on closed equity.

Subscribe to see the portfolio. You can do it for free using the 7-day trial if you want.

And our current open positions:

Please subscribe to see more of the portfolio we are constructing.

New user guide - Paid Portfolio Posts

Hot Takes with Hank

Discord Channel - open channel available to all.