The Storm Before the Calm

Week 07 - Equity Portfolio Update

I highly recommend using the link to view these posts in a desktop browser. Substack limits the size of emails, and since I use a lot of images, some readers have been missing important data by only viewing the truncated email.

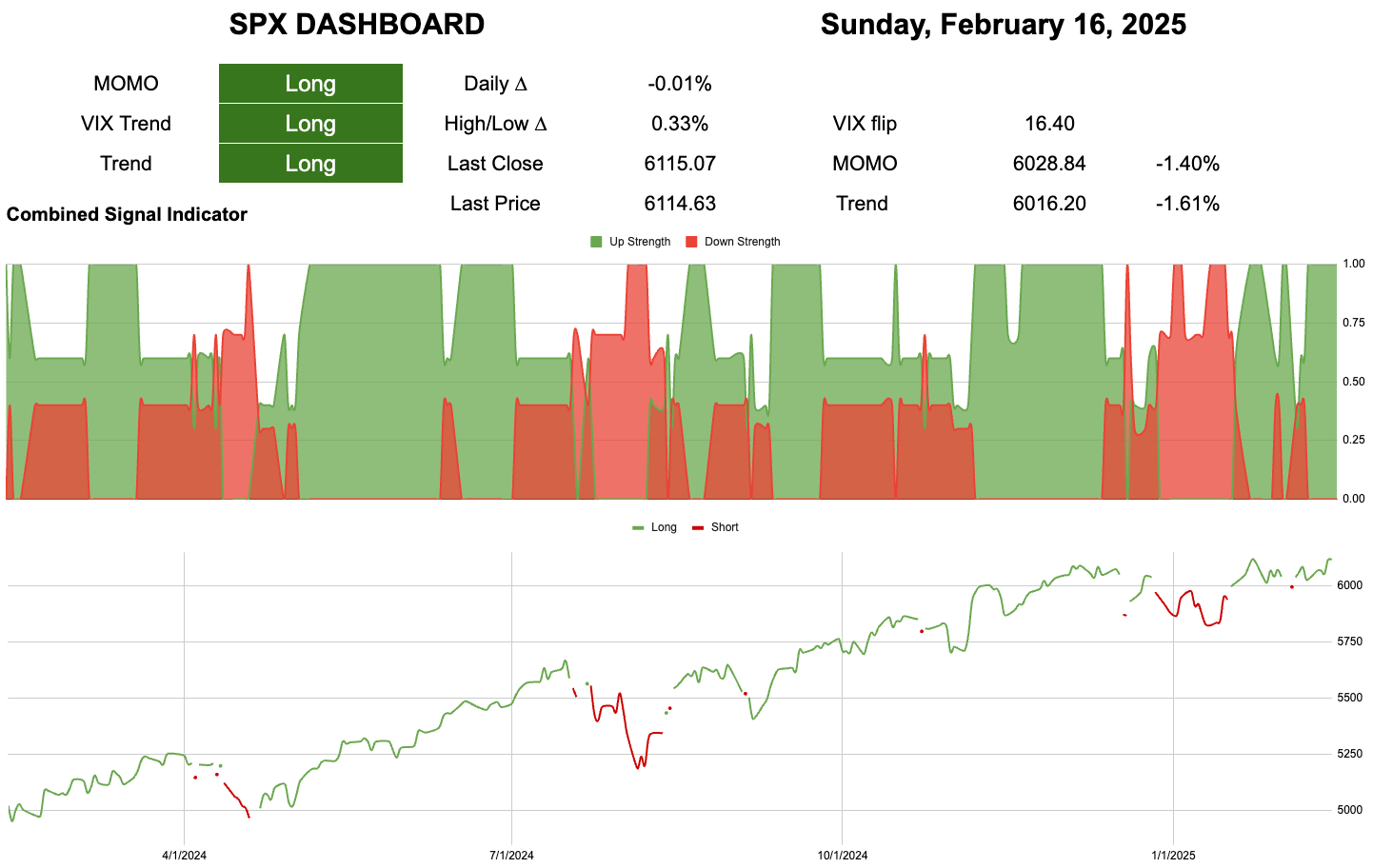

6016 - 6028 Would break the trend and momentum.

A ~ -1.5% daily down move which is pretty low on the expected outcomes.

Daily timeframe:

We have almost fully reversed the shortest timeframe SoS the longer are starting to follow.

Realised volatility is dropping.

Both upside and downside volatility bands are compressing.

I am going a little deeper on the short-term index moves for subscribers below.

Current Open Equity = 33.3%

Stop Loss Trigger = 28.3%

Current Closed Equity Return = 30.3%

Our open equity outstanding is ~33% since we started in Dec ‘23. We have been able to capture ~30% returns in closed trades, meaning ~3% open equity still belongs to Mr Market. Until we close the trade it doesn’t yet belong to us!

If all our stop losses hit bar any gap risk we hope to close ~28%

It cannot always be rosy! There is no free lunch we have to risk losing to be in the game to win. We could have a -2% drawdown.

Subscribe to see the portfolio. You can do it for free using the 7-day trial if you want.

And our current open positions:

Please subscribe to see more of the portfolio we are constructing.

New user guide - Paid Portfolio Posts

Hot Takes with Hank

Subscriber Discord