The day they said would never come...

Thursday 21st December - Daily Equity Update.

A red day? Surely not.

To put yesterday’s move in perspective this chart only 6 months ago was full of 3-4% moves.

As we have moved through time VIX flip is edging closer, but as yet no triggers to begin hedging. The individual positions closing is a mini-hedge by reducing overall exposure.

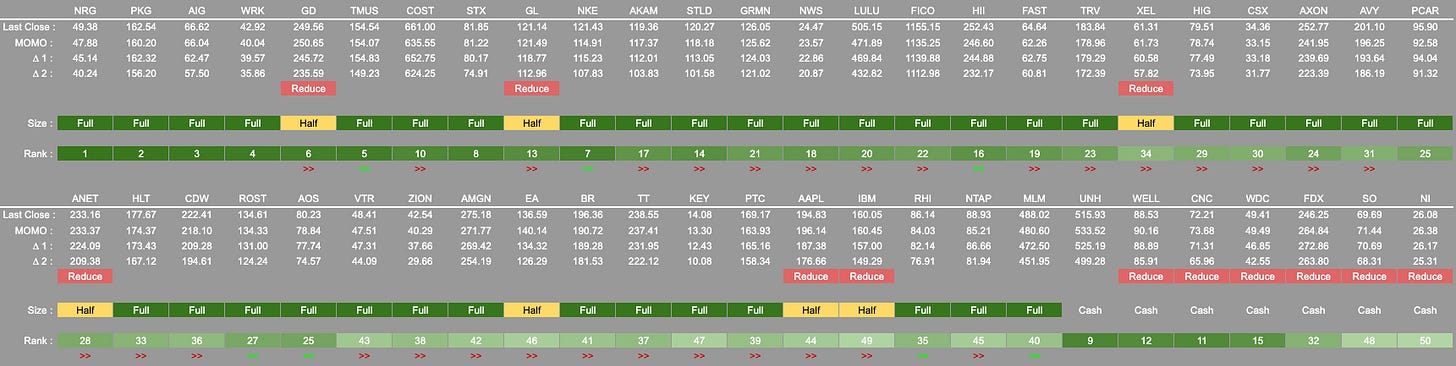

Reduce to Half : GD GL XEL ANET AAPL IBM

Close to Cash : WELL CNC WDC FDX SO NIFDX was an ouchy! We win some, and we lose some.

This highlights I hope was such a fast move higher price drags the level of momentum and trend along with it. This means they all cluster around the same price point. As we can see the charts look very different from Sunday.

Let’s see how this plays out through the end of the week.