Swim with the current, or...?

Friday 31st May - Daily Equity Update

40-60 points below to hit decision points.

I will lift the skirt a little.

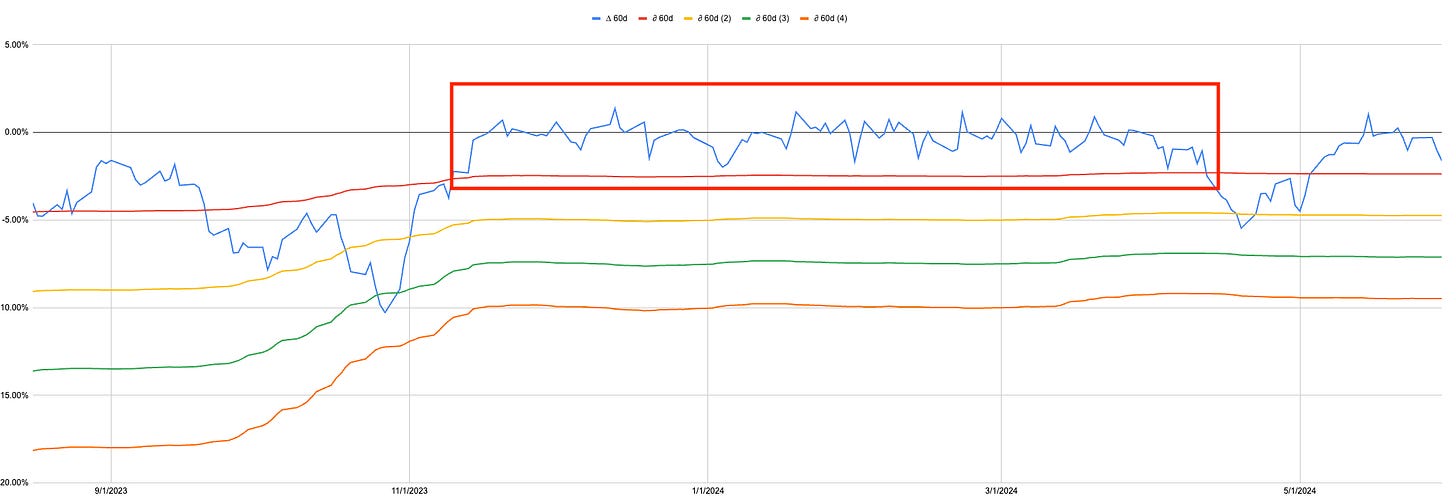

Prices don’t matter it’s the levels of prices and how we move through time. This is where we have been 4 months of this rally. When we transpose these levels back onto a price chart where is it? 5195.33

This is why it is hard to only use one indicator. There is a 65% chance that if we pass the first line we move to the second as we did in April.

The VIX indicator is also very close, but it has 10 high values to move through first that are stuck in the lookback.

The same goes for the momentum signal the old low of May 1st will start to disappear next week moving momentum higher. How do we treat that? Does the momentum level higher mean it’s easier to break? Possibly. The SP500 has been confounding people for years that momentum continues when no one thinks it can. Am I about to start saying that I know when it will change?

Err nope!

Could everything break today, tomorrow or next week? It sure can but it might not. I don’t know.

All I do know is that internal to the portfolio 10-15 individual stocks have already told us that under the surface we had to make decisions. If it all goes we know roughly what our max drawdown will be and we already have 20-30% cash.

There will be all kinds of news and views and nonsense today. What we cannot do is moan constantly that “markets never react to news” but then today declare that the market prices are somehow telling us something.

Which is it? It cannot be both. Just as politicians cannot simultaneously be idiots but are somehow in charge of a global controlling cabal. Pick your poison.

Sometimes we swim with the current and sometimes against it, but we have to keep swimming nonetheless.