Stuck in the Middle with #few

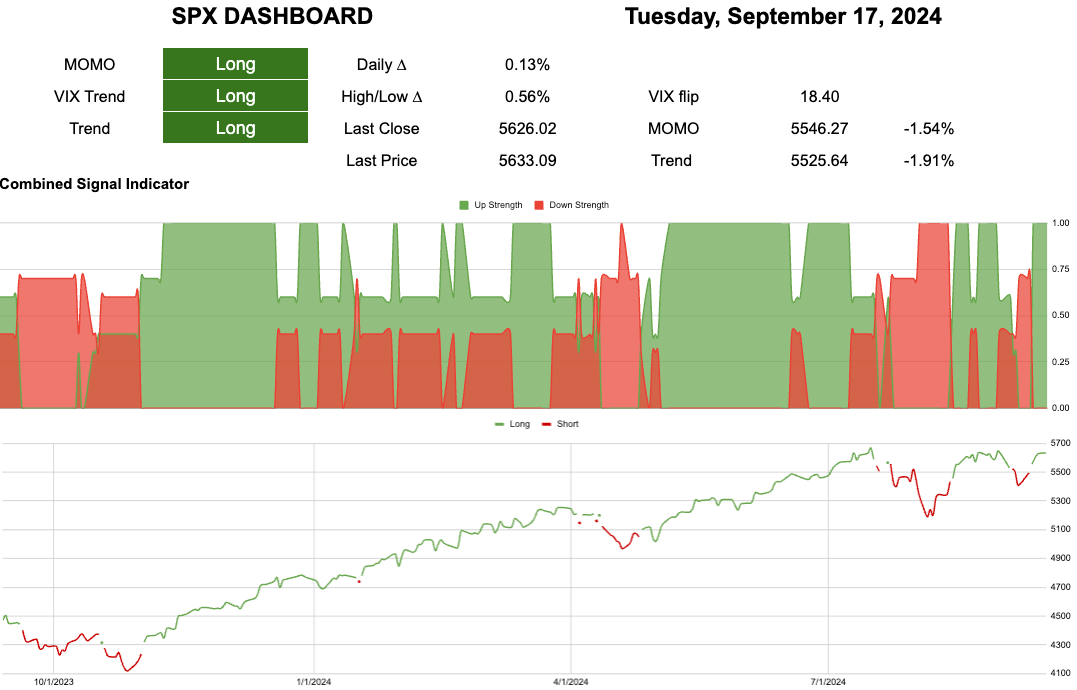

Daily SPX update.

All green on the board.

5546 / 5525 would signal a break in momentum and trend.

How likely is that?

Unlike the last 6-9 months, a 2% downward move has now occurred with the recent volatility.

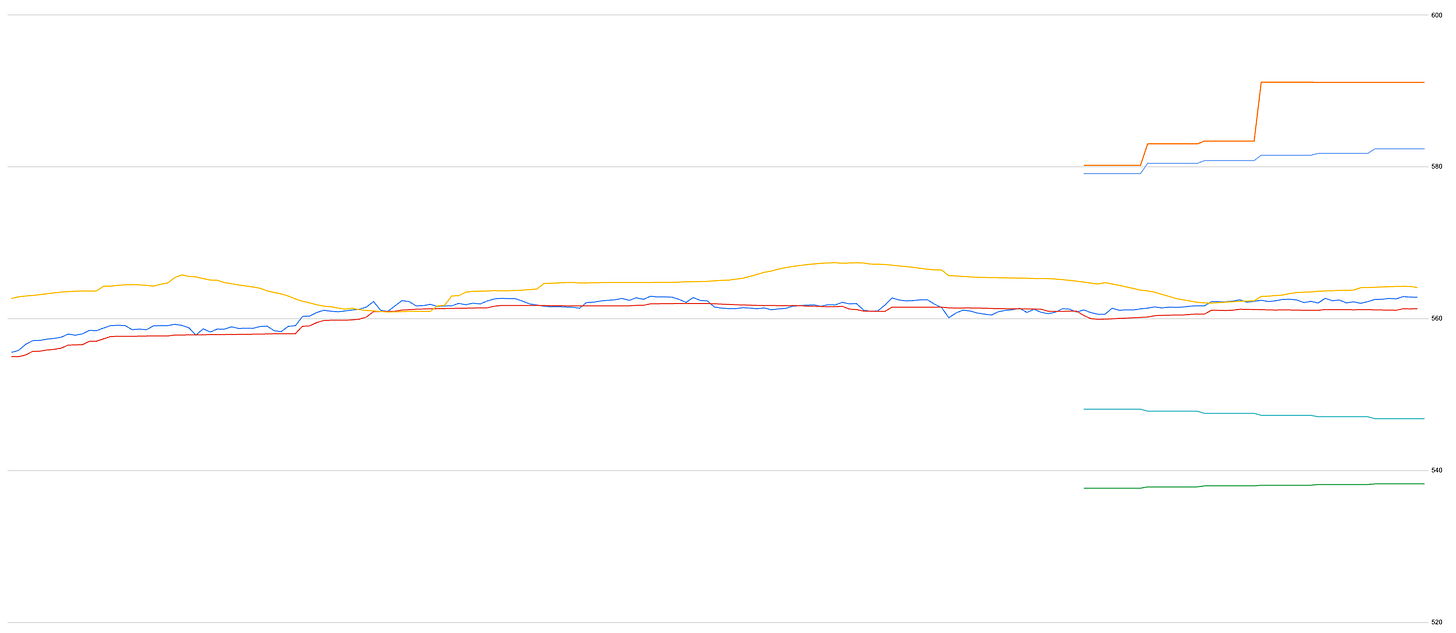

Viewed through trade ranges, we are right in the middle of all timeframes.

We still have a sell signal as the most recent signal on the daily timeframe. Is it wrong, or is it just early? Is there a difference?

Everything I have built points to being long on things, regardless of whether they are fancy or the latest shiny thing on fintwit. As I’ve said before, the sell signals are not as robust as the buy signals.

As we head into OpEx and The Fed meeting, we seem to be in a holding pattern.

I don’t flip coins – the portfolio is full. As I tried to imply on Sunday, in the perfect backtest we all recognize on days when things go right, there were no half measures, even when "news" was factored in.

That is why, following the backtest, the days it didn’t work form the basis for our stop levels and measures.

Open Equity : 30%

Stop Loss Return : 23.9%

Closed Equity Return : 21.8%

Lots of new positions went in yesterday. Let’s see how it goes.