Storm in a Tea Cup?

Week 08 - Equity Portfolio Update

I highly recommend using the link to view these posts in a desktop browser. Substack limits the size of emails, and since I use a lot of images, some readers have been missing important data by only viewing the truncated email.

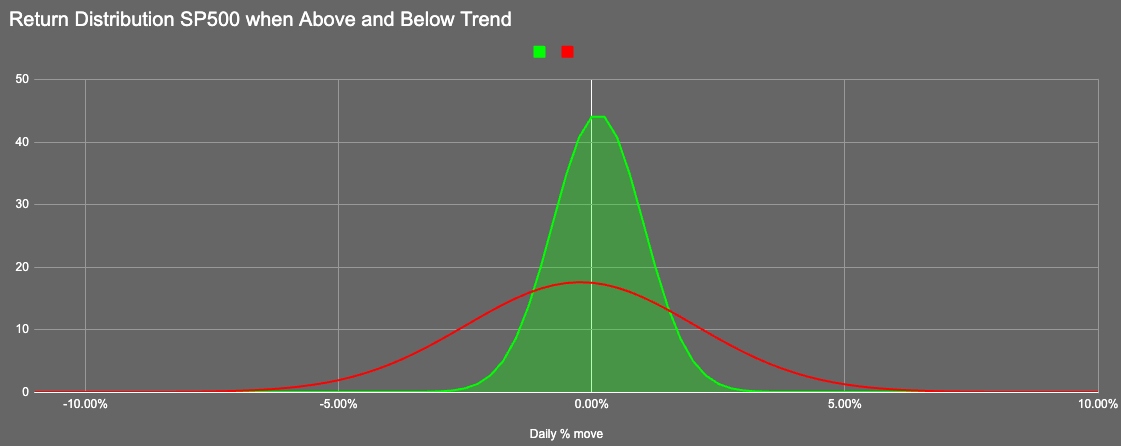

If you listened to Hot Takes with Hank this week. Trend is neutral because we find ourselves between ∆1 and ∆2.

So we find ourselves on a trend basis still in the Green distribution. If the weakness continues we will transition to the Red.

Shared this chart last week. It seems we were right not to worry about a transition… Until it all came in one go on Friday!

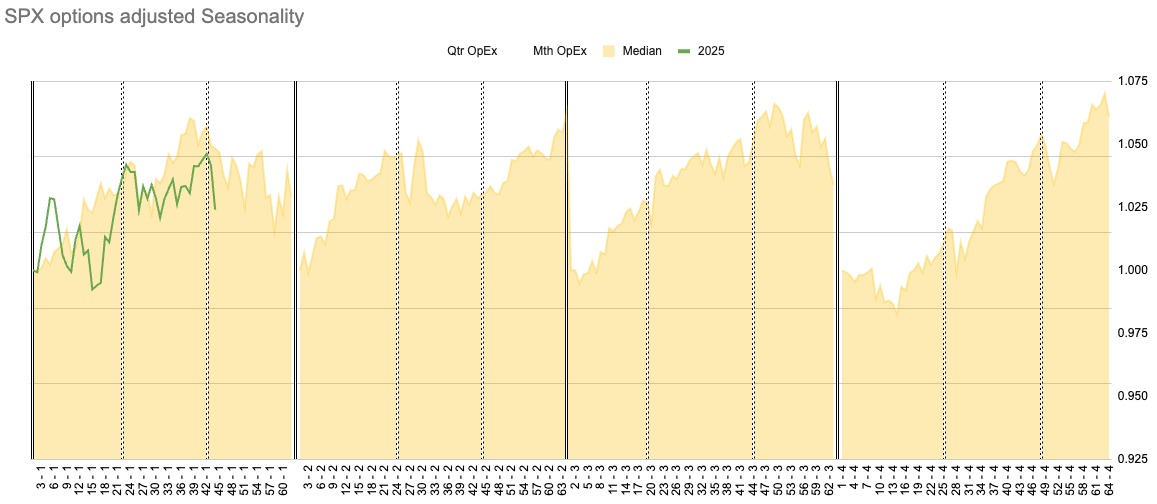

If we readjust the calendar for options expiry are we heading into a period of weakness?

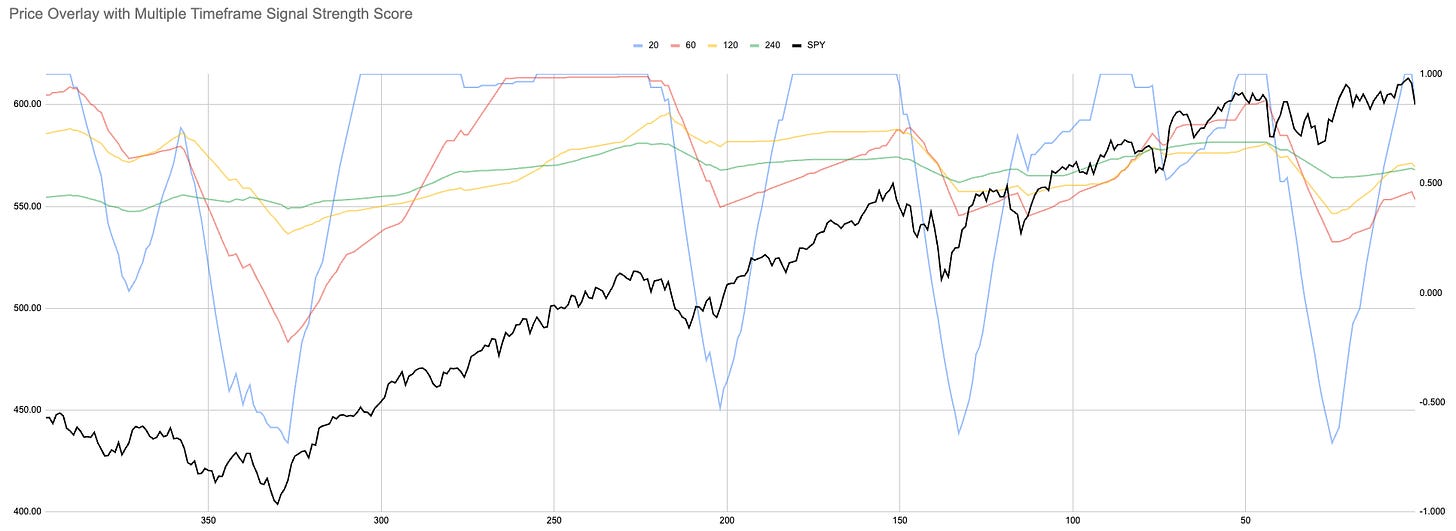

Daily timeframe:

The portfolio updates and further colour on the index are behind the paywall.

If you leave us here have a great week.

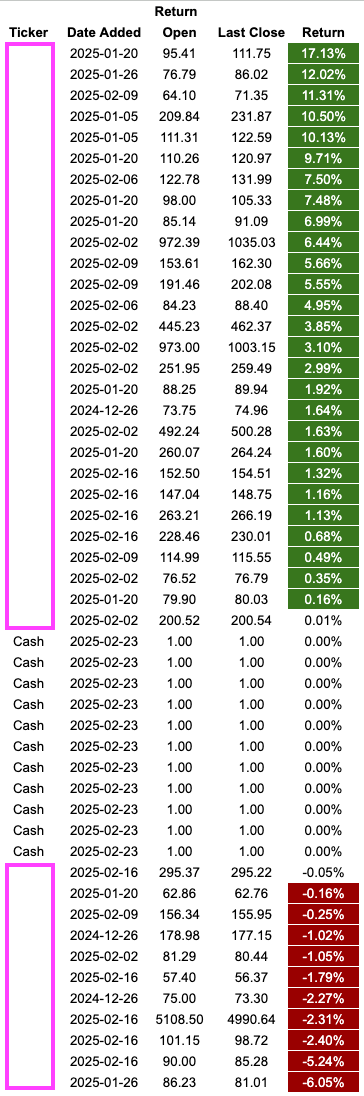

Current Open Equity = 32.4%

Stop Loss Trigger = 28.9%

Current Closed Equity Return = 29.4%

Our open equity outstanding is ~32% since we started in Dec ‘23. We have been able to capture ~29% returns in closed trades, meaning ~3% open equity still belongs to Mr Market. Until we close the trade it doesn’t yet belong to us!

If all our stop losses hit bar any gap risk we hope to close ~29%

It cannot always be rosy! There is no free lunch we have to risk losing to be in the game to win. We could have a -0.5% drawdown on closed equity.

Subscribe to see the portfolio. You can do it for free using the 7-day trial if you want.

And our current open positions:

Please subscribe to see more of the portfolio we are constructing.

New user guide - Paid Portfolio Posts

Hot Takes with Hank

Discord Channel - open channel available to all.