Short and sweet...

Friday 15th December - Daily Update

Life before markets I am afraid.

A little trip to A+E with my son out of the way, he is great and back to bouncing around the house!

No changes at the index level. I use this as a means to decide if hedges are required. The moves in the portfolio will automatically reduce risk as we see below.

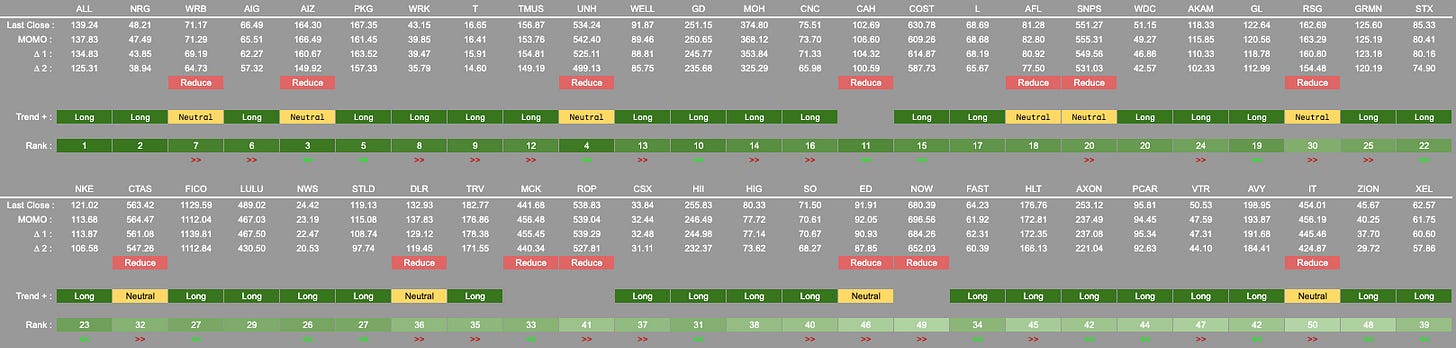

Lots of moves as listed above.

Out is out. Neutral is half-size.

This has two benefits:

Depending on how close in price momentum and trend are, we will get the chance to reduce the position before a trend break minimising our loss.

If we are still in an uptrend we capture some gains to redeploy.

An example of this today would be WRB or AIZ which both have ~10% gains coming into today. We can now capture half of that and redeploy it into other trades. If this is the start of a reversal for these two names it also means we don’t give it all back to the market.

Sir, in one of your tweets you say, that you use momentum, trend and volatility to score every ticker in the SP500. How are you using volatility in this context?