Seasonality Season.

Week 8 - Weekly equity Update

I had a couple of questions about seasonality this week so I have posted the SPX returns using OpEx and not calendar days.

As you can see this is a period of potential weakness. If everyone is highlighting it should we assume it has been hedged? Or am I taking a sample from within a small subset and therefore to a larger set of investors it remains an unknown danger?

As ever nothing is perfect, this is a single path defined by many reduced to a single snapshot. As you can see from the Dec - Jan OpEx period SPX performance underperformed the historic return.

When the price stops rising momentum and trend have a chance to catch up to the current price. This is caused by old lower prices disappearing from the lookback.

We remain in the same position as much of this year. Volatility rising along with price above momentum and trend.

4904 and 4913 are the decision points heading into this week.

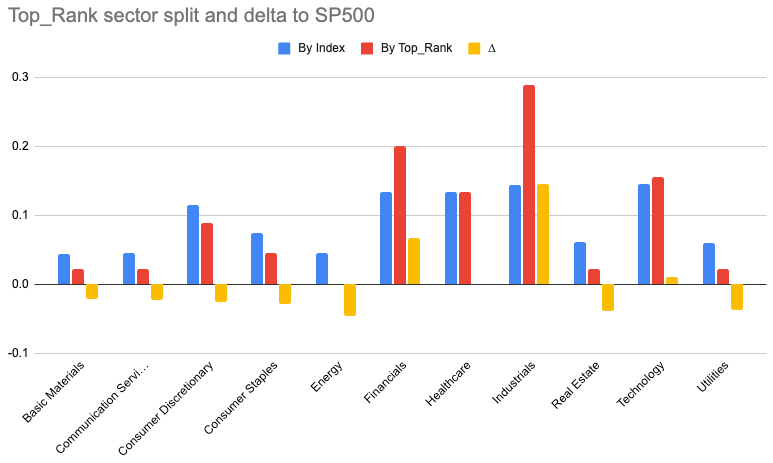

Industrials breakout?

Chris, how do you define MOMO and Trend? Are they some kind of 21/34 emas?