Rotation, Gyration and Oscillation.

Week 03 - Equity Portfolio Update

I highly recommend using the link to view these posts in a desktop browser. Substack limits the size of emails, and since I use a lot of images, some readers have been missing important data by only viewing the truncated email.

We are now back above Momentum (5952) and Trend (5986). It would take a -0.73% move to break back below.

We know that kind of move can occur in either regime.

Daily timeframe:

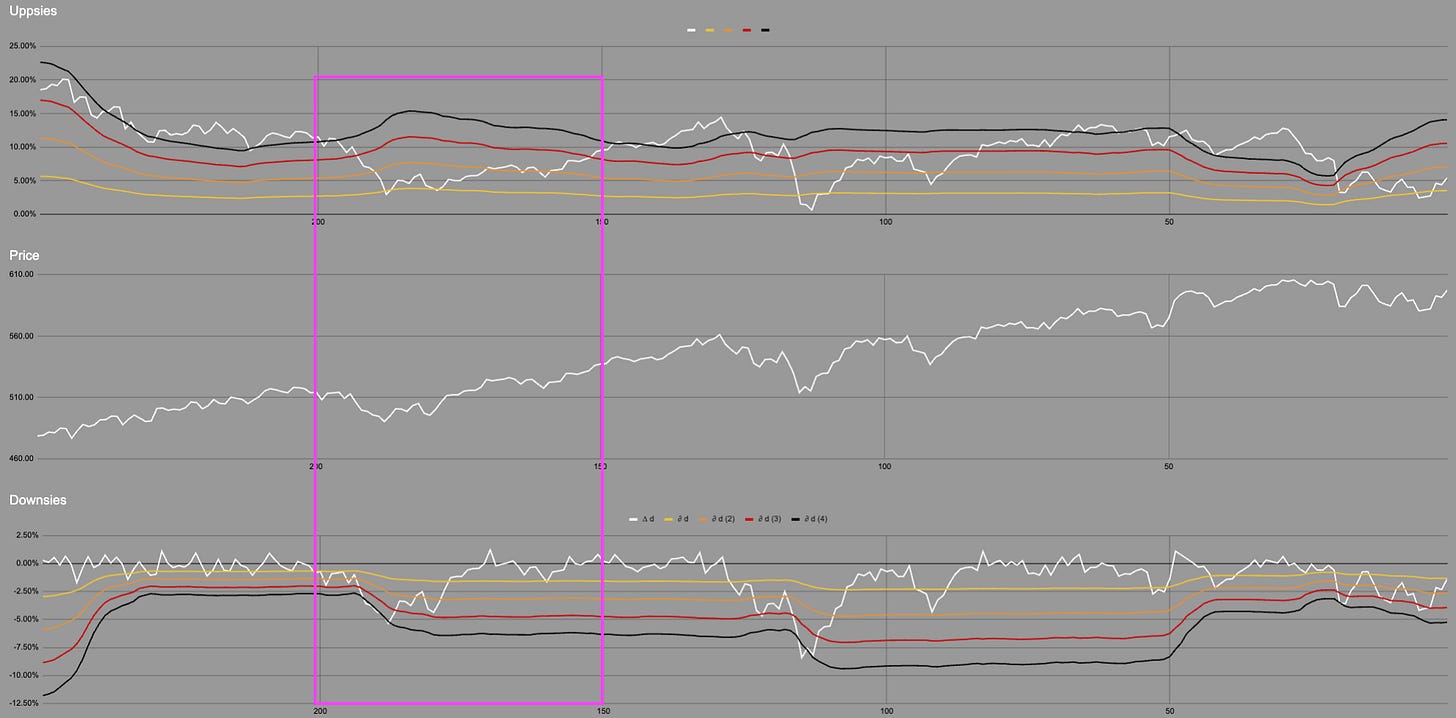

The short sharp corrections of this phase of the volatility cycle seem to be continuing.

We had a brief green blip earlier in this weak period but as spoke about in HTwH this weekend, far more constituents are participating in this upturn.

Are we heading for an April repeat?

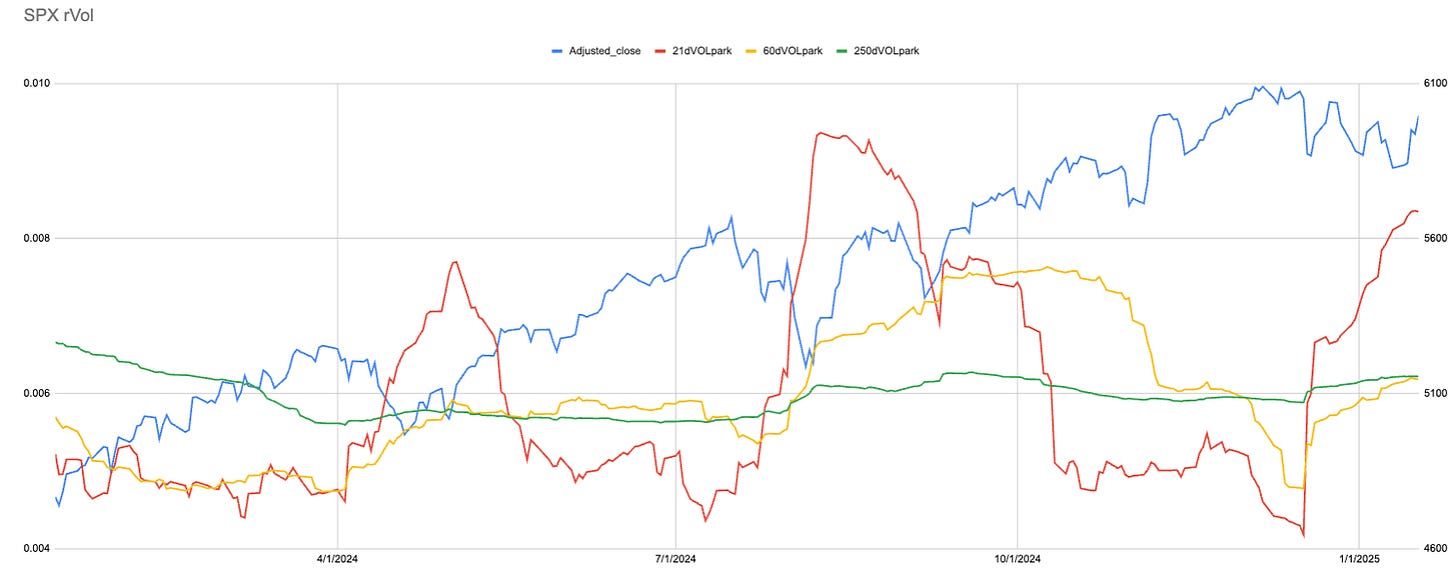

Realised volatility as always lags implied. This is another example of needing to track metrics that perhaps you don’t use. I used the trend follower example in HTwH this weekend. Even if you don’t trend follow knowing when they may or may not enter a trade can be useful. You may be a very short term trader and not knowing what vol control funds are doing has worked fine for the last 4-5 days. Perhaps on Tuesday when you think things are “overbought” knowing that vol control regardless of the little wiggles will be buying alongside trend followers.

Who knows?

Le Croissant crumbs:

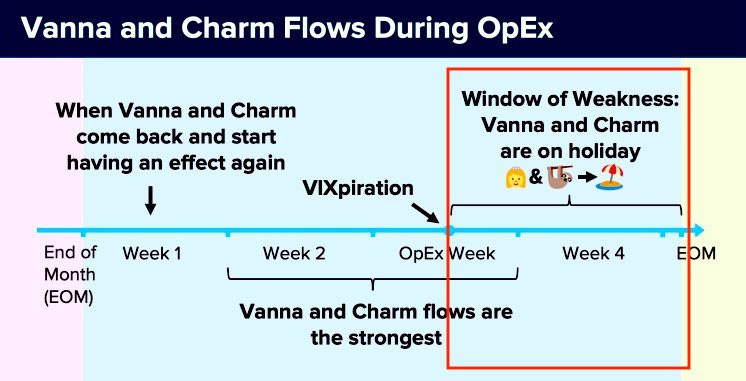

Are the crumbs an appropriate guide for the next few weeks? Does it matter that OpEx was before VIXperation?

Does the sequence matter?

Current Open Equity = 33.8%

Stop Loss Trigger = 30.2%

Current Closed Equity Return = 33.2%

Our open equity outstanding is ~34% since we started in Dec ‘23. We have been able to capture ~33% returns in closed trades, meaning ~1% open equity still belongs to Mr Market. Until we close the trade it doesn’t yet belong to us!

If all our stop losses hit bar any gap risk we hope to close ~30%

It cannot always be rosy! There is no free lunch we have to risk losing to be in the game to win. We could have a -3% drawdown.

Subscribe to see the portfolio. You can do it for free using the 7-day trial if you want.

And our current open positions:

Please subscribe to see more of the portfolio we are constructing.

New user guide - Paid Portfolio Posts

Hot Takes with Hank

Subscriber Discord