Reaction to the Reaction

Friday 26th July - Daily Equity Update

Index level hedges are still the order of the day.

Let's try to dissect QQQy vs. IWMy.

I use this term like a factor term. To me, QQQy means more likely to trend. This makes sense when you think that if something has trended more, it will move up the indexes and see greater flows. If that continues, it will appear in QQQ and SPY, which by far see the largest aggregate flows and, importantly, the largest equity options volume.

IWMy means it is far more likely to mean revert. Flows are not as large, so it has less chance to move up the indexes. It is likely to appear in SPY and IWM and form a smaller part of each index.

More likely to mean revert, to me, means that if these equities/indexes reach some version of oversold, they can move just as much as the more trending equities. The difference is they can often make that move over a shorter timeframe, but it is less likely to persist.

If we look at SPY, we have bought on weakness between long trending moves.

The same for QQQ.

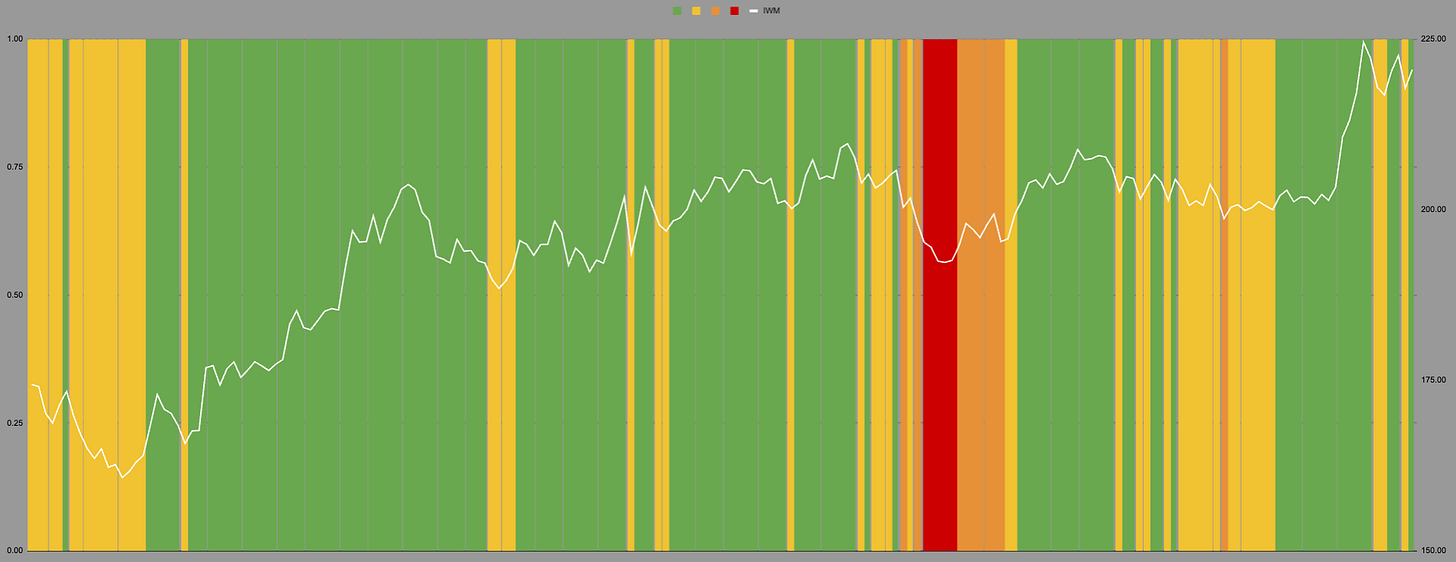

It is very different for IWM.

There are two views to this comment:

“...but it is less likely to persist.”

One is that this IWM move is short-lived. It is a reactionary move to what is happening elsewhere in the equity space. L/S equity funds are having to cover their shorts because longs are falling, etc. Pick your “pod shop blowing up” meme as you see fit.

The second is that yes, this could be reactionary, but if the move sticks around and maintains momentum while the other stuff is losing momentum, then the trade could stick around.

The more perhaps boring IWMy will be higher in the selection process for these trades moving forward.

It doesn’t mean you short the QQQy stuff because, barring some huge blow-up, it will still see flows. It may mean that for a short period there is nothing to short.

IWMy will see momentum flows; QQQy will retain its passive flows.

This is what I have discussed before as the true blow-off potential. There is nothing to short; boring stuff is ahead of the cool stuff. Economic indicators weaken, confusing the bears. QQQy stuff outperforms nominally due to passive flows, but IWMy stuff is higher in momentum scores, confusing the bulls who want to be long the stuff they are normally long.

I believe this is the part of the story where no one knows what the fuck is going on.

Who knows?

We follow the model; we get some stuff right, and we get some stuff wrong.

I wouldn’t try to be too clever about it. This is probably the time in the story when we hear about friends, nephews, and Twitter mates giving up work to trade full-time.

It will all appear so easy and don’t forget Mr Trump will definitely win the election and look what happened last time ;)

Closed equity return has now crossed +20% since we started in November. I know this is a bit naughty I was sharing in other places before going public on Substack on December 5th.

Drawdown on closed equity I have now included to show how little I care about open equity.

Open equity belongs to the market. Closed equity belongs to me. Along the way, I want to take some of that open equity away from the market. I will not change my risk management based on open equity, it does not belong to me, and I am not in control of it.