Panic at the Disco!

Dance near the door?

PANIC!!

No don’t do that!

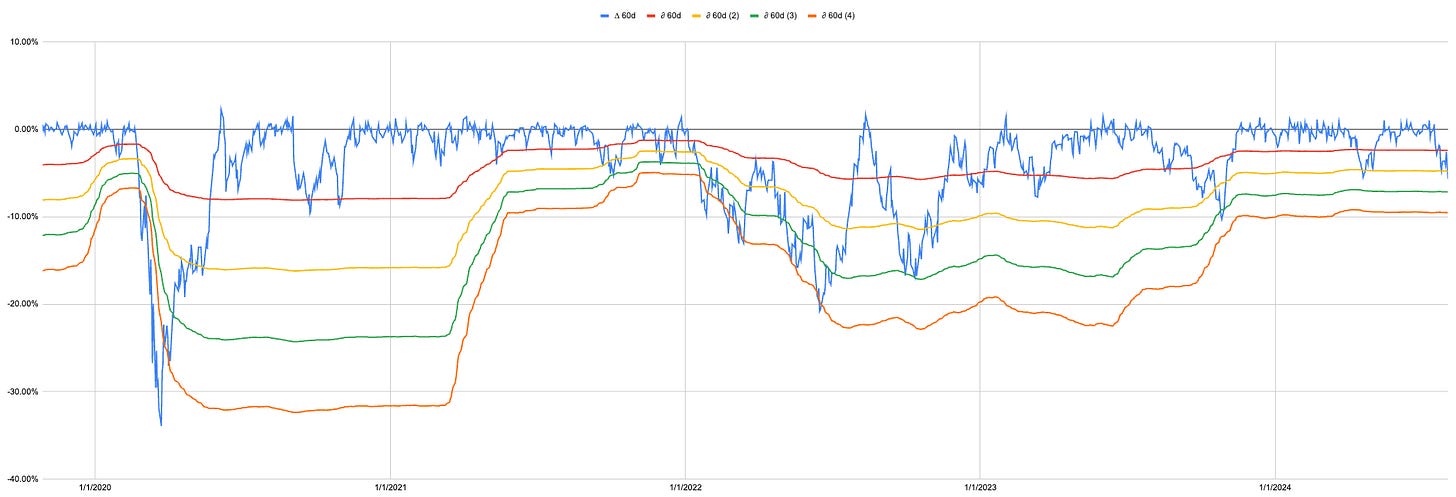

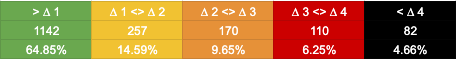

These wiggly lines that calculate our trend levels are used for a reason.

Here they are shown another way and this is what they represent.

The S&P 500 spends only 11% of its time below this current level.

OK, but why is this important?

What I share here before the paywall is focused on the index. I hope to share a single lens with which to view the index and how to hedge it.

This is only one piece of how I classify and measure every ticker in the S&P 500. Currently, the portfolio has 44 long positions.

6 are cash

5 are new this weekend and hence 0%

3 are in a drawdown of less than 2%

36 are positive and have a return between 1 - 20%

It has been hard to write these opening sections recently as our portfolio looks nothing like the index. It is hard to talk directly to the index when I feel none of the emotions attached to the current moves.

I don’t need to time getting long again because I am already long.

On Thursday, I discussed that IWM puts would be a better hedge for me because of the current composition of the portfolio. The puts worked very well, but the portfolio didn’t really react.

So, good directional trade, I guess, but it didn’t really hedge anything.

What next?

Well, again I need to separate portfolio from index. We know that the biggest movers move the most due to concentration and options volume.

There will be a bounce.

I am not trying to buy it, but I have to be conscious that we could see a flip with what is currently working and the names that are caught in the bounce.

Do I need to hedge that?

I don’t know.

In the last 2 days, due to closing positions, we suffered a drawdown on closed equity return of -0.3%.

I must try harder!

Closed equity = 19.9%

Open equity = 25.8%

Stop loss Drawdown = 20%

I am a random dude on the internet! None of this is trading advice. This is me sharing my portfolio and trying to share how I think about things.