Not Falling is Not Rising.

Week 52 - Equity Portfolio Update

I highly recommend using the link to view these posts in a browser, preferably on a laptop or computer. Substack limits the size of emails, and since I use a lot of images, some readers have been missing important data by only viewing the truncated email.

Well as we head into Christmas, Santa has been most kind. If you have been on the journey since the beginning we very nearly unwrapped a 31% return prezzie.

I want to thank everyone who has come along on the journey. I appreciate you all!

This Substack now has 360 followers and 49 paid subscribers which is amazing!

It may be strange to clarify what the reason for this portfolio is over a year into sharing but here we go.

My intention for this portfolio was never to create some 100%-a-year asymmetric potluck tail-on-fire strategy that then dies in an equally impressive dumpster fire.

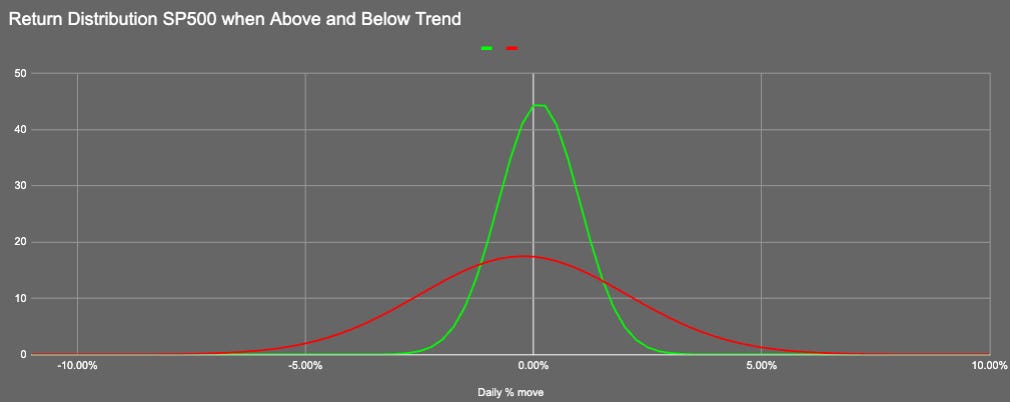

I want to attain SPX returns without SPX drawdowns.

This is a long-only strategy which feels important to say right now. If there are no longs in the internals of the SP500 then we will be in cash. That may seem like a strange thing for some but to me not losing money is the single most important thing.

I am not trying to be right I just want to lose as little as possible when I am wrong.

There are always places to make money, keeping hold of it on the other hand can be rather challenging.

I have no idea what 2025 will bring but the prices will tell us what to do.

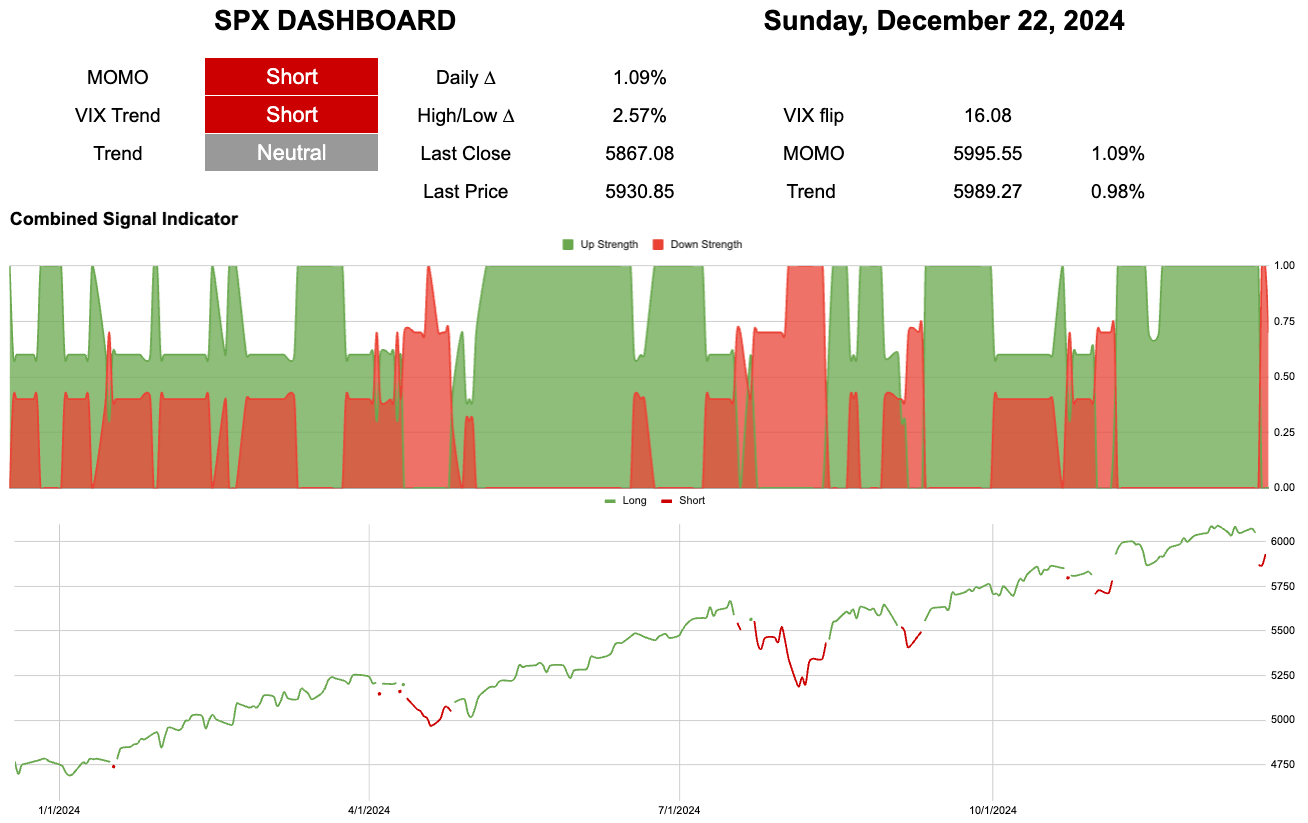

The line in the sand coming into a new week is ~5990. It's the same as it has been for a couple of weeks, except we’re below it.

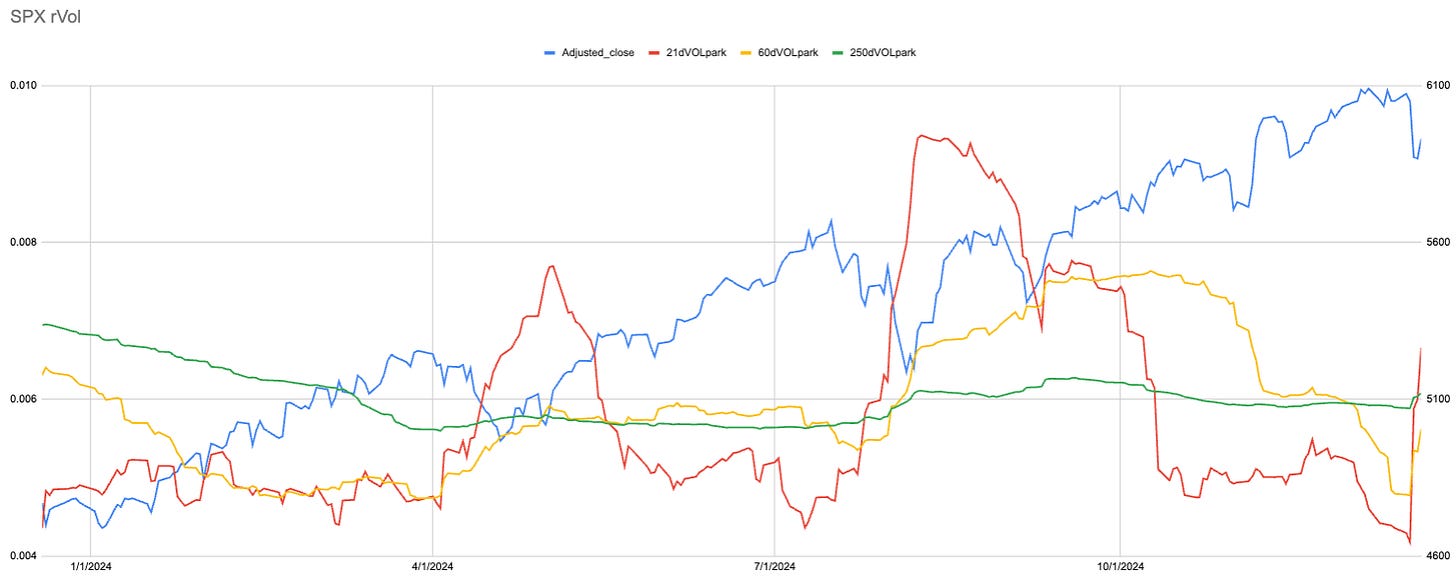

Realised volatility took a sharp jump this week.

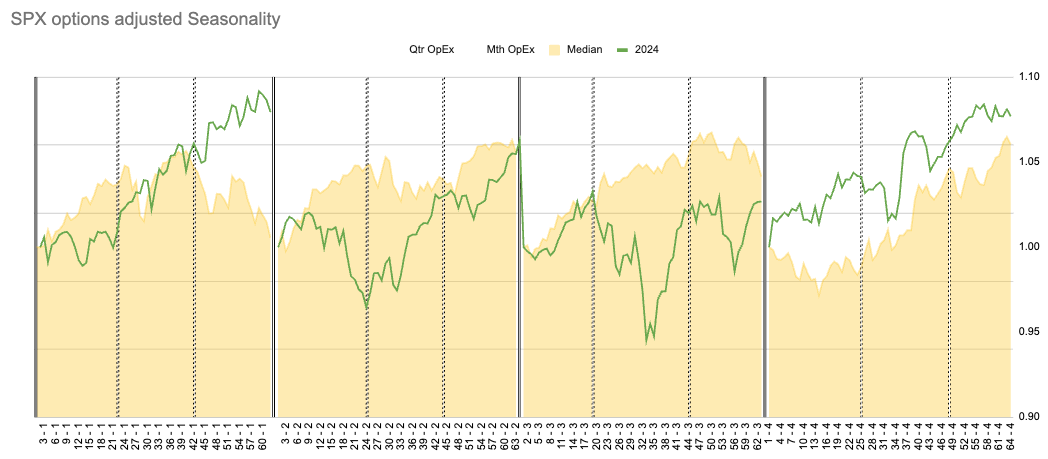

Seasonality as seen through OpEx dates has played out rather nicely with the Santa Clause effect.

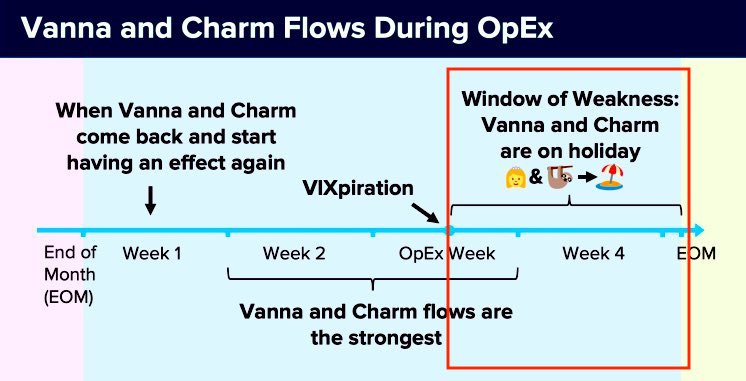

Then we have the Croissant Effect.

Daily

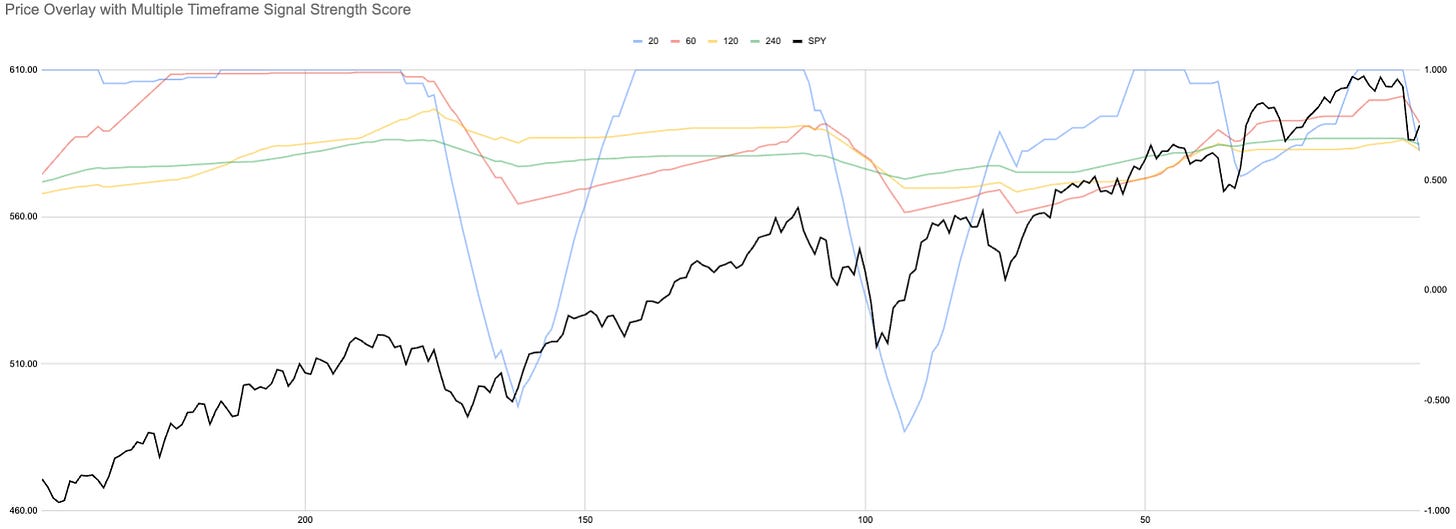

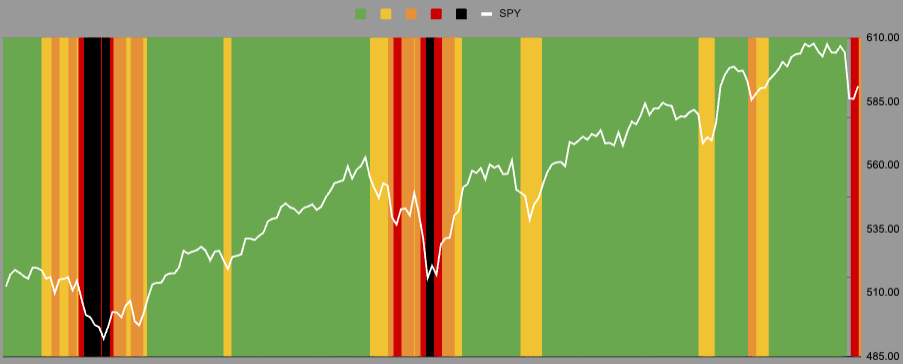

All timeframes Strength of Signal have turned down. They are all coming from a very high level.

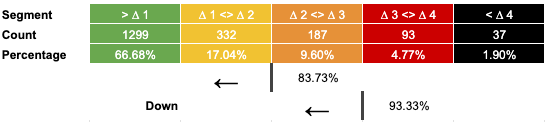

We remain very much in the red distribution.

As we head into the New Year I have a more in-depth view of the index for paid subscribers.

Current Open Equity = 34.3%

Stop Loss Trigger = 32.9%

Current Closed Equity Return = 30.9%

Our open equity outstanding is ~34% since we started in Dec ‘23. We have been able to capture ~31% returns in closed trades, meaning ~3% open equity still belongs to Mr Market. Until we close the trade it doesn’t yet belong to us!

If all our stop losses hit bar any gap risk we hope to close ~33%

Subscribe to see the portfolio. You can do it for free using the 7-day trial if you want.

And our current open positions:

Example of positions closing this week.

Eww yucky red ones!!

Please subscribe to see more of the portfolio we are constructing.

New user guide - Paid Portfolio Posts

Subscriber Discord