Navigating the Market: Rebounds, Rotations, and Untapped Moves

Week 43 - Equity Portfolio Update

5734 - 5789

The line in the sand as we move into the new week.

After a high-beta/low-beta rotation, those interest rate-sensitive sectors are now largely in rebound.

Everyone clamoured for energy exposure only to get run over. Let’s see what happens next.

There was some give-back over the last two weeks, amounting to 30 bps of closed equity. I can handle that when we offset it against a potential 28% return if all stop losses get triggered. With current open equity positions, it could be a 33.5% return since starting the portfolio last December. As always, that open equity belongs to the market, not me, so until positions close, that gain might be nice to look at, but it doesn’t exist in my account. Yet!

Current Open Equity = 33.5%

Stop Loss Trigger = 28%

Current Closed Equity Return = 25.5%

Here is an example of the positions that we have closed this week:

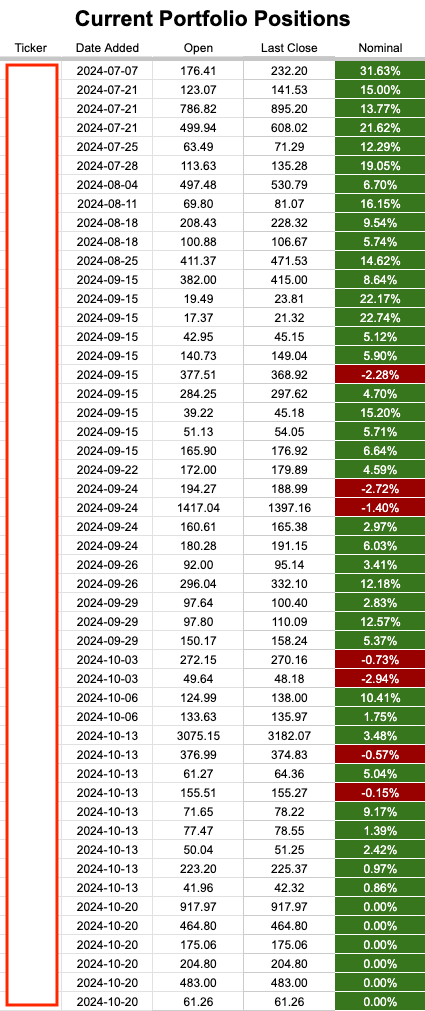

And our current open positions:

If you would like to see more of the portfolio we are constructing, please subscribe.

New user guide - Paid Portfolio Posts

New user guide - Free Index Overview