Navigating Recency Bias and Volatility with a Steady Hand

Recency bias is an interesting phenomenon.

A month ago, no one knew where their water wings were. When they finally found them, they realized they had holes in them.

After nearly drowning, they are now piling on the fact that they have water wings and are jumping out of the water.

The signal tells us to be cautious, and in the portfolio, we have increased our cash positions accordingly.

We should strive to maintain emotional consistency. You could hurt yourself just as much by being overly cautious today because you weren’t cautious enough five weeks ago and are now overcompensating.

I’m not talking in absolutes. It’s not about being 100% long or short, or claiming, “This will do this, that will do that.” That’s not my approach.

The reason I can entertain the idea of a small call position—maybe not today, but let’s see how things develop over the weekend—is because my portfolio is doing reasonably well.

Yes, I had to close some positions at a loss this week, but it didn’t break me. Some positions even went up for me yesterday.

Having balance in the portfolio allows me to simultaneously consider reducing positions at my stops while also thinking about potential positive risk at the index level.

No FinTwit flip-flopping here.

Hourly

Coming into this week, the small options trade didn’t work. Does that stop us from trying again? For me, no. It was a small trade, and it didn’t burn me enough to prevent trying again.

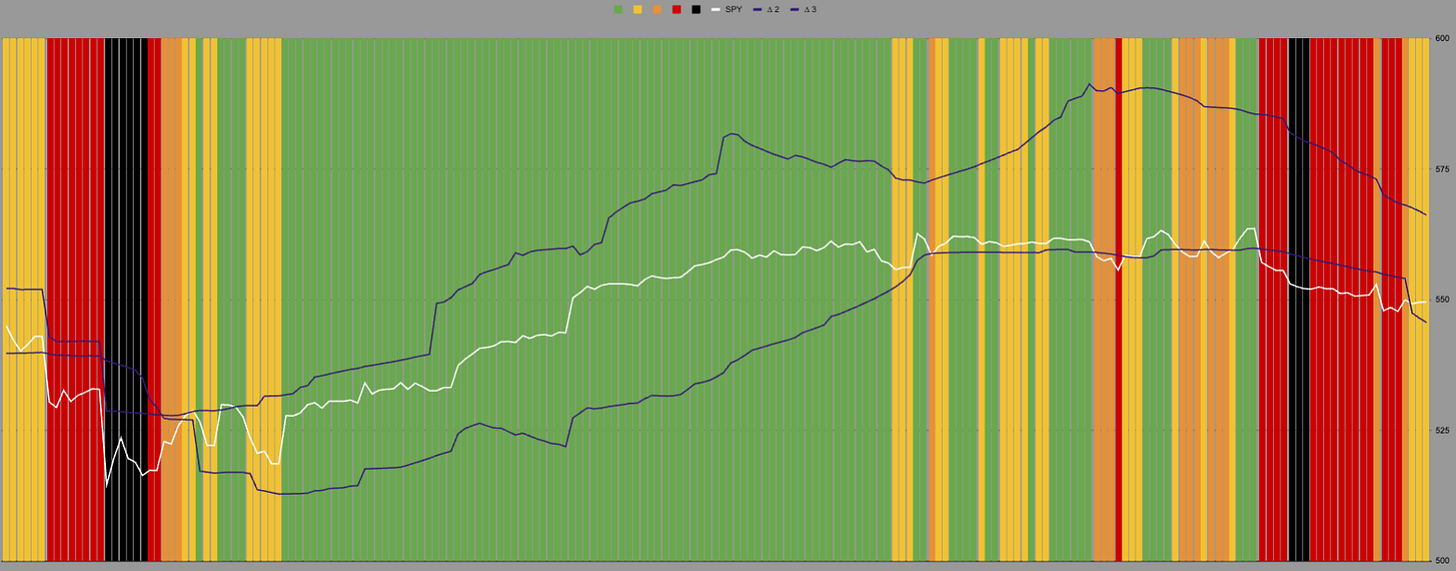

If anyone listened to my conversation with Mike Green over the summer, this on the hourly chart is similar to what I was trying to convey at a higher timeframe for the end of 2022.

Back then, I was talking about "threes" and "fours," and now we’ve moved on from colours.

You can see we hit Black (four) at a higher price.

However, just a couple of hours before yesterday's close, we reached Orange (three) but at a lower price.

Despite being at a lower price, the strength of the move yesterday wasn’t as strong.

If we add to that our shortest-term strength of signal just hit a minimum. We need to see how this plays out.

What does that mean?

At least on the lower timeframe (it hasn't yet moved to daily measurements), my measure of the volatility of volatility is falling.

I’m not referring to VIX or VVIX here—this is purely my own measure of volatility.

We always need a framework for our decisions. At the hourly level, prices only move through these levels 11% of the time. So, from here, there’s a 1 in 10 chance it could fall further.

Here comes the balance!

The largest moves down tend to happen at red and black levels. So, just because the odds are low doesn’t mean I’ll bet the house on it.

Depending on price action, I may buy a small call position today or early next week. I’m not going to buy a massive futures position—just a small call position to augment what we’re already doing in the portfolio.

What’s happening in the portfolio is what’s giving me the confidence to potentially take this risk in other areas.

The portfolio chuggs along.

Barring any gap risks if everything hits its stops today we could potentially hit 25% return since we started.

That is what allows me to be comfortable thinking in both directions and not be thrown around by the market.

I am just a random guy on the internet sharing his thoughts and my own portfolio. Good and Bad. Do your own research and take risks appropriate to you. Take what is useful to you from my process and leave what is not suitable. Make sure it is your own process.

There is nothing more damaging than the get-out-of-jail-free card people use when they copy someone else. Make it your own. Take accountability.