Month End Mark Up?

Friday 1st November - Daily Update

Who knew 5800 was the line in the sand?

Any who coming into this the important part was that the portfolio was almost 50% cash. Nice!

The index and the tickers inside the index are very different things. There are not 100 billions of dollars globally hedging Advanced Auto Parts.

We will see coming out of this below the tickers and sectors were correcting before the index, and they will likely rebound while everyone is freaking out that 2 -3 indexes are still falling.

This part of the daily post is simply an aid to the real work that goes into the portfolio.

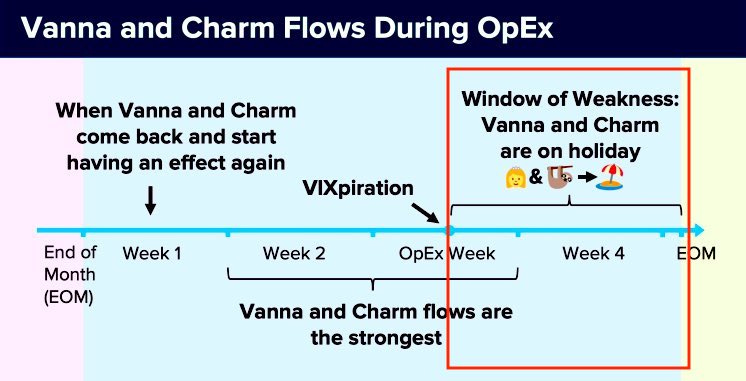

Daily

Using these measures to keep us within the 83% bracket SPY would need to remain above ~ 560

You can see more in this week’s weekend rundown and portfolio update.

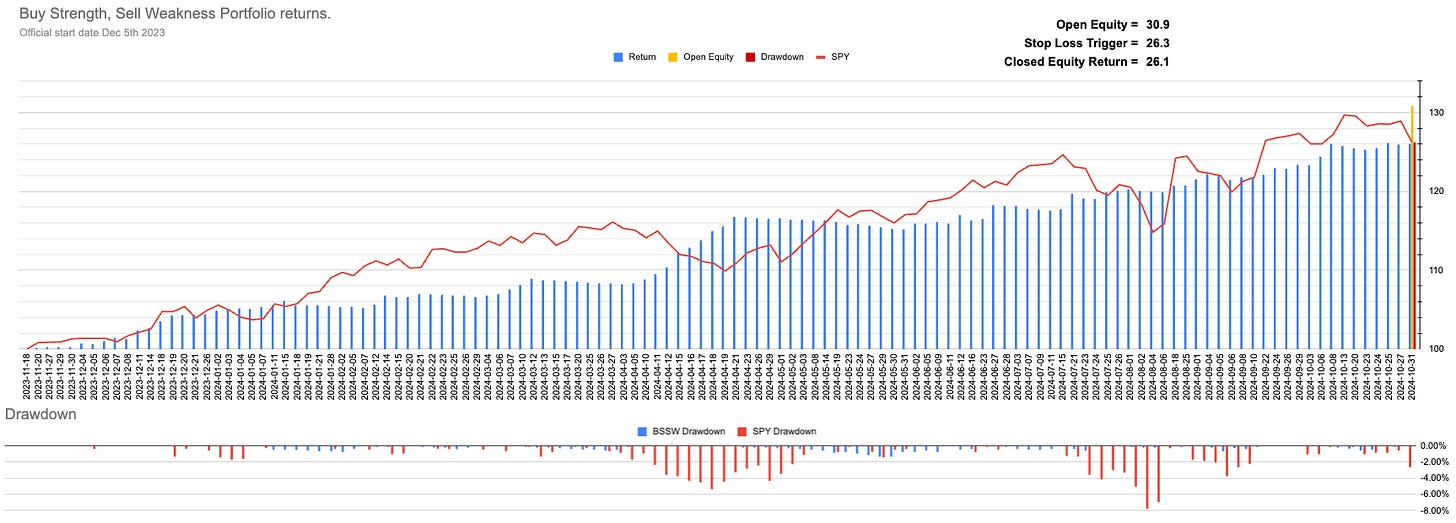

Current Open Equity = 30.9%

Stop Loss Trigger = 26.3%

Current Closed Equity Return = 26.1%

I use the knowledge above to build a portfolio of the best-performing stocks within the SP500.

Subscribe to see the portfolio. You can do it for free using the 7-day trial if you want.

https://discord.gg/gkzCYg6g ← New subscribers make sure to join Discord using this link. If you are a new paid subscriber send me a DM to gain access to the subscriber section.

Keep reading with a 7-day free trial

Subscribe to Buy Strength, Sell Weakness to keep reading this post and get 7 days of free access to the full post archives.