Monday Madness

Monday 10th June - Monday Madness

All anyone cares about is stocks and when they are safe to buy bonds again. So today let’s cover the first one.

Markets can crash. First, they must lose momentum and break a trend. 5283 and 5227 respectively.

This helpful box is green.

OpEx-derived seasonality is upward and possibly continues through the summer.

Volatility-derived trend levels will continue to compress as October 23 is the last remaining -10% drawdown in the lookback. With future volatility pinned around the election and as we move through time Oct 23 will have less impact on the realised calculation. Realised volatility will compress.

Short-term that will increase flows. Long-term compressed levels will eventually be easier to break. Eventually.

Consensus seems to think we repeat 2016 and post-election hedges are removed driving the market higher. By then bar any exogenous shocks the only drawdown left will be what we just saw in April. Let’s see.

So how does that look on a chart? The trend is down there at the bottom in blue. Daily momentum is in purple dashed. Intra-Day momentum is in green dashed. I don’t day trade but I always populate this chart. Just like I have all the other charts which when combined builds a signal, these intra-day levels must break before we reach the daily levels we use use at the index level.

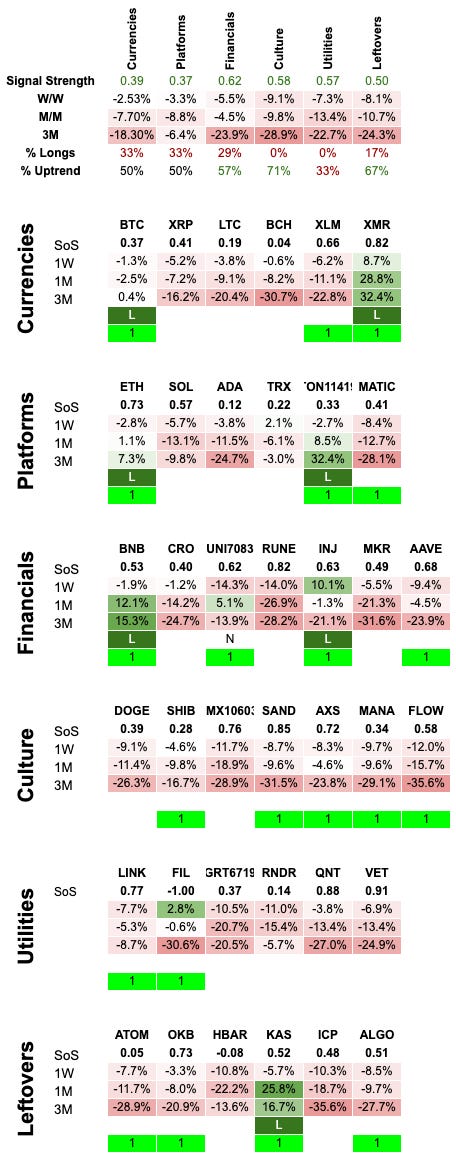

CRWD, GDDY and KKR have been specially selected from a cast of thousands to climb the mount that is SP500 inclusion.

I joked yesterday about where on the chart SMCI was included. They are defined really by whether they are IWMy or QQQy.

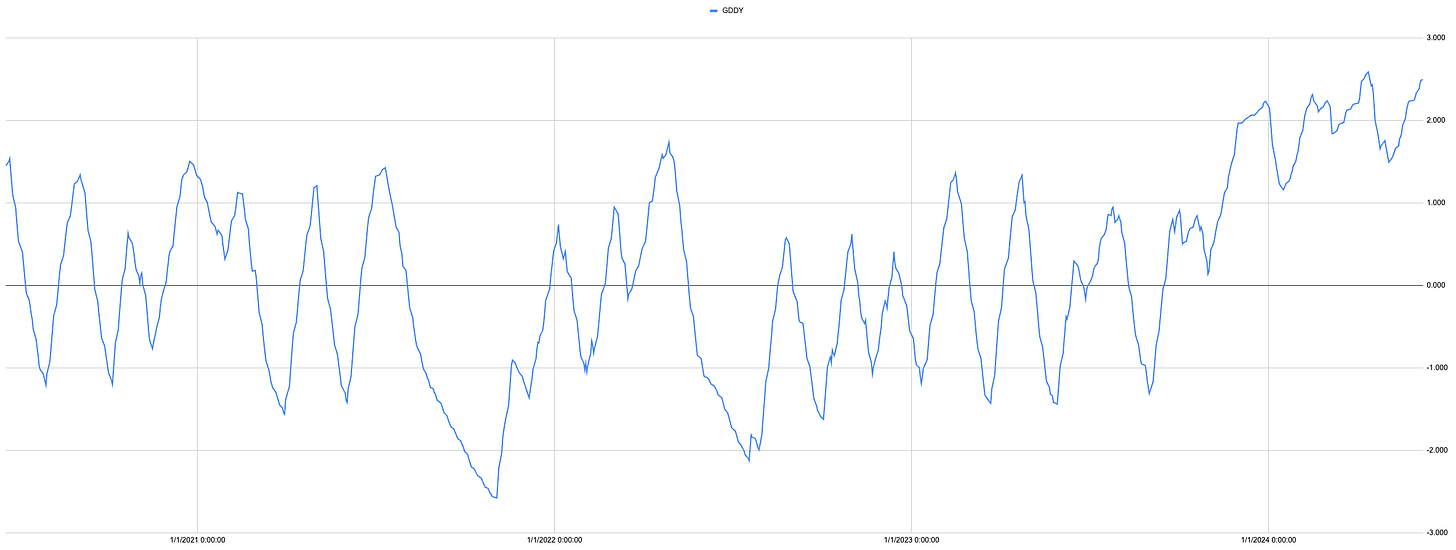

GDDY looks the best placed to continue, but that does not mean it will be a straight line.

It certainly changed its spots so to speak at the end of last year. Losing its mean reverting characteristics.

GDDY is currently a long and would be in the top 20 SP500 on its current Signal Strength score.

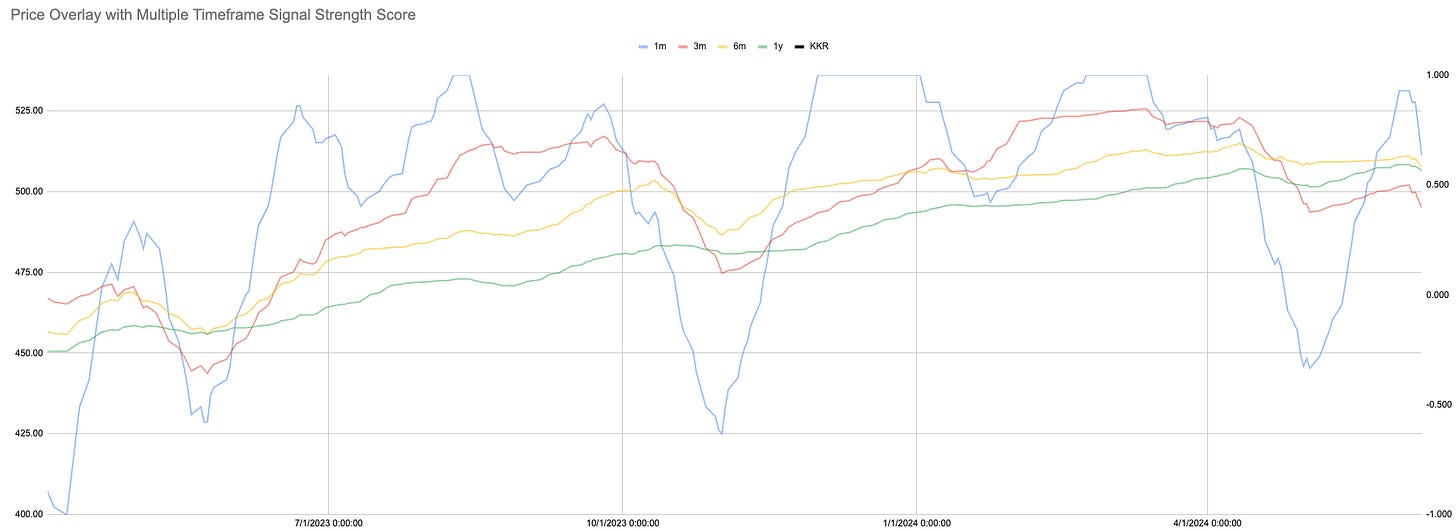

KKR is a long but its Strength of Signal looks different with the longer dated measures moving lower.

Pre-market this morning shows KKR up +9% Its current SoS would put it in the top 90.

CRWD is also up pre-market +5%

The longer-term SoS has already turned and it’s current score would put it in the top 150.

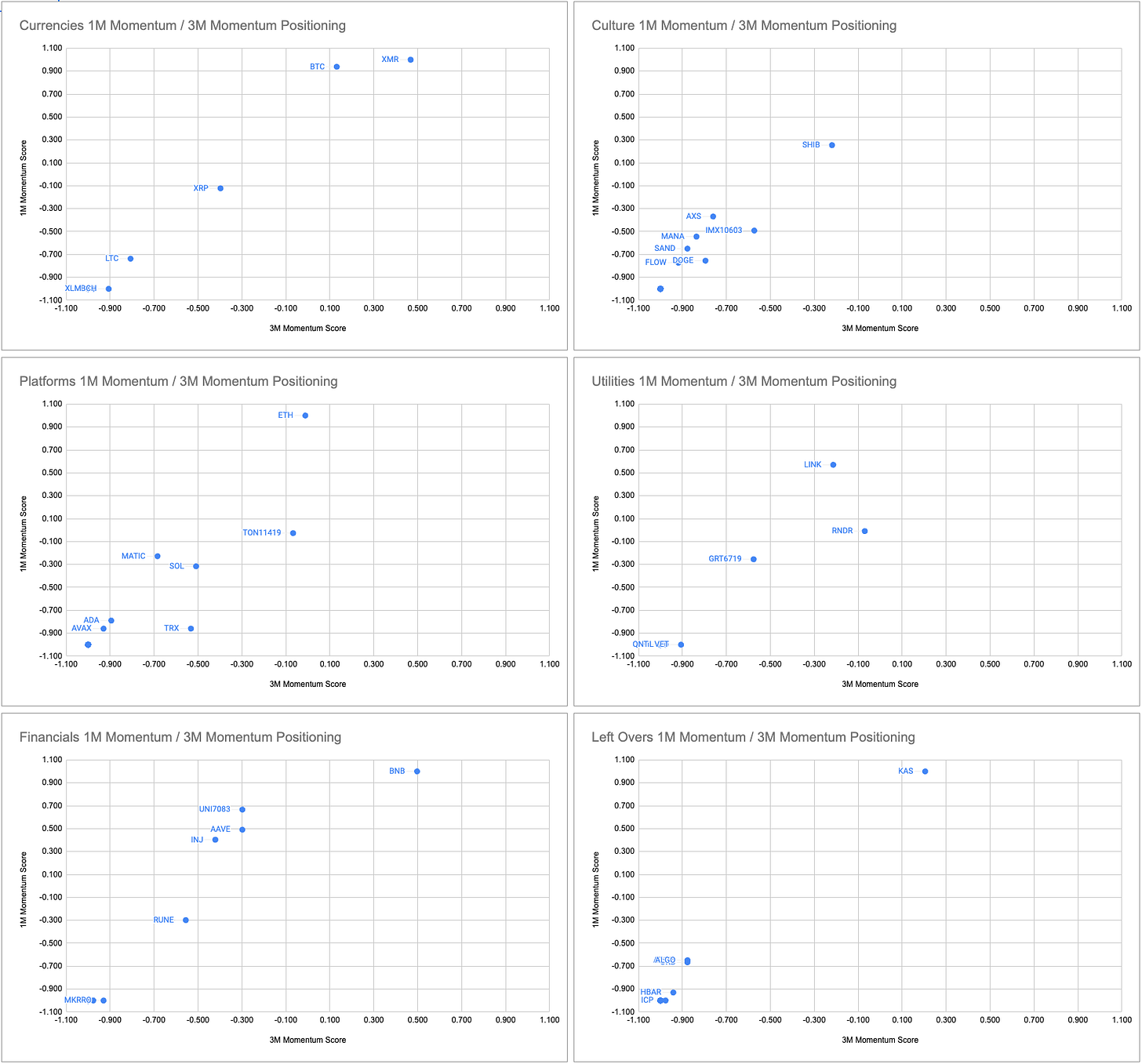

Crypto Update.

Thank you for examining the three additions.