Momentum Crash Incoming!!!

This may or may not but definitely is click bait.

Now the title is of course clickbait I have gotta catch them fish ;)

Chris isn’t me :)

I am a pretty simple guy so as much as the title is bait it came from what I saw this morning.

I have the same mechanism that I use every day to the downside also runs to the upside.

Now I don’t use it directly because I do not want to put a cap on what the crazy market can give us, we use other metrics to get us out.

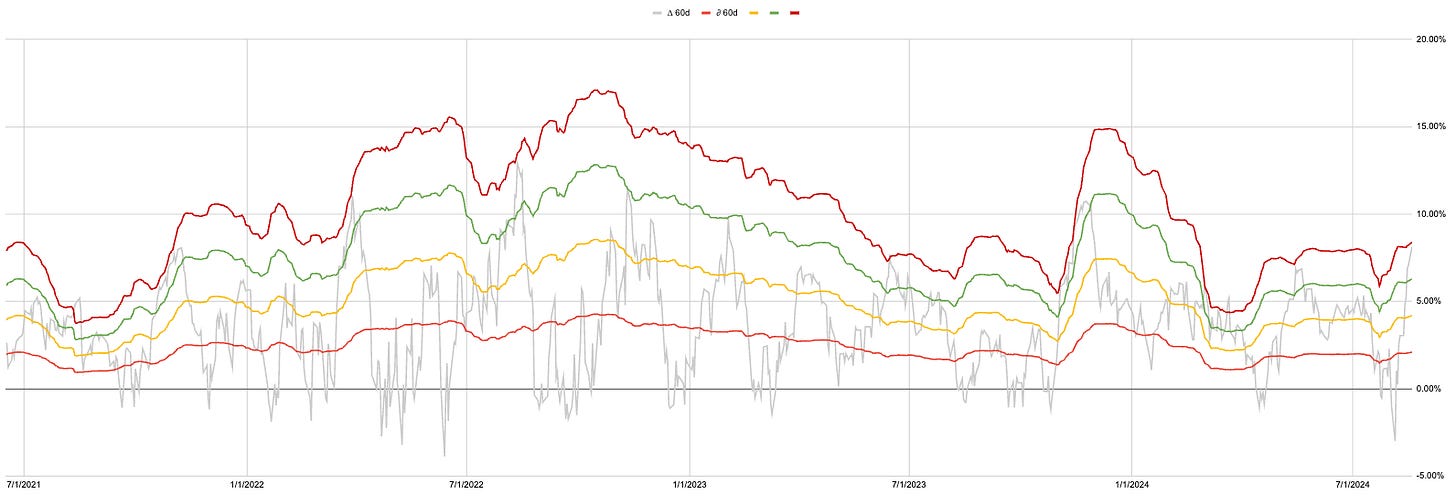

Momentum has run a lot which is obvious. Momentum could turn down. At the same time, the price could continue to go higher. It just won’t go as fast.

It almost perfectly describes how I laid out the calls trade.

When the path is less defined we use options to limit our loss if we are wrong. We are now above trend, momentum and gamma positive.

Options may no longer be the driving impact of the market as the rate of change shifts. With that, the big price moves we have seen may also disappear.

It does not mean the market crashes.

Simply we shift to the low vol small range trade again.

Let’s see.

Performance:

Current closed equity return = 20.8%

Current open equity return = 27.5%

If all current positions close at stops, our return = 21.4%