Mandelbrot Would be Proud

Turtle Shaped Fractals All the Way Down

Back to bright green since Wednesday.

Fintwit mentioned something big happening next week, so I asked ChatGPT what "The Fed" was:

The Fed: "The Federation of Endless Decisions" – A group dedicated to making every decision-making process—whether it's picking a restaurant or choosing a Netflix show—last forever, with no final consensus.

Well, now I know.

This thing is green.

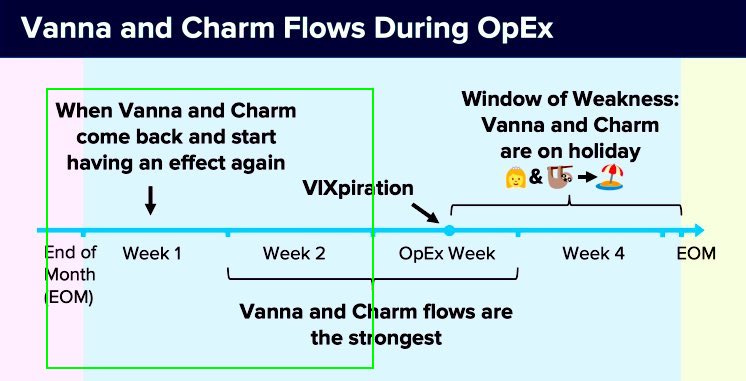

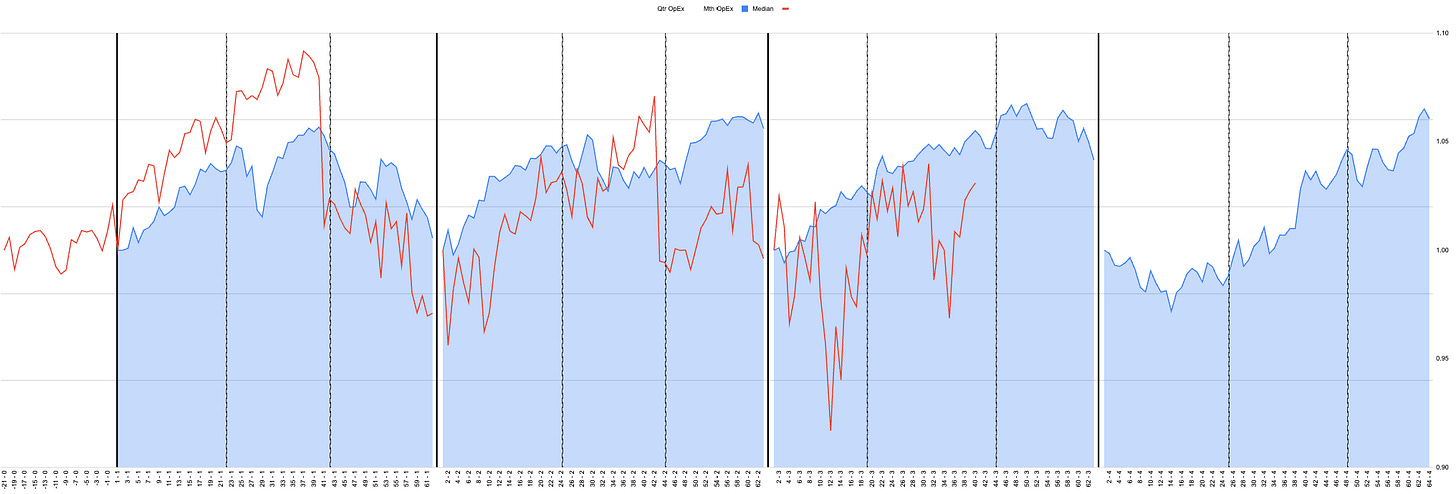

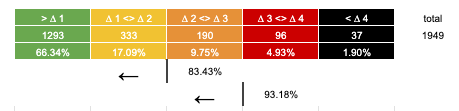

If we stick strictly to calendar dates, the median outcome suggests a weaker scenario.

However, if I make a crude correction for additional holidays and leap years, we come up with this.

I got the idea for these charts from Cem Karsan, who talks about "volume-weighted time." Obviously, we've just gone through summer when volumes are naturally lower, so does each summer day count for less? That might be his point. Something to think about.

Daily

We got the second dip and bounce. Where to from here who knows?

Hourly

Turtles all the way down. Mr. Mandelbrot would be proud—the same cycles appear on all timeframes.

This chart reminds me of an old video I made about combining products from another research service.

If you were using only the hourly levels on the chart, maybe a day trader would consider shorting here. But no, you're still 50/50 in the middle of the larger range.

You always have to treat each asset individually.

If we use the same measure that generates the rainbow charts but calculate for the upside, not downside, the "black bar of doom" doesn’t look so scary, does it?

On the hourly timeframe, SPX spends 12% of its time "killing bears" and generating tweets like:

“Aaargh, this market doesn’t make sense. The Fed is breaking everything.”

I never started this experiment to tell everyone exactly what the market is doing or to say, "I think this will happen because of that."

I know many of my posts are open to interpretation, at least the free section. Behind the paywall, I lay out exactly what my portfolio looks like.

Interpretation is what we’re doing here.

Our biases, knowledge, and positioning define what we want to see.

I don’t care what The Fed does. I don’t care who gets elected. I don’t care if Janet Yellen is "cooking the books."

The hubris to think that one tiny woman is manipulating the entire treasury market—get over yourself.

A question came up in the Discord channel about backtests, and I tried to answer as best I could.

The backtest assumes that you could make every single portfolio decision precisely at the correct moment, with the correct sizing, regardless of the news or the Fintwit cacophony going on at the time.

Good luck.

This week, after having lots of boring stocks and a pile of cash, the system has ramped back up to a full allocation.

"But what about The Fed? What about deflation? Discretionary doesn’t do well in that regime."

Then don’t follow it. Or only open half-position sizes.

Neither of these scenarios occur in a "cleansed lab" environment backtest.

If you’ve been following along with your own rules and process, we’re sitting on about a 22% return.

If you're happy with that, you can always sit out.

Be comfortable with your process. I’m comfortable with mine. If it’s wrong, I have stops.