Macro Tuesday - The No Bullshit Version

Macro Update

TL;DR

💵 FX : Americans might not get cheap European holidays this year.

🌽 Grains : Food will likely be more expensive.

🏗️ Metals : Why isn't Silver very strong?

📈 Equities : Brazil.

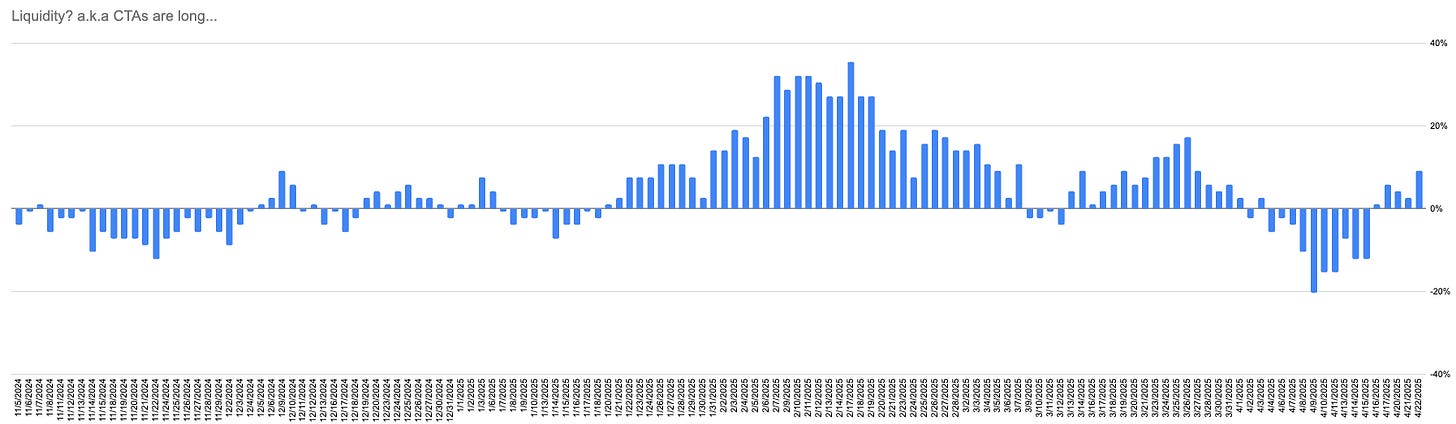

📡 Radar : FX and OilCTAs are starting to get net long again.

Is it the “right” stuff?

In a financial system seemingly flooded with people selling 2x2 growth and inflation models and their associated backtests.

Hot tip!! Be very careful with those backtests. They move and have revisions. If you listened to HTwH a couple of weeks back, where I discussed walk forward testing, looking back at Q4 of 1998 using historically revised data to assume what you “should” have been long or short is not helpful.

Onwards…

I told you there would be no bullshit!

Recent Equity Portfolio Update

Latest Hot Takes with Hank Episode

OK now for a smidge of nonsense. Lets call it Mean Reversion Corner.

I am a trend follower, so this is cutting against the grain, but let’s give it a shot.

FX positions at the very short term are showing Strength of Signal weakening. Is this important? Well they haven’t broken trend and long term signals are still rising.

Why are you highlighting it then?

The 3-month signal shown here as 63 days rarely gets higher than this level. That doesn’t mean to short it, only we might take a break of trend a little more seriously.

Next is Oil shown here via CL and BZ very much the reverse of non-dollar currencies. Very out of favour.

If I show here on this very on-brand messy chart, the 128 Strength of Signal (6-month) rarely crosses this Rubicon.

Again, it has not regained trend, I simply want to put it on people’s radar.

Thank you if you made it this far for indulging a little macro bullshit ;)