Long term and short term conundrum.

Week 4 - Weekly equity Update

It feels crazy to say “elevated” but VIX is elevated to its recent low of 12 in December. That aside the SPX index remains above momentum and trend.

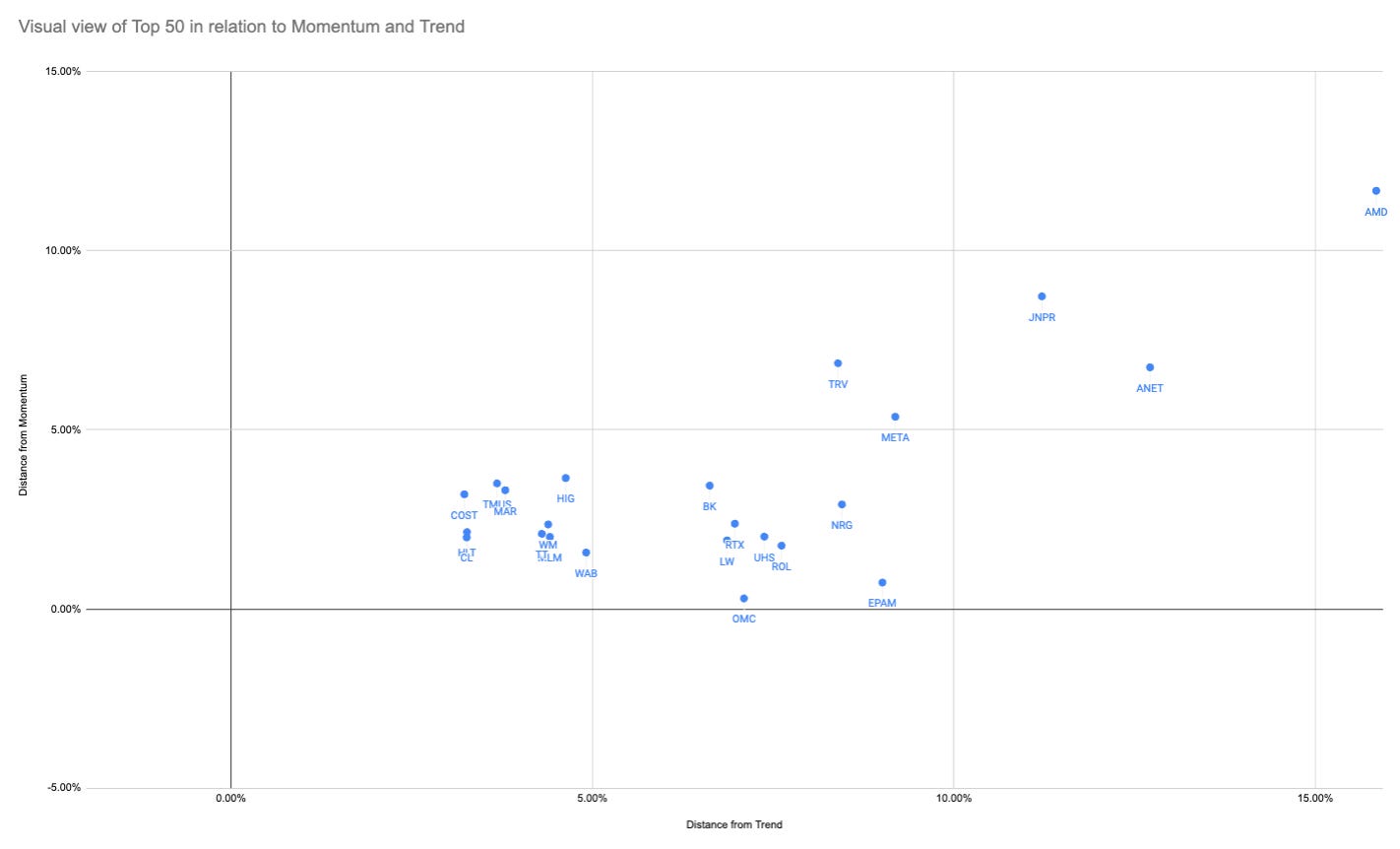

The system is in a weird position as it has leaned ultra-short-term. It has only found 23 positions to be long, which is very annoying as there are plenty of longs using longer timeframes.

It is akin to Apr-May 2023 where the index was pinned in a weird band let’s see how it plays out.

Jam Croissant - Window of Weakness

This was an interesting interview last Friday.

I have been posting recently some of the work I have done not looking at calendar seasonality but OpEx seasonality.

1-1 on this chart would be Dec OpEx so depending on the year somewhere around 18th Dec and then numbered by day to the next Quarterly OpEx.

Red is where we are now. Blue is the Median outcome and the lighter colours are individual years.

This was a tweet I put out yesterday looking at the +/- 10% band the SP500 so often finds itself within.