JPM Topiary and other Gardening Tips.

JHEQX and other nonsense.

5582 - 5604 is the line in the sand as we spend the next 12 hours talking about JPM topiary.

Daily

Hourly

I spoke last week about how old prices leaving a lookback window can be just as important as new prices. You can see that, despite almost no movement, we appear to be moving down the bands. Yes and no. What is really happening is that the bands are contracting.

This is also a good example of my thoughts heading through the election and into next year. Similar to the lower half of the chart, October 2023 will disappear from the lookback, causing the higher timeframe bands to compress.

This does not imply an immediate crash after October, but it does mean we will be in a position heading into next year with potentially less “trend” support.

Minute

I don’t normally show these very short timeframes because I think there is too much noise. However, I believe it connects to the next chart.

As we combine the timeframes and levels, we can see that we remain pinned in this band.

I joked earlier, but we cannot overlook the JPM Hedge Equity position because it is massive and still hanging out in the market.

The short call leg is 5750 on the SPX, which has pinned us here like a big gamma magnet. That expires today and will roll up and out +5%.

These bands are used the way they are because they are decision points or tipping points. If they hold, they are great buy signals; if they don’t, could we see 547 as the next decision point?

That would be a -4.3% drawdown from current prices. Scary!

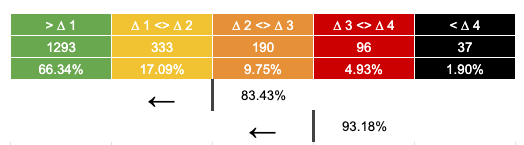

Again, we need to remember what these levels mean. If SPY falls to 547, it falls to a threshold where it spends 83.43% of its time trading above.

Then we will face the same decision we have now, just at a higher timeframe.

So, let’s take it to the top.

Momentum/Trend/VIX trend are all currently green.

5582 - 5604 is the line in the sand.

Looking at shorter timeframes, we are very near a decision point in direction.

Let’s watch. Have a plan for both directions and act accordingly.

The portfolio was updated yesterday. You can see our current performance below to have full access please become a paid subscriber.

Current Closed Equity Return = 23.4%

Current Open Equity = 31.5%

Stop Loss Trigger = 25.7%

Have We Moved on from the Safety Trade?

A brief overview of the sectors looking over some of the charts paid subscribers can access behind the paywall of these weekend posts.