If China Stimulates in the City, but Wishes They Did It in the Woods...?

Remember how China was stimulating?

Well, the latest news is essentially saying, "Whoa, we didn’t mean that much stimulation."

So, do we stick with the old narrative, or the new, contradictory one?

Who knows... or should I say, who news?

I know I keep repeating myself, but think about this: what if any number of stories over the past two years were just as important (and maybe equally wrong), but they came at times when the market structure couldn’t support an upward move?

And what if this latest piece of information arrived at exactly the right moment—where a positive move, despite being fundamentally unlikely, became the most logical structural outcome?

Now, the question is: can it be sustained?

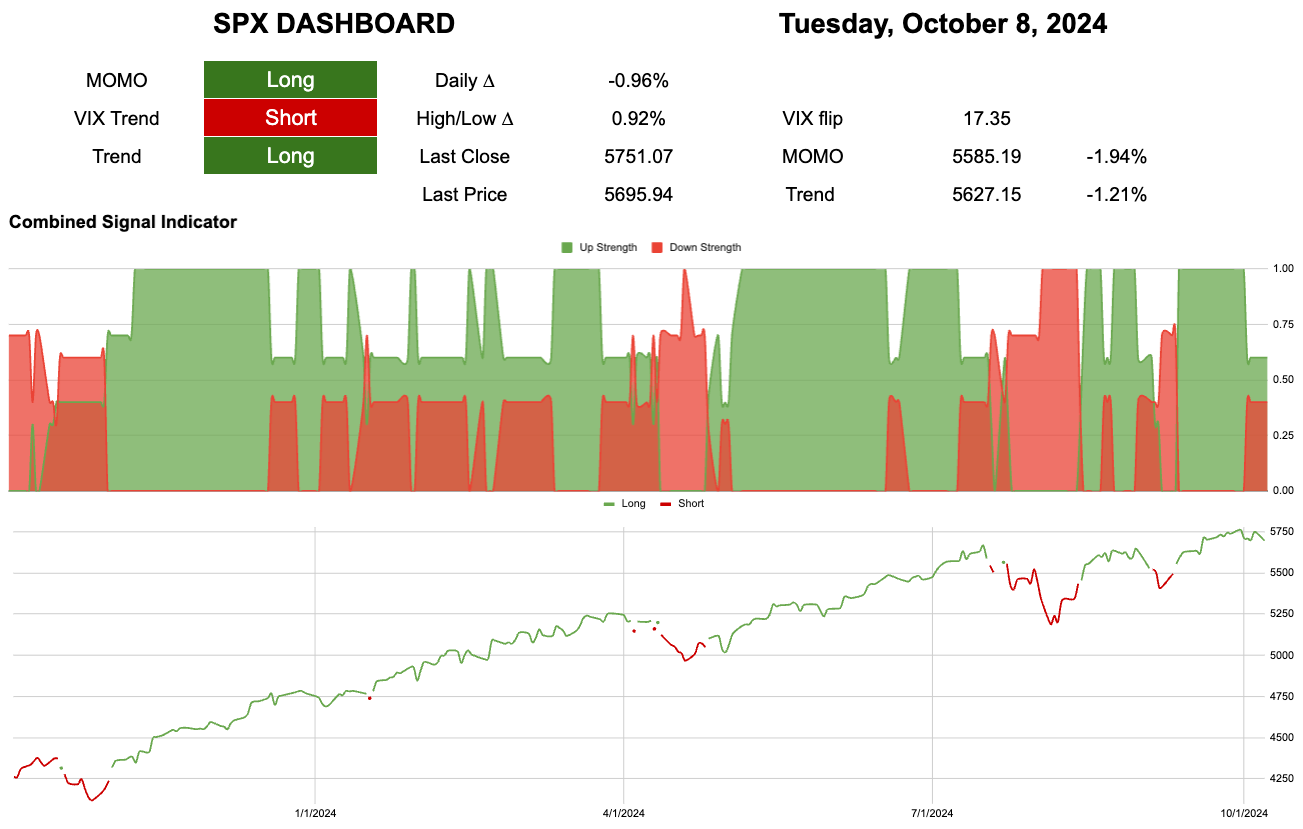

Daily

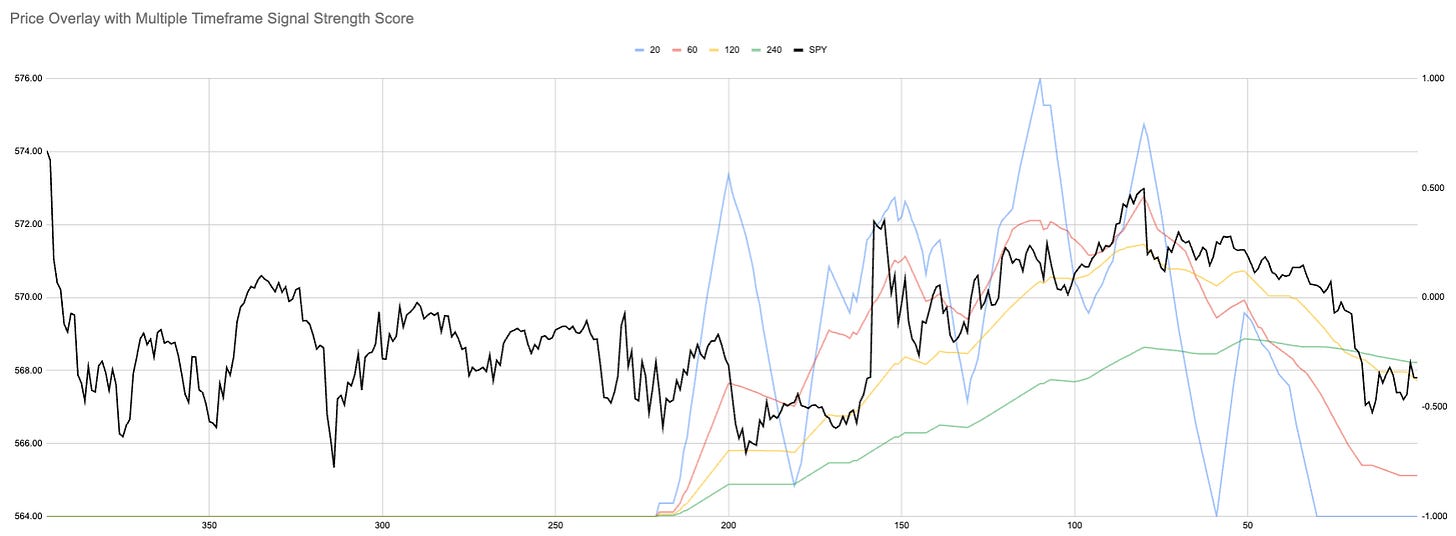

Hourly

5 minute

We have to examine each level to try and get a clearer picture.

Heading into Friday lunchtime, we hit a maximum on SoS; now we’re at a minimum.

For those who’ve been following for a while, you know my sell signals aren’t as robust as my buy signals—especially on such short timeframes.

We have a "stinky fingers" trigger right now, which indicates negative momentum across multiple timeframes.

These signals tend to work best in pairs. We have “the bottom” potentially now we need to wait for momentum confirmation. Either this weakness will get confirmed in the higher timeframes, or we’ll see a buy signal here, pushing us into the next bull phase.

It may “feel” like missing out on the start of a move but confirmation is the most important thing, not chasing.

Let’s see…

Current Closed Equity Return = 26%

Current Open Equity = 30.4%

Stop Loss Trigger = 25.9%

Closed equity since the start of this Substack has now hit 26%

I consider open returns to still belong to the market, until they are in my account.

Of closed equity i.e. starting with $10,000 and any gains from closed positions has not had a drawdown larger than 2%.

Yes the yellow line showing current open equity positions moves a round with the market winds. That is what we are trying to capture. When I close it it becomes mine and I care much more about it.