If a Data Release Craps in the Woods...

...and only the bears are there to hear it...

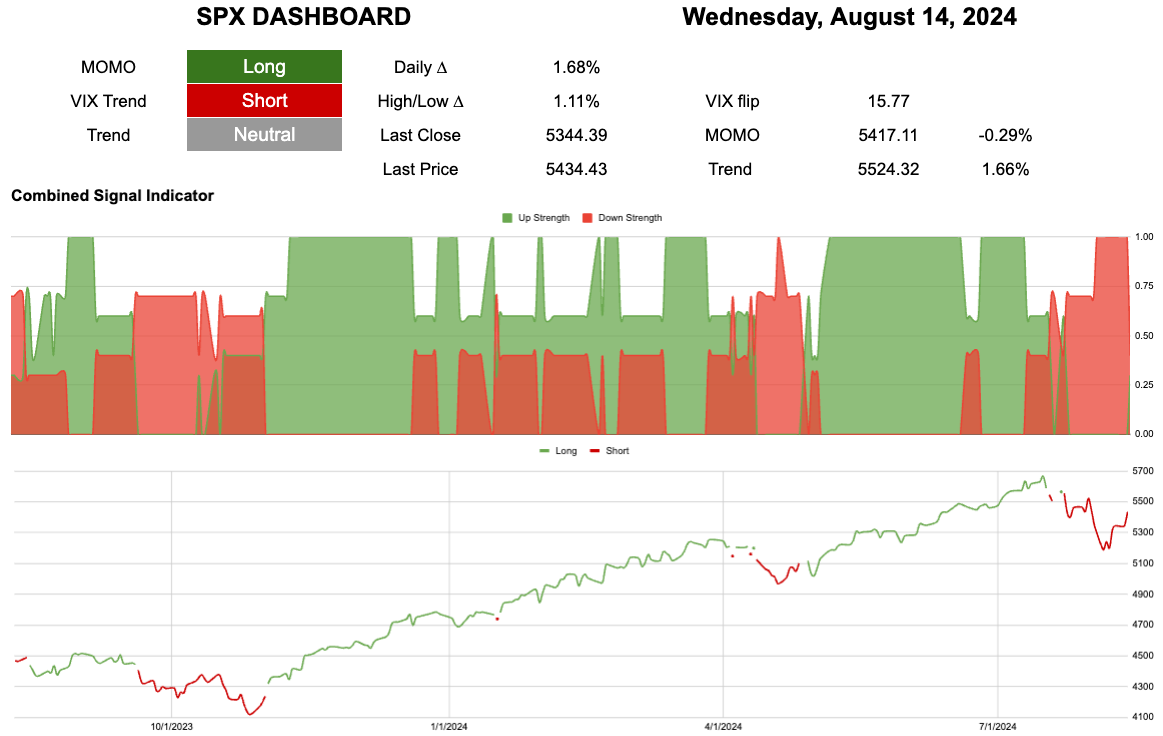

OK, so we have a shift here.

We are back above momentum and straddling the two trend levels.

Those that followed Monday’s post and took some defined risk in calls well done.

Short timeframes move quickly.

Returning to the hourly chart from Monday you can see our shortest measure is at a maximum. As we start building the layers it is far more important that each subsequent longer timeframe is looking more constructive.

This will hopefully build up to the daily timeframe.

That doesn’t mean that we could get intermittent weakness.

Twitter tells me there are data releases this week and I believe they will be the single most important data releases ever to happen in the whole entire world since the ones that came out last month and the ones that will come next month.

Imagine the hubris required to think one number moving by 10bps defines an entire economy of 350million people. Wowser.

Unless there is a huge structural change any weakness will be used to again add to defined risk options with a view that we build up the layers.

For paid subscribers what we have to remember is our portfolio is not the SP500 we have selected the parts that are still performing well. I highlighted the risks last night in chat and on voice, thank you to those that were able to join.